Covering the 4 weeks of 4 – 31 January

2026

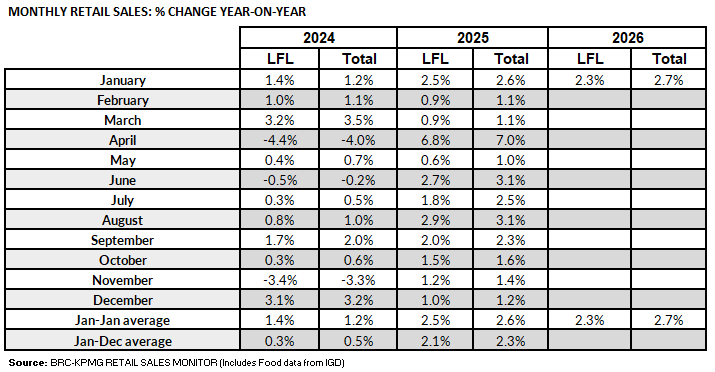

- UK Total retail sales increased by 2.7% year on year in

January, against a growth of 2.6% in January 2025. This was above

the 12-month average growth of 2.3%.

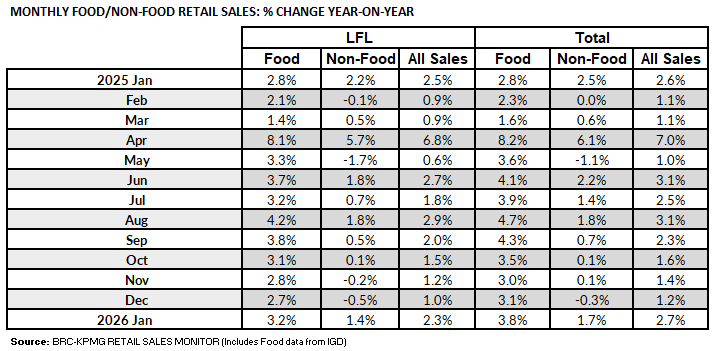

- Food sales increased by 3.8% year on year in January, against

a growth of 2.8% in January 2025. This was flat against the

12-month average growth of 3.8%.

- Non-Food sales increased by 1.7% year on year in January,

against a growth of 2.5% in January 2025. This was above the

12-month average growth of 1.1%.

- In-Store Non-Food sales increased by 2.0% year on year in

January, against a growth of 2.6% in January 2025. This was above

the 12-month average growth of 0.9%

.

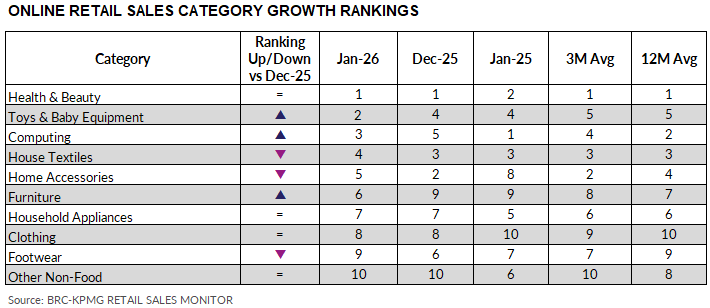

- Online Non-Food sales increased by 1.3% year on year in

January, against a growth of 2.2% in January 2025. This was below

the 12-month average growth of 1.4%.

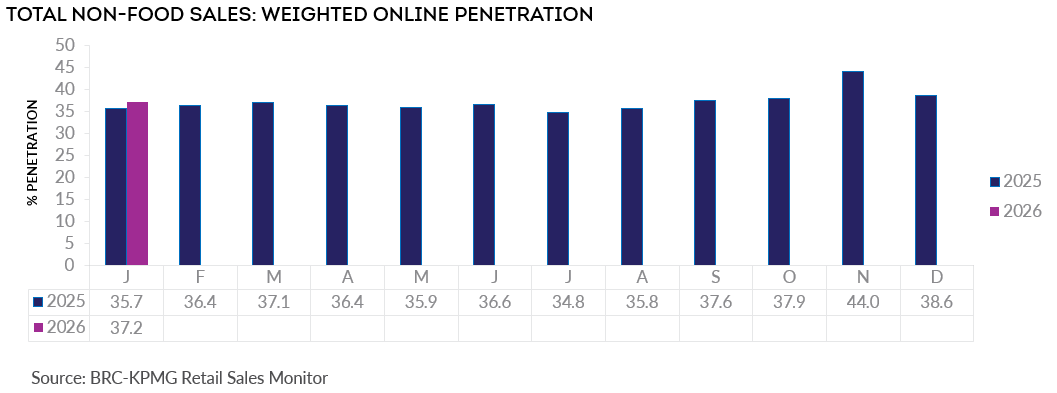

- The online penetration rate (the proportion of Non-Food items

bought online) increased to 37.2% in January from 35.7% in

January 2025. This was below the 12-month average of 37.4%.

Helen Dickinson, Chief Executive at the British Retail

Consortium, said:

“A drab December gave way to a brighter January as retail sales

picked up pace. Many shoppers had held off Christmas spending and

waited for the January sales, with the start of the new year

showing the strongest growth. And bargain hunting was not limited

to online, with in-store sales showing the highest growth in over

six months.

“While retailers welcomed the increase in spending, many

challenges remain in 2026. Consumer confidence, while improving,

remains weak; costs of energy and packaging are rising, and the

new Employment Rights Act could limit the ability of retailers to

offer more flexible jobs. The Government must focus on getting

the last of these right – ensuring protections for workers

without damaging the availability of the jobs themselves. This is

essential as unemployment continues to climb.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

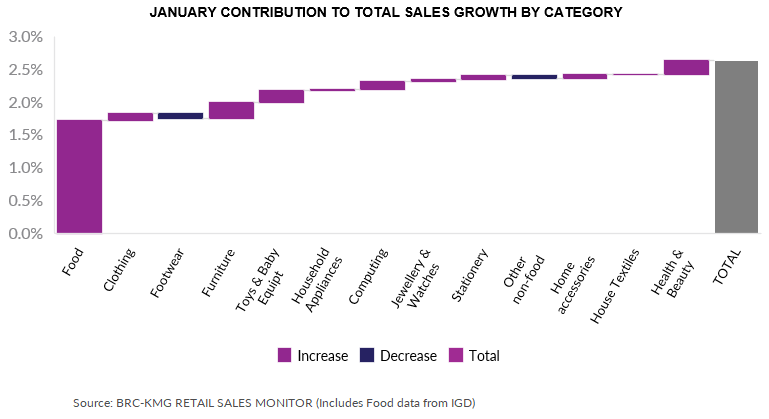

“The year started well for the retail sector, with welcome sales

growth. January sales enticed consumers to spend, with

personal electronics, furniture, and children's clothes and toys,

all among the best performing categories. New Year health

and personal care goals led to related spending, including on

wellness focussed food and drink items.

“Many retailers will be pleased that their promotional

strategies worked in January, but they remain acutely aware of

the challenge of consistently growing sales volumes when

consumers continue to be cautious about, and savvy with, their

spending.”

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“After the end-of-year festivities, shopper confidence was muted

in January, primarily driven by concerns about future price

rises. January also brought with it extensive new grocery retail

product launches, particularly centred around health, encouraging

health-minded shoppers to trial something new. The outlook for

2026 indicates that food inflation will persist for some time

meaning some shopper concerns are well-founded. As a result, we

expect shoppers to continue to scrutinise their purchasing.”