Period Covered: 01 – 07

June 2025

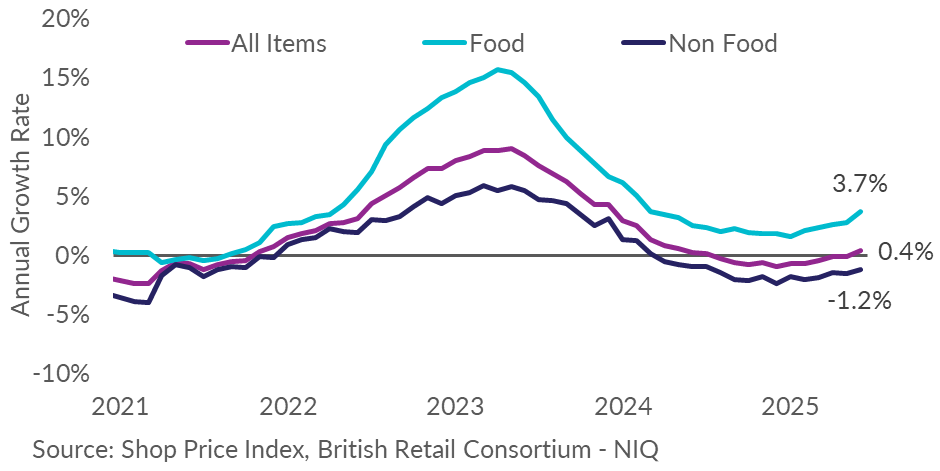

- Shop price inflation increased to 0.4% year on year in June,

against a decline of -0.1% in May. This is above the 3-month

average of 0.1%.

- Non-Food inflation increased to -1.2% year on year in June,

against a decline of -1.5% in May. This is above the 3-month

average of -1.4%.

- Food inflation increased to 3.7% year on year in June,

against growth of 2.8% in May. This is above the 3-month average

of 3.1%.

- Fresh Food inflation increased to 3.2% year on year in June,

against growth of 2.4% in May. This is above the 3-month average

of 2.5%.

- Ambient Food inflation increased to 4.3% year on year in

June, against growth of 3.3% in May. This is above the 3-month

average of 3.8%.

|

|

OVERALL SPI

|

FOOD

|

NON-FOOD

|

|

% Change

|

On last year

|

On last month

|

On last year

|

On last month

|

On last year

|

On last month

|

|

Jun-25

|

0.4

|

0.3

|

3.7

|

0.7

|

-1.2

|

0.1

|

|

May-25

|

-0.1

|

0.2

|

2.8

|

0.4

|

-1.5

|

0.1

|

Note: Month-on-month % change refers to changes in the

level of prices.

Helen Dickinson, Chief Executive of the BRC,

said:

“Within three months of the costs imposed by last Autumn's Budget

kicking in, headline shop prices have returned to inflation for

the first time in close to a year. Food inflation showed little

sign of slowing down, particularly in fresh produce, where prices

of meat have been impacted by high wholesale prices and more

expensive labour costs. Meanwhile, fruit and vegetable prices

increased due to the hot, dry weather reducing harvest yields.

Non-food goods remained in deflation as retailers cut prices

across product categories, especially DIY and gardening so

customers could make the most of the sunshine.

“Retailers have warned of higher prices for consumers since last

year's Autumn Budget and the huge rises to Employer National

Insurance costs and the National Living Wage. We predicted a

significant rise in food inflation by the end of this year, and

this has been accelerated by geopolitical tensions and impacts of

climate change. To limit further rises, Government must find ways

to alleviate the cost pressures bearing down on retailers. The

upcoming business rates reform offers such an opportunity, and

the Government must ensure no shop pays more as a result of the

changes.”

Mike Watkins, Head of Retailer and Business Insight,

NielsenIQ, said:

“Price increases are being driven by

broader economic conditions and ongoing changes in the supply

chain. While the current spell of good weather is helping to

boost demand at many retailers, rising prices could become a

concern if consumer willingness to spend declines later in the

year. Which means we can expect retailers to reinforce their

value-for-money messages over the summer.”