Period Covered: 01 – 07

April 2025

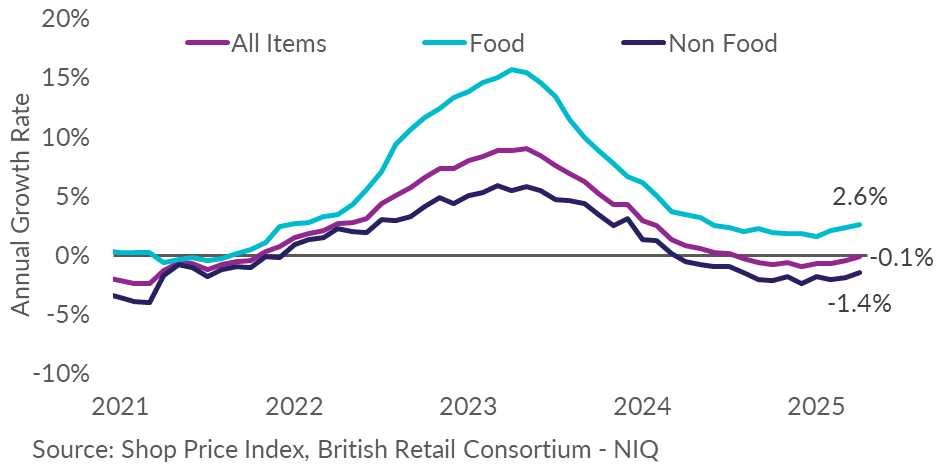

- Shop price inflation increased to -0.1% year on year in

April, against a decline of -0.4% in March. This is above the

3-month average of -0.4%.

- Non-Food inflation increased to -1.4% year on year in April,

against a decline of -1.9% in March. This is above the 3-month

average of -1.8%.

- Food inflation increased to 2.6% year on year in April,

against growth of 2.4% in March. This is above the 3-month

average of 2.4%.

- Fresh Food inflation increased to 1.8% year on year in April,

against growth of 1.4% in March. This is above the 3-month

average of 1.5%.

- Ambient Food inflation was unchanged at 3.7% year on year in

April, against growth of 3.7% in March. This is above the 3-month

average of 3.4%.

|

|

OVERALL SPI

|

FOOD

|

NON-FOOD

|

|

% Change

|

On last year

|

On last month

|

On last year

|

On last month

|

On last year

|

On last month

|

|

Apr-25

|

-0.1

|

0.0

|

2.6

|

0.7

|

-1.4

|

-0.4

|

|

Mar-25

|

-0.4

|

-0.2

|

2.4

|

0.0

|

-1.9

|

-0.2

|

Note: Month-on-month % change refers to changes in the

level of prices.

Helen Dickinson, Chief Executive of the BRC,

said:

“The days of shop price deflation look numbered as food inflation

rose to its highest in 11 months, and non-food deflation eased

significantly. Everyday essentials including bread, meat, and

fish, all increased prices on the month. This comes in the same

month retailers face a mountain of new employment costs in the

form of higher employer National Insurance Contributions and

increased NLW.

“Despite price competition heating up, retailers are unable to

absorb the total impact of these £5bn of employment costs and the

additional £2bn costs when the new packaging tax comes into

effect in October. It is crucial that poor implementation of the

upcoming Employment Rights Bill does not add further pressure to

costs – pushing prices further up, and job numbers further down.”

Mike Watkins, Head of Retailer and Business Insight,

NielsenIQ, said:

“Shoppers continue to benefit from

lower shop price inflation than a year ago, but prices are slowly

rising across supply chains, so retailers will be looking at ways

to mitigate this as far as possible. And whilst we expect

consumers to remain cautious on discretionary spend, the late

Easter will have helped to stimulate sales.”