Fieldwork conducted on 04-07 April

2025

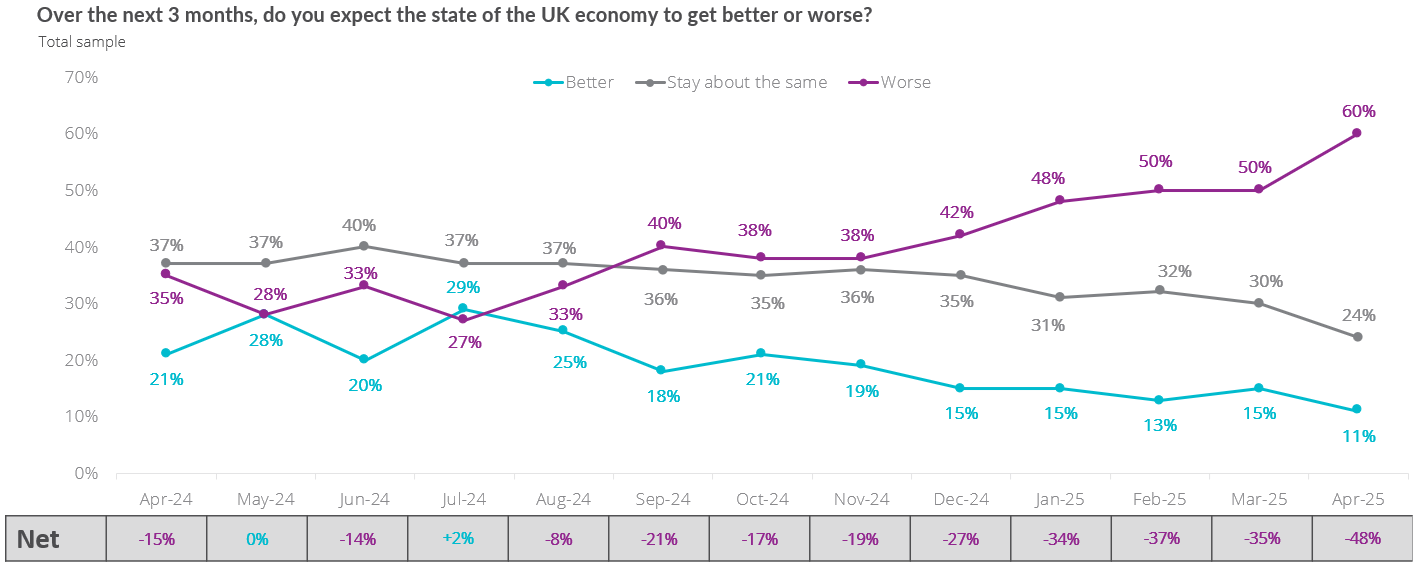

According to BRC-Opinium data, consumer expectations

over the next three months of:

-

The state of the economy dropped significantly

to -48 in April, down from -35 in March.

-

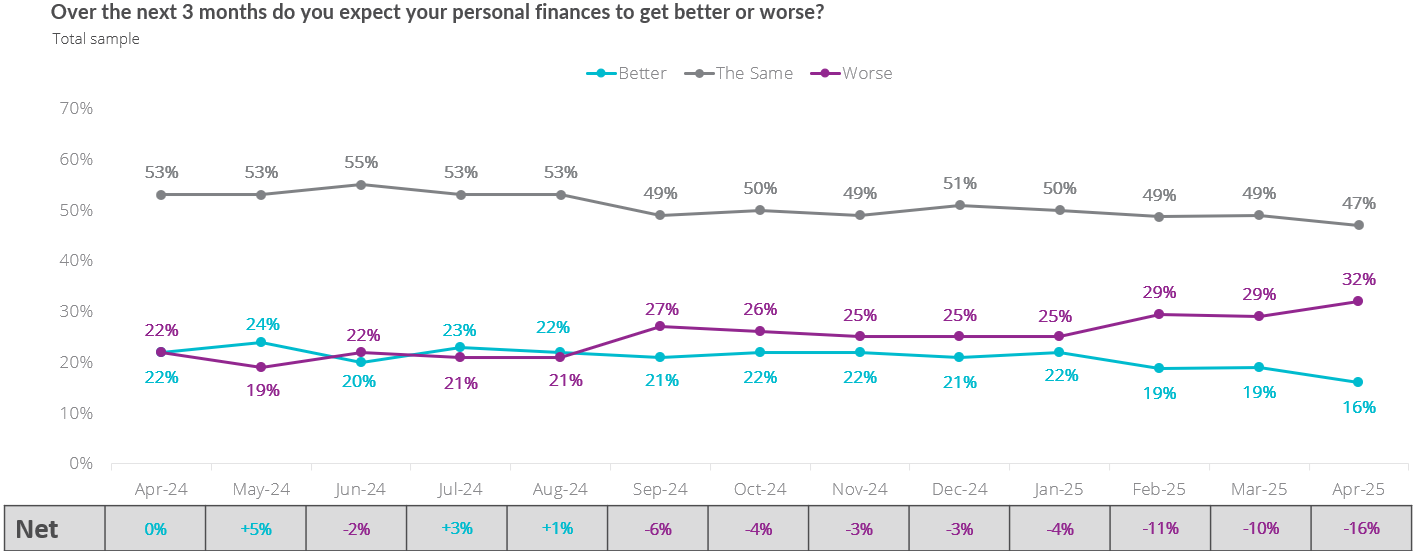

Their personal financial situation worsened to

-16 in April, down from -10 in March.

-

Their personal spending on retail rose to +3

in April, up from 0 in March.

-

Their personal spending overall fell slightly

to +10 in April, down from +11 in March.

-

Their personal saving rose slightly to -4 in

April, up from -5 in March.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“With fieldwork completed just days after Donald Trump's

“Liberation Day” tariffs, it is unsurprising that consumer

expectations for the economy plummeted to a record low. The

original tariff schedule, since reduced for most countries, was

expected to reduce growth in the UK and elsewhere. Yet despite

this economic pessimism, expectations of retail spending rose

slightly as the prospect of Easter shopping drew closer.

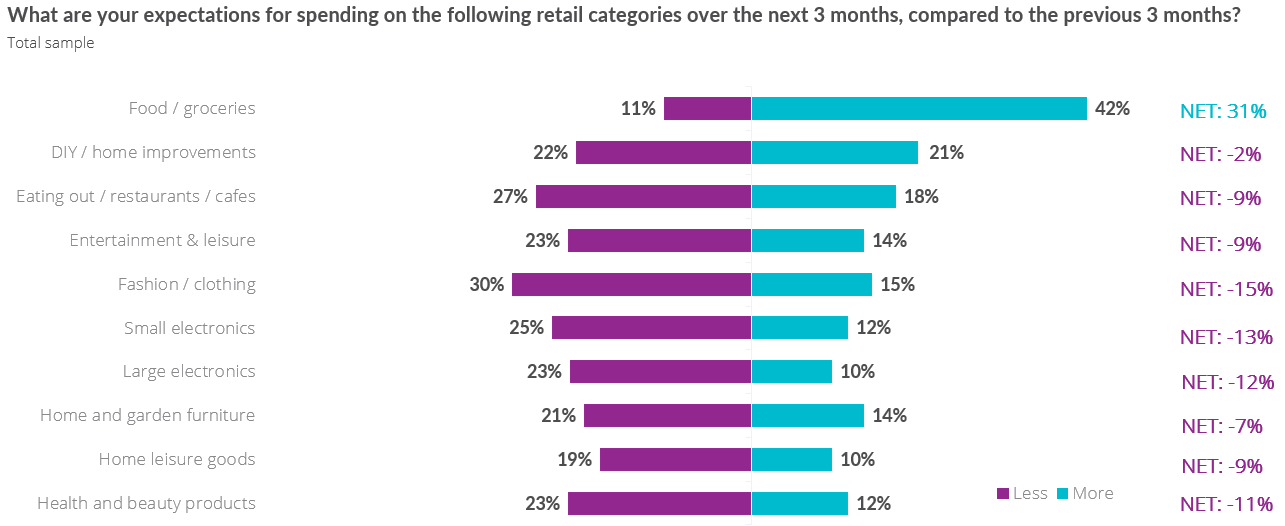

Unsurprisingly, expected spending on groceries saw the largest

increase, with over 4 in 10 expecting to spend more in the coming

months, rising to half of the over 55s. Meanwhile, Gen Z planned

to take advantage of the improving weather, with rising spending

expectations for eating out and health & beauty products.

“Even with a pause on many of the US tariffs, business and

consumer confidence remains fragile. The risk of higher global

prices is an unwanted addition to the £7bn in new costs hitting

retailers this year from higher employer National Insurance,

increased NLW, and a new packaging tax. Many retailers are also

concerned about the risk of cheap Chinese products being diverted

from the US to other destinations, including the UK. The UK

should review the de minimis rules, which allow low-value imports

to avoid checks and duties. It is vital the UK's strict quality

standards are upheld to ensure the best outcome for British

businesses and consumers.

Consumer expectations for the state of the economy

over the next three months:

Consumer expectations for their personal financial

situation over the next three months:

Consumer expectations of spending over the next three

months by category:

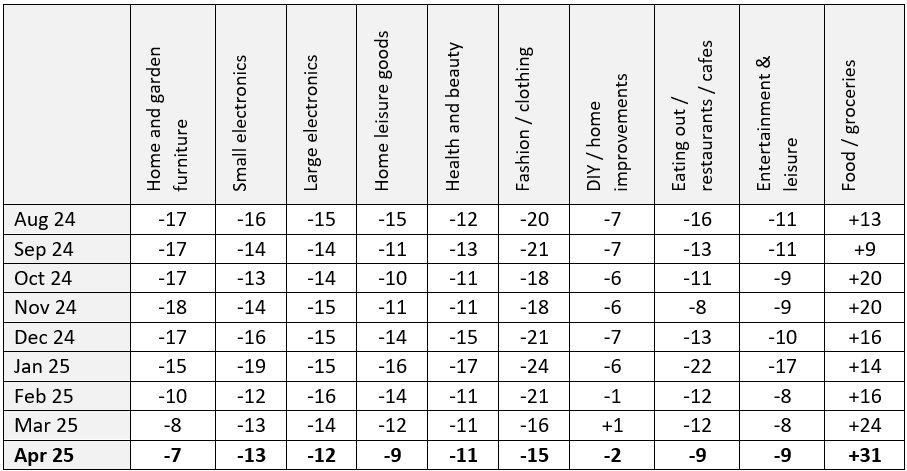

Consumer NET expectations of spending over the next

three months by category:

-ENDS-

The BRC sent this release to our "Monitors" and "General

Retail" media list. To check/update what media lists you are on,

please contact us below.

All monitor dates for next year can be found here

Methodology:

Fieldwork conducted by Opinium for the BRC. Sample included 2,000

UK adults and results have been weighted and assigned a net

score. The better/worse figures in the graphs are rounded, while

net scores are calculated from precise figures. Questions were:

- Over the next 3 months, do you expect your personal finances

to get better or worse?

- Over the next 3 months, do you expect the state of the UK

economy to get better or worse?

- What do you plan to do in relation to your spending over the

next 3 months?

- Reflecting on your retail spend across different categories,

overall do you expect to spend more or less on retail items over

the next 3 months?

- What are your expectations for saving over the next 3 months?

- What are your expectations for spending on the following

retail categories over the next three months compared to the

previous 3 months?