Covering the four weeks 2 February – 1 March

2025

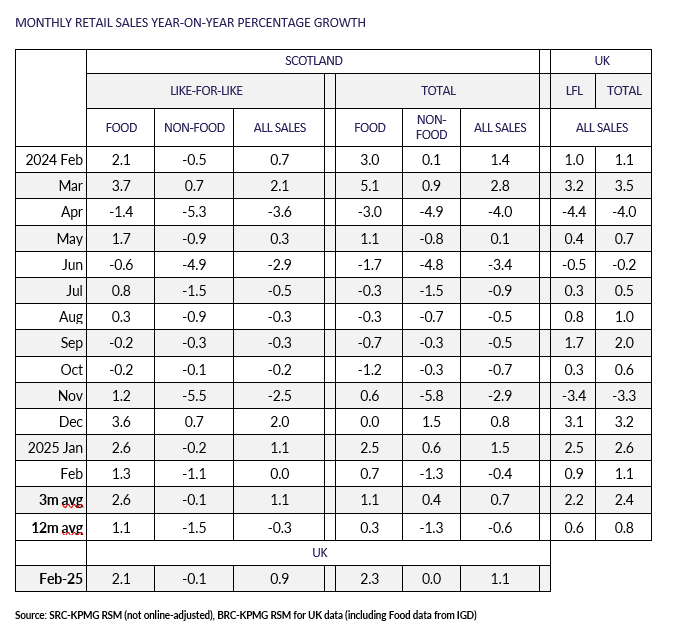

- Total sales in Scotland decreased by 0.4% compared with

February 2024, when they had increased by 1.4%. This was below

the 3-month average increase of 0.7% and above the 12-month

average decrease of 0.6%. Adjusted for inflation, there was a

year-on-year increase of 0.3%.

- Scottish Sales were flat on a like-for-like basis compared

with February 2024, when they had increased by 0.7%. This was

below the 3-month average increase of 1.1% and above the 12-month

average decrease of 0.3%.

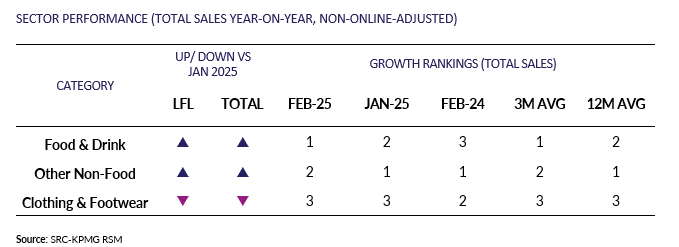

- Total Food sales in Scotland increased by 0.7% compared with

February 2024, when they had increased by 3.0%. This was below

the 3-month average increase of 1.1% and above the 12-month

average increase of 0.3%.

- Total Non-Food sales in Scotland decreased by 1.3% compared

with February 2024, when they had increased by 0.1%. This was

below the 3-month average increase of 0.4% and above the 12-month

average decrease of 1.3%.

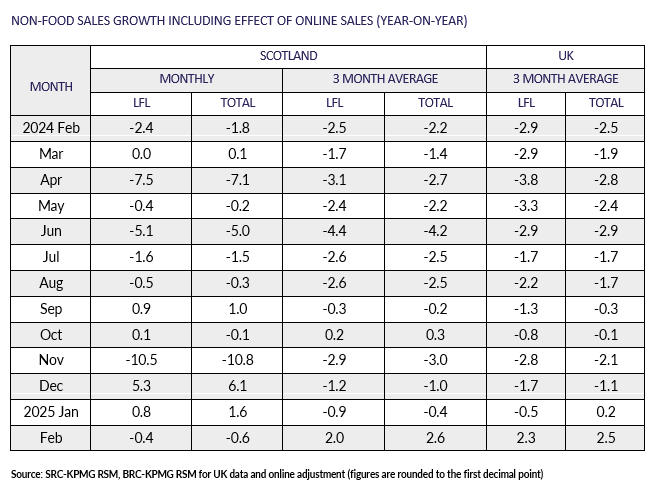

- Adjusted for the effect of online sales, Non-Food sales in

Scotland decreased by 0.6% compared with February 2024, when they

had decreased by 1.8%. This was below the 3-month average

increase of 2.6% and above the 12-month average decrease of 1.2%.

David Lonsdale, Director of the Scottish Retail

Consortium:

“The total value of Scottish retail sales nudged down in February

compared to the year before, albeit in real-terms - once adjusted

for falling shop prices - they recorded a third successive month

of growth. This was a more muted set of results and reflected the

fall in shopper footfall which faded during February.

“Computing and furniture did well and grocery continued to grow.

Valentine's Day gave a lift to sales of jewellery, fragrances and

chocolates. Purchases of toys and baby equipment however fell

back, as did clothing and footwear, as the cold weather

deterred shoppers from buying new Spring and Summer ranges.

“With soaring council tax and water bills just around the corner,

and more than enough geo-political uncertainty abound, it remains

to be seen how all of this impacts shoppers' propensity to spend.

What isn't in doubt is the imposition of government-mandated tax

rises from next month, from UK, Scottish, and local

administrations, will shackle customers and retailers with

substantial extra costs. That will serve to make trading even

tougher for Scotland's retailers.”

Linda Ellett, UK Head of Consumer, Retail and

Leisure | KPMG

“Scottish retail sales fell slightly in February, as consumers

remained cautious with their spending. Many are continuing

to prioritise saving, travel and experiences, with nervousness

about the economy deferring other big ticket

purchasing.

“As we have seen already this year, retailers are increasingly

reflecting upon online and in-store sales data, considering the

implications of the recently announced employment cost rises and

business rates pressure, and scrutinising where best to be

located. Online shopping and the growth of social commerce has

contributed to a lowering of demand for some physical retail

stores and boardrooms will continue to keep a close eye on

monthly footfall and sales data as 2025 progresses.”