Covering the four weeks 02 February 2025 – 01 March

2025

According to

BRC-Sensormatic data:

-

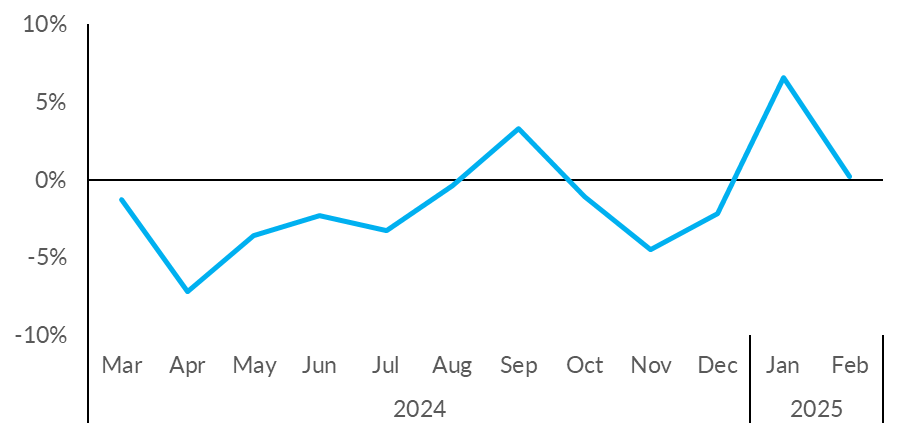

Total UK footfall increased by 0.2%

in February (YoY), down from 6.6% in January.

-

High Street footfall increased by

0.1% in February (YoY), down from 4.5% in January.

-

Retail Park footfall increased by

2.0% in February (YoY), down from 7.9% in January.

-

Shopping Centre footfall increased by

0.1% in February (YoY), down from 7.4% in January.

- Footfall increased year-on-year for both

Wales, up by 2.7%, and England,

up by 0.2%. Northern Ireland saw a year-on-year

decrease of 0.1%, while Scotland experienced a

decline of 0.3%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Footfall increased for the second consecutive month, with retail

parks continuing to outperform other retail destinations. The

variety of larger retail outlets and the option of free parking

enticed customers to visit retail parks over their local high

street or shopping centre which saw only marginal improvements.

Strong investment in retail parks and fewer empty stores has led

to consistent positive shopper traffic over the past year.

“Retailers are always looking for ways to invest in shopping

destinations and the communities they serve. Unfortunately, the

£7 billion worth of costs facing the industry from the Budget

will hinder retailers' ability to do this. At a time when many

high streets are in desperate need of revitilisation, the

government must do more to support the retail industry's ability

to invest. Ensuring no shop pays more as a result of business

rates reform and delaying the new packaging levy would allow for

more investment in stores and jobs, giving footfall a better

chance of recovery in 2025.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic,

commented:

“After January's jump-start, retail footfall in February stalled,

with retailers seeing only the slimmest improvements compared to

2024 last month. While the good news is that shopper counts

remained steady, many would have been hoping for a more

substantial leap building off a strong start to the year.

Retail Parks, consistently one of the top performers in 2024,

once again outstripped other retail destinations in February, as

the convenience and choice built into their retail offerings

again proved popular with customers. With Easter falling

late and well into April this year, this will, undoubtedly, put

added pressure on retailers as we head into March. To plug

the gap, retailers have an opportunity to create compelling

reasons to visit and enhance their offerings with greater

convenience and choice, which have been the standout strengths of

Retail Park performance.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE

YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Feb-25

|

Jan-25

|

|

1

|

Wales

|

2.7%

|

8.5%

|

|

2

|

North West England

|

1.9%

|

7.7%

|

|

3

|

London

|

1.8%

|

6.7%

|

|

3

|

West Midlands

|

1.8%

|

10.0%

|

|

5

|

South East England

|

0.4%

|

9.4%

|

|

6

|

England

|

0.2%

|

7.4%

|

|

7

|

Northern Ireland

|

-0.1%

|

3.5%

|

|

8

|

Scotland

|

-0.3%

|

1.0%

|

|

9

|

East of England

|

-0.8%

|

8.5%

|

|

10

|

North East England

|

-1.0%

|

6.8%

|

|

11

|

East Midlands

|

-1.3%

|

6.4%

|

|

12

|

South West England

|

-1.4%

|

7.9%

|

|

13

|

Yorkshire and the Humber

|

-3.5%

|

3.3%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Feb-25

|

Jan-25

|

|

1

|

Birmingham

|

5.0%

|

14.3%

|

|

2

|

Manchester

|

3.9%

|

10.3%

|

|

3

|

Edinburgh

|

1.9%

|

2.8%

|

|

4

|

London

|

1.8%

|

6.7%

|

|

4

|

Belfast

|

0.1%

|

4.8%

|

|

6

|

Nottingham

|

-0.3%

|

6.7%

|

|

7

|

Glasgow

|

-1.1%

|

1.9%

|

|

8

|

Cardiff

|

-1.8%

|

9.1%

|

|

9

|

Liverpool

|

-2.5%

|

3.2%

|

|

10

|

Bristol

|

-5.2%

|

6.2%

|

|

11

|

Leeds

|

-5.6%

|

1.0%

|

-ENDS-

2025 Monitor dates can be found here: Insight

Calendar

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.

While High Streets, Shopping Centres and Retail Parks are the

main components of the Total Footfall, there are also additional

categories not included as separate indices. These include

outlets, travel hub locations, and free standing locations such

as garden centres.