Covering the five weeks 29 December 2024 – 01

February 2025

-

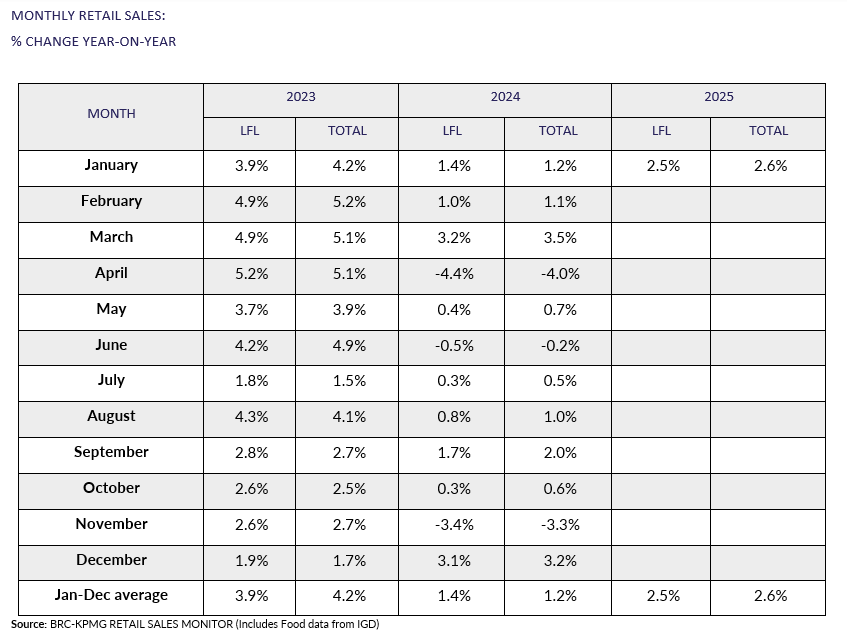

UK Total retail sales increased by 2.6% year

on year in January, against a growth of 1.2% in January 2024.

This was above the 3-month average growth of 1.1% and above the

12-month average growth of 0.8%.

-

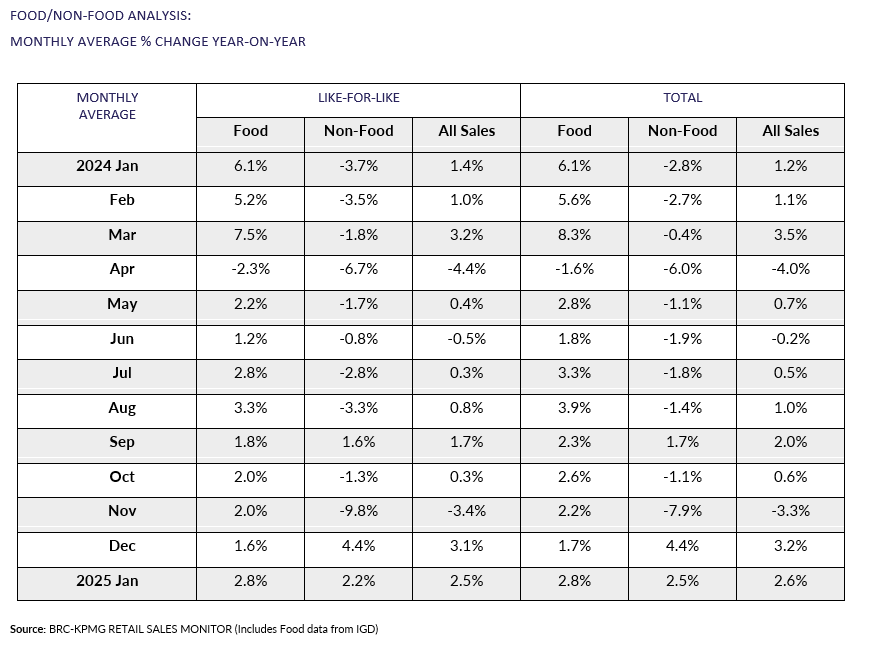

Food sales increased by 2.8% year on year in

January, against a growth of 6.1% in January 2024. This was

above the 3-month average growth of 2.3% and below the 12-month

average growth of 3%.

-

Non-Food sales increased by 2.5% year on year

in January, against a decline of 2.8% in January 2024. This was

above the 3-month average growth of 0.2% and above the 12-month

average decline of 1.1%.

-

In-Store Non-Food sales increased by 2.6% year

on year in January, against a decline of 2% in January 2024.

This was above the 3-month average decline of 0.7% and above

the 12-month average decline of 1.7%.

-

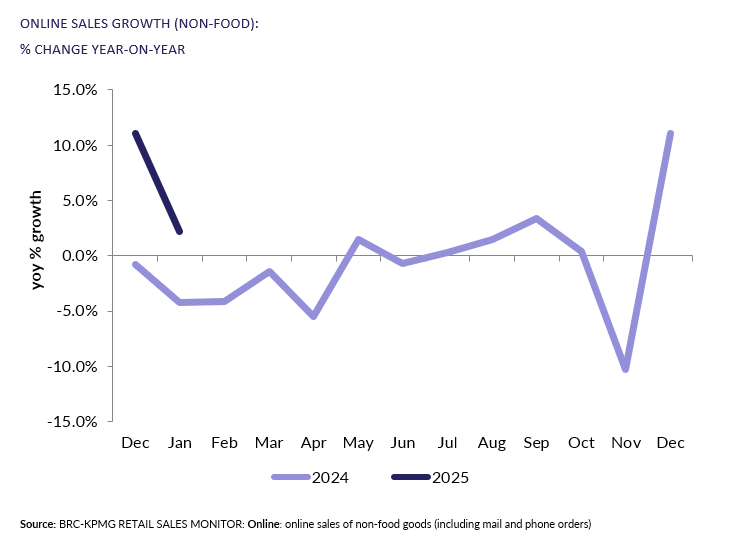

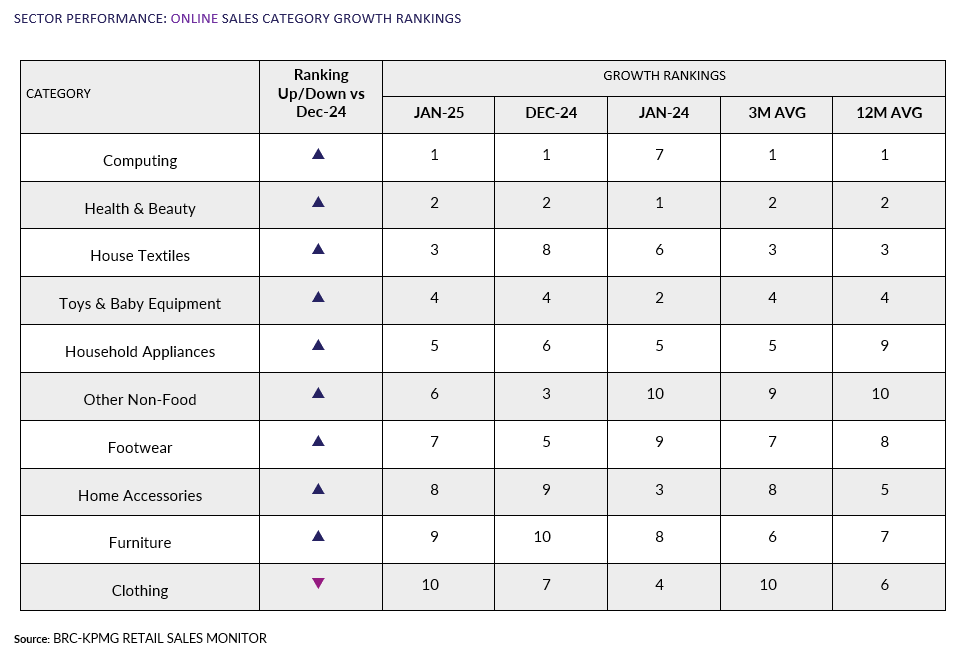

Online Non-Food sales increased by 2.2% year

on year in January, against a decline of 4.2% in January 2024.

This was above the 3-month average growth of 1.8% and above the

12-month average growth of 0.1%.

-

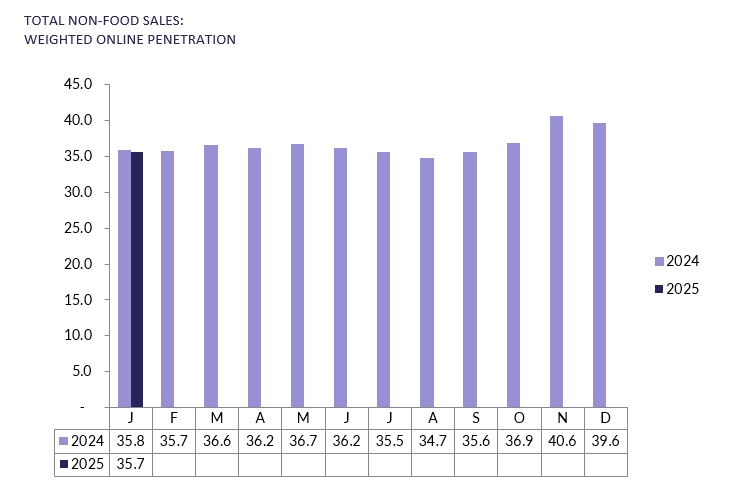

The online penetration rate (the proportion of

Non-Food items bought online) decreased to 35.7% in January

from 35.8% in January 2024. This was below the 12-month average

of 36.7%.

Helen Dickinson OBE, Chief Executive

of the British Retail Consortium, said:

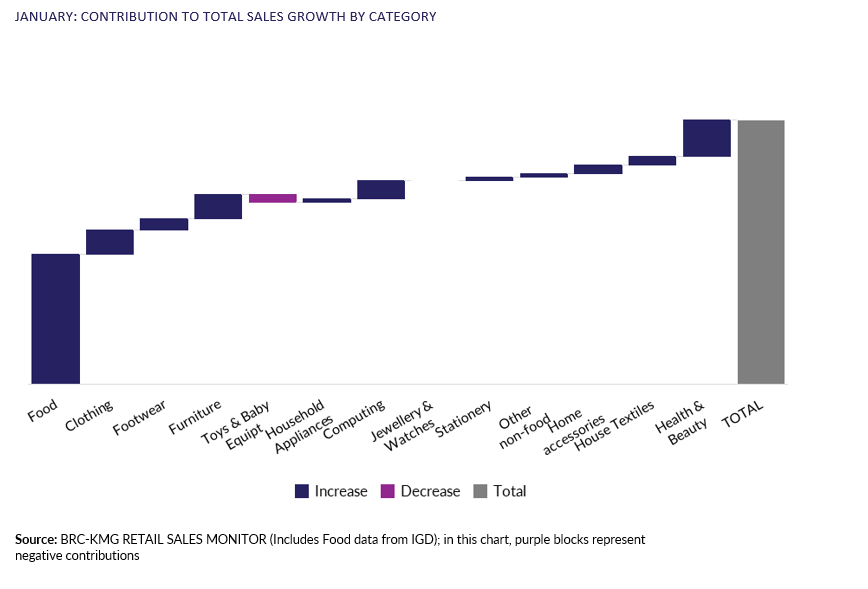

“January sales kicked off a solid month for retail with stores

delivering their strongest growth in almost two years, albeit on

a weak comparable. Consumers headed to the shops to refresh their

homes for the year ahead, taking advantage of big discounts on

furniture, bedding and other home accessories. With growth across

nearly all categories, only toys and baby equipment remained in

decline. While the bouts of stormy weather put a temporary

dampener on demand, sales growth held up well throughout the rest

of the month. This was also helped by the earlier start of the

reporting period, adding a few more post-Christmas shopping days

into the mix.

“Whether this strong performance can hold out for the coming

months is yet to be seen. Inflationary pressures are rising,

compounded by £7bn of new costs facing retailers, including

higher employer national insurance contributions, higher National

Living Wage, and a new packaging levy. Many businesses will be

left with little choice but to increase prices, and cut

investment in jobs and stores. Government can mitigate this by

ensuring its proposed business rates reforms do not result in any

shop paying more in business rates.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“2025 got off to a welcome start for retailers with much needed

sales growth in January. But viewed over a three-month

period that included Christmas and Black Friday, non-food sales

have flatlined. Overall, the golden quarter failed to

shine.

“The trading environment remains tough for retailers, with

consumer demand still subdued and household essential bills still

high. Business costs are also coming under pressure, with

rising employment costs only increasing that in the coming

months. Boardroom focus on costs and competitiveness is

sharpening. Pricing adjustments, product launches, store

closures, job losses, and increased automation and AI are all set

to reshape the retail landscape in 2025.”

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“The current climate of economic uncertainty is reflected in

IGD's January shopper confidence index, which has declined by 3

points. With unemployment at 4.4% (+0.4% vs this time last year),

shoppers have responded by employing strategies to control their

spend. The notable increase in volume over value sales suggests a

shift towards private label products and a change in purchasing

categories, as shoppers anticipate further price rises for food

and drink.”

-ENDS-

Notes:

- Like the ONS, the BRC typically follows a 4-4-5 pattern for

the number of reporting weeks in each month (January-4 weeks,

February-4 weeks, March-5 weeks and so on throughout the year).

Following the ONS, the BRC is using a 5-week January this year

instead of the typical 4 weeks. Therefore, 2025 will be a 53-week

year. The comparison weeks for last year will follow this year's

schedule; weeks 1-5 of this year will be compared to weeks 1-5 of

last year for January, then February weeks 6-9 of both years, and

March weeks 10-14 of both years. The rest of the year will follow

the 4-4-5 pattern with week 53 being compared to week 1 2025.