BRC-SENSORMATIC FOOTFALL

MONITOR – DECEMBER

2024

The later timing of Black Friday in 2024 meant that it

falls into December's, rather than November's figures, while the

reverse was true in 2023. This worsens November figures and

improves the December figures. This effect is cancelled out in

the three month to December figure.

Covering the five weeks 24 November – 28 December

2024

According to

BRC-Sensormatic data:

-

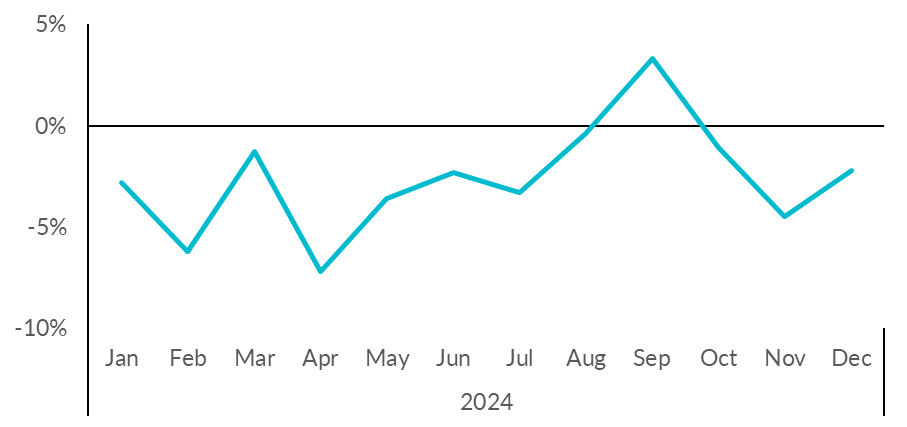

Overall, Total UK footfall in 2024 was down 2.2%

compared to 2023.

- For the three months to

December (Golden Quarter) footfall decreased by

2.5% (YoY)

-

Total

UK footfall decreased by 2.2%

in December (YoY), up from -4.5% in November.

-

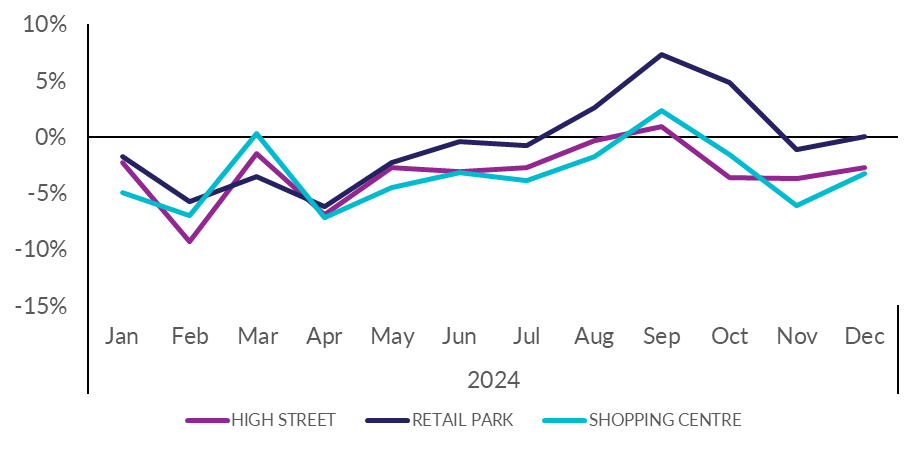

High

Street footfall decreased by

2.7% in December (YoY), up from -3.7% in November.

-

Retail

Park footfall unchanged at

0.0% in December (YoY), up from -1.1% in November.

-

Shopping

Centre footfall decreased by

3.3% in December (YoY), up from -6.1% in November.

- Footfall decreased year-on-year for all four nations,

with Scotland falling by

1.5%, England by

2.1%, Wales by 2.6%,

while Northern Ireland experienced the

biggest decline at 5.8%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“A drab December which saw fewer shoppers in all locations,

capped a disappointing year for UK retail footfall. This means

2024 is the second year in a row where footfall has been in

decline. High streets and shopping centres were hit particularly

hard throughout the year as people veered towards retail parks to

take advantage of free parking and the variety of larger stores.

Even the Golden Quarter, typically the peak of shopping activity,

provided little relief, with footfall down over the period. While

the Black Friday weekend delivered more promising results, they

were overshadowed by a lacklustre festive season.

“Shopping habits have been changing fast and customers are

increasingly looking for more experiential shopping, as well as a

variety of cafes, services and things to do. Unfortunately,

investment in town centres and high streets is held back by our

outdated business rates system, which penalises town and city

centes. The Government's proposals to reform business rates may

ease the burden for some retailers, but it is vital that,

ultimately, no shop ends up paying more in rates than before.

With retailers facing £7 billion in additional costs this year

from increased tax and regulations, the changes to the business

rates system must be made in way that supports retail investment

and growth in the years ahead.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic,

commented:

“While December saw some flurries of festive footfall around a

few key trading days, overall, the picture was filled with much

less sparkle as shopper traffic remained subdued in what should

have been the highlight of the Golden Quarter. While store

visits did build ahead of Christmas, it was never quite enough to

reverse the shopper count deficit against last year. As

footfall limped towards the festive finish line, December's

lacklustre performance compounds a disappointing end to 2024,

marking the second consecutive year of declining store traffic.

Retailers will now need to look afresh to 2025 and chart a

course to adopt innovative strategies to reverse this trend or

maximise the sales potential of fewer visitors, finding new ways

to make each store visit count.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE

YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Dec-24

|

Nov-24

|

|

1

|

South East England

|

-1.1%

|

-2.0%

|

|

1

|

West Midlands

|

-1.1%

|

-6.1%

|

|

3

|

London

|

-1.2%

|

-2.1%

|

|

4

|

North West England

|

-1.4%

|

-3.3%

|

|

5

|

Scotland

|

-1.5%

|

-6.8%

|

|

6

|

England

|

-2.1%

|

-4.2%

|

|

7

|

Wales

|

-2.6%

|

-7.1%

|

|

8

|

East Midlands

|

-2.7%

|

-6.2%

|

|

9

|

Yorkshire and the Humber

|

-2.9%

|

-9.1%

|

|

10

|

North East England

|

-3.3%

|

-9.0%

|

|

11

|

East of England

|

-3.4%

|

-1.8%

|

|

12

|

South West England

|

-4.8%

|

-4.7%

|

|

13

|

Northern Ireland

|

-5.8%

|

-2.8%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Dec-24

|

Nov-24

|

|

1

|

Birmingham

|

4.8%

|

-4.7%

|

|

2

|

Glasgow

|

0.2%

|

-9.4%

|

|

3

|

Edinburgh

|

-1.1%

|

-5.6%

|

|

4

|

London

|

-1.2%

|

-2.1%

|

|

5

|

Leeds

|

-3.0%

|

-10.8%

|

|

5

|

Manchester

|

-3.0%

|

-2.0%

|

|

7

|

Nottingham

|

-3.3%

|

-7.4%

|

|

8

|

Cardiff

|

-3.5%

|

-8.6%

|

|

9

|

Liverpool

|

-3.8%

|

-5.5%

|

|

10

|

Belfast

|

-7.2%

|

-2.3%

|

|

11

|

Bristol

|

-7.5%

|

-7.8%

|