Covering the four weeks 27 October – 23 November

2024

-

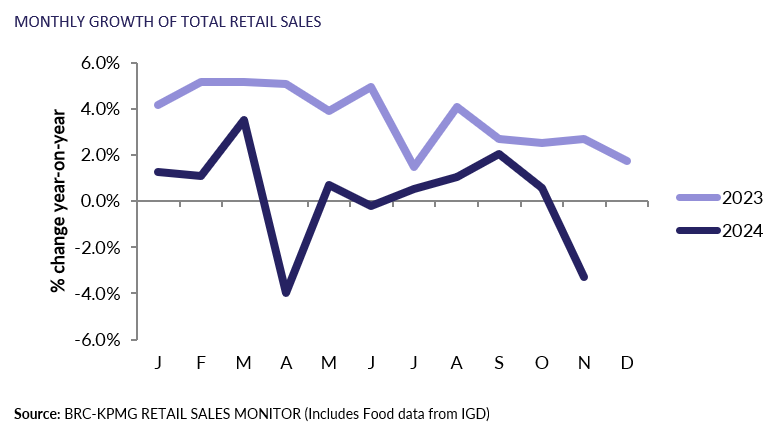

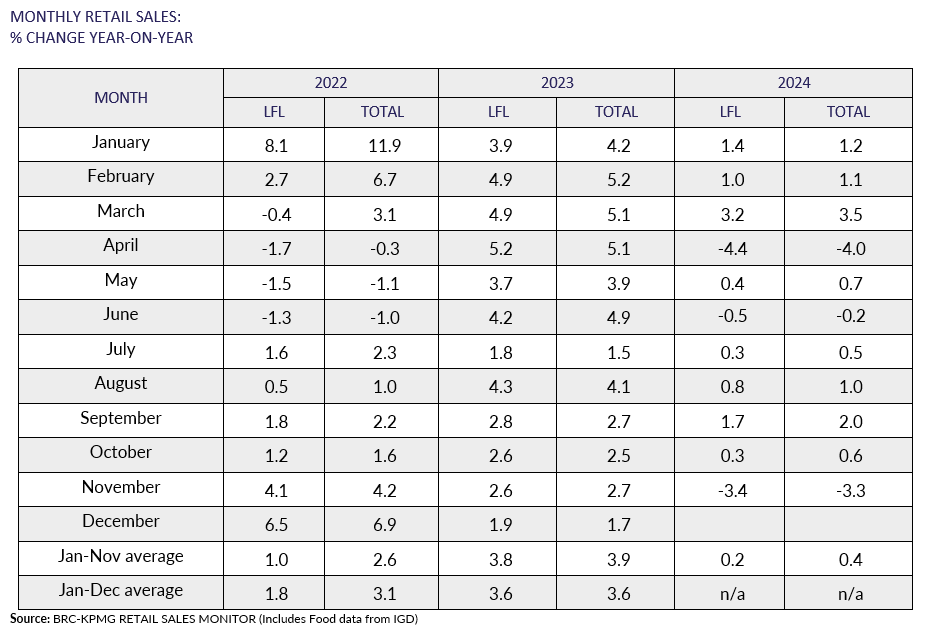

UK Total retail sales

decreased by 3.3% year on year in November, against a growth of

2.6% in November 2023. This was below the 3-month average

growth of -0.1% and the 12-month average growth of 0.5%.

-

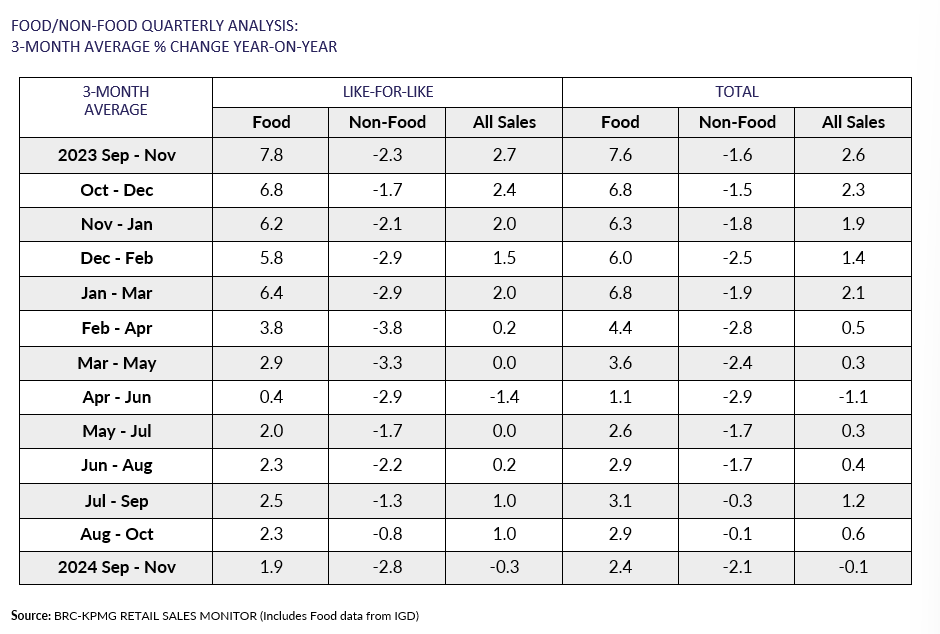

Food sales increased 2.4% year on year over

the three months to November, against a growth of 7.6% in

November 2023. This is below the 12-month average growth of

3.7%. For the month of November, Food was in growth

year-on-year.

-

Non-Food sales decreased 2.1% year on year

over the three-months to November, against a decline of 1.6% in

November 2023. This is above the 12-month average decline of

2.2%. For the month of November, Non-Food was in decline

year-on-year.

-

In-store Non-Food sales over the three months

to November decreased 2.2% year on year, against an increase of

2.2% in November 2023. This is above the 12-month average

decline of 2.5%.

-

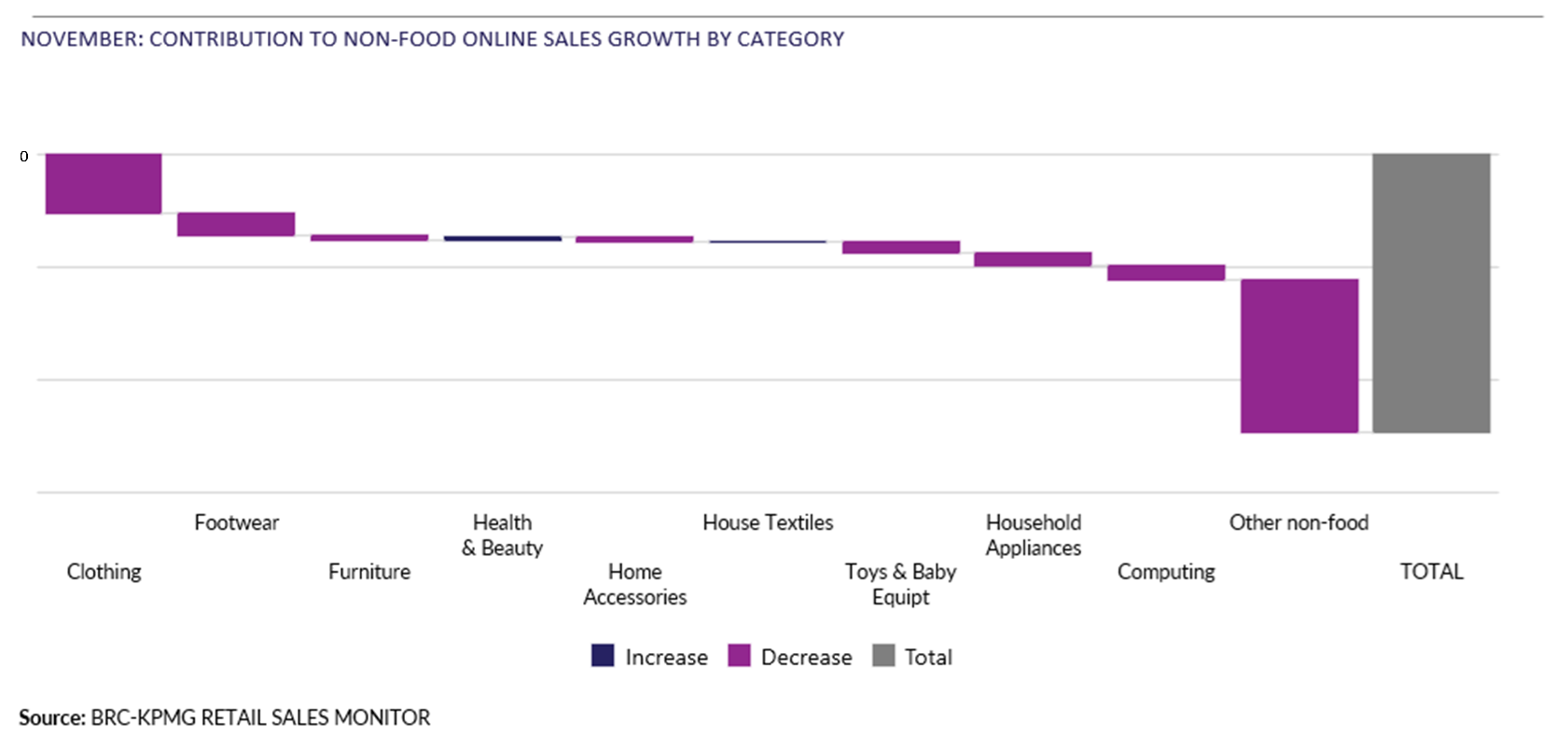

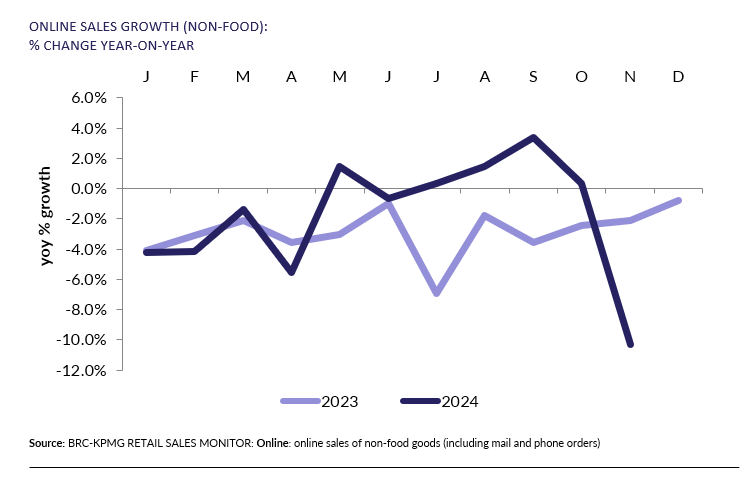

Online Non-Food sales decreased by -10.3% year

on year in November, against an average decline of -2.1% in

November 2023. This was below the 3-month average decrease of

1.7% and below the 12-month average decline of 1.5%.

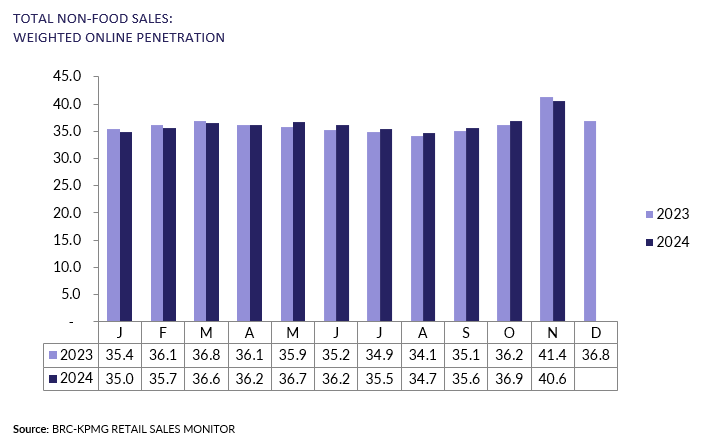

- The online penetration rate (the proportion

of Non-Food items bought online) decreased to 40.6% in November

from 41.4% in November 2023. This was above the 12-month average

of 36.4%.

Helen Dickinson, Chief Executive at

the British Retail Consortium, said:

“While it was undoubtedly a bad start to the festive season, the

poor spending figures were primarily down to the movement of

Black Friday into the December figures this year. Even so, low

consumer confidence and rising energy bills have clearly dented

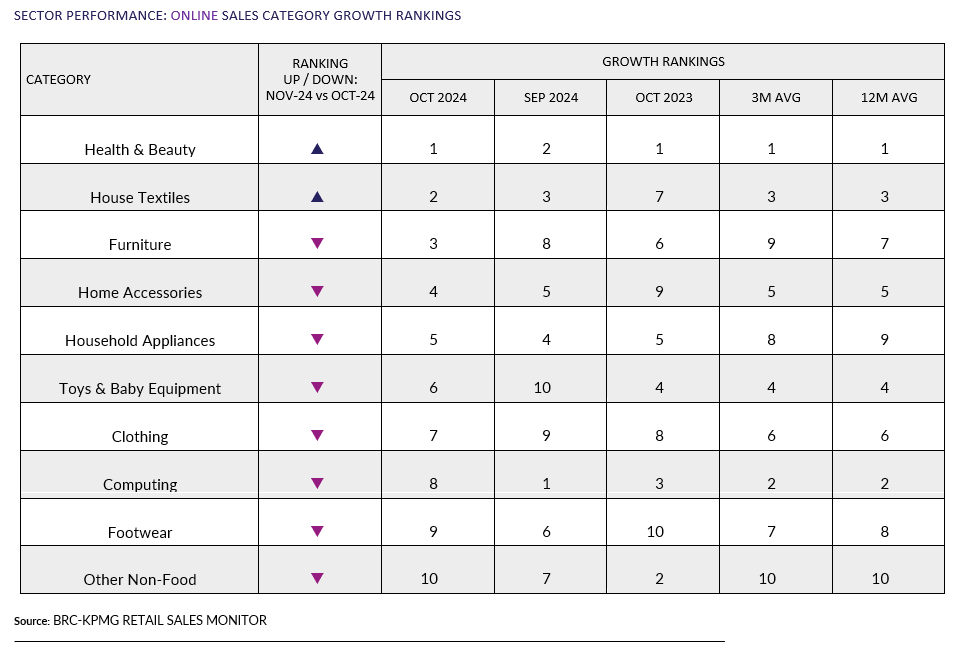

non-food spending. Spending on fashion was particularly weak as

households delayed purchases of new winter clothing, while health

spending was boosted by the season's arrival of coughs and colds.

“Retailers will be hoping that seasonal spending is delayed not

diminished and that customers get spending in the remaining weeks

running up to Christmas. If not, retailers will be feeling the

squeeze from both sides as reduced revenues are met with huge

additional costs next year. The Budget, as well as the

introduction of new packaging levies, will cost retailers over £7

billion extra next year. How effectively the government works the

industry to mitigate these costs will determine the extent of

price rises and job losses in the future.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“Along with the cold snap at the end of the month, retail sales

also went into minus numbers for November.

“An upturn in health product buying also signalled that the

winter months had arrived and, along with food and drink, was one

of very few categories to see in-store or online sales growth.

“While the majority of November's data tells a disappointing tale

for the retail sector, this reporting didn't include Black Friday

week, so the hope for retailers is that consumers were being

savvy shoppers and that the promotional push in the last days of

the month saw held-back consumer spend materialise and mitigate

what is otherwise a disappointing month. If not, then we

may see some retailers launching Christmas sales early.”

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“Post-October Budget, shoppers have likely noticed the media

reaction from businesses, but this hasn't significantly shifted

their behaviour. November's grocery market performance shows

year-on-year growth in both value and volume. IGD's latest

research highlights signs of festive cheer, with 5% more shoppers

than last year (41% vs 36% in 2023) planning to spend what

they want this Christmas. However, despite this uplift, it's

unlikely to be a bumper Christmas for all, as many remain focused

on budgeting. The festive optimism is there, but the underlying

caution means spending will still be influenced by economic

pressures, especially on out-of-home activities.”

-ENDS-

Notes:

A note on Black Friday. The ONS calendar dates (which BRC follow)

are:

- November 2024: 27 Oct – 23 Nov, which excluded Black Friday

in 2024; compared to

- November 2023: 29 Oct – 25 Nov, which included Black Friday

in 2023.

Conversely, December 2024 (24 Nov – 28 Dec) will include Black

Friday, while its 2023 comparison did not. This will artificially

inflate next month's figures.