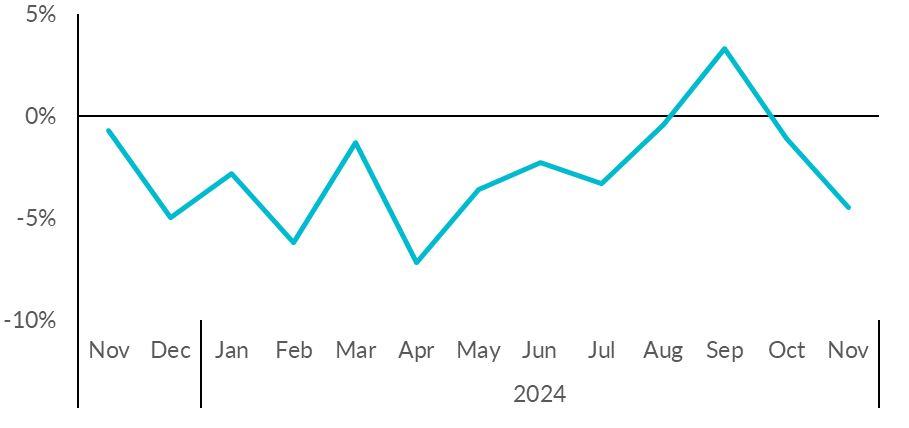

The later timing of Black Friday in 2024 meant that it does not

fall into this month's figures, but is included in last year's

comparable, exacerbating the year-on-year decline.

Covering the four weeks 27 October 2024 – 23 November

2024

According to BRC-Sensormatic data:

-

Total UK footfall decreased by 4.5%

in November (YoY), down from -1.1% in October.

-

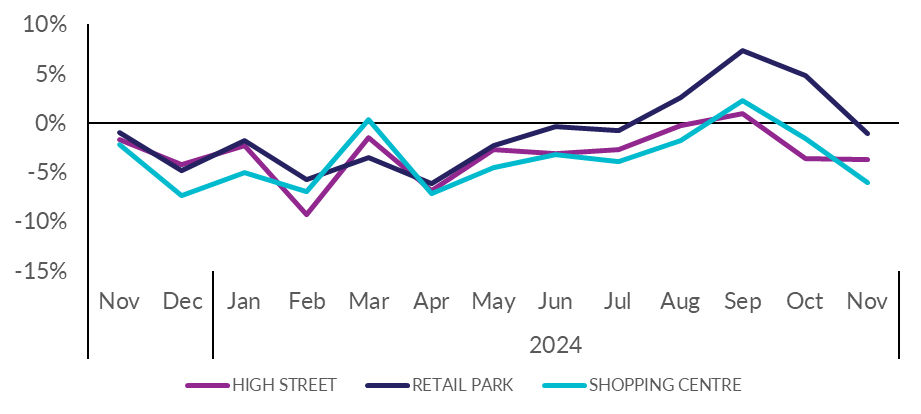

High Street footfall decreased by

3.7% in November (YoY), down from -3.6% in October.

-

Retail Park footfall decreased by

1.1% in November (YoY), down from +4.8% in October.

-

Shopping Centre footfall decreased by

6.1% in November (YoY), down from -1.6% in October.

- Footfall decreased year-on-year for all four nations, with

Northern Ireland falling by 2.8%,

England by 4.2%, Scotland by

6.8%, while Wales experienced the biggest

decline at 7.1%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Footfall took a disappointing tumble in November, as a

later-than-usual Black Friday and low consumer confidence meant

customers were hesitant to hit the shops. Some northern cities

also suffered particularly badly due to Storm Bert, which caused

travel disruption towards the end of the month. Retailers remain

hopeful that the Black Friday and Christmas sales will help to

turn around the declining footfall seen through most of 2024,

crucial as we enter the “golden quarter”.

“Retail not only contributes to the economy of local areas but is

essential to everyday life in communities across the country. New

costs bearing down on retailers in 2025, including from rises in

Employer National Insurance, National Living Wage, and packaging

taxes, means investment in jobs, stores, and high streets will

likely be curtailed. If the Government wishes to bolster footfall

and the growth and investment that would come with it, it must

help retailers mitigate the impact of the £7 billion additional

costs they face from next year.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic,

commented:

“Retail store visits dipped in November as consumer confidence

remains volatile, perhaps not helped by post-Budget spending

jitters and shoppers withholding festive purchases, opting

instead to shop around for the best prices or hold out for

further discounting. This lacklustre footfall performance

will have come as a blow for many retailers, who would have been

counting on getting early Christmas trading results under their

belts before the start of advent. However, it's worth

noting that these figures do not include Black Friday and the

Saturday of the Black Friday weekend - tipped as one of the top

busiest days for store shopping during peak trading - which will

hopefully jump start seasonal shopping. Now, all eyes turn

to December, where retailers hope to make up for lost ground and

turn around their festive fortunes. This will rely not only

on effective merchandising and shored up inventory availability,

but on building the compelling and immersive experiences that

bring the seasonal magic to life in-store.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Nov-24

|

Oct-24

|

|

1

|

East of England

|

-1.8%

|

-1.8%

|

|

2

|

South East England

|

-2.0%

|

-2.1%

|

|

3

|

London

|

-2.1%

|

-2.5%

|

|

4

|

Northern Ireland

|

-2.8%

|

1.3%

|

|

5

|

North West England

|

-3.3%

|

1.0%

|

|

5

|

England

|

-4.2%

|

-1.5%

|

|

7

|

South West England

|

-4.7%

|

-5.0%

|

|

8

|

West Midlands

|

-6.1%

|

1.5%

|

|

9

|

East Midlands

|

-6.2%

|

0.3%

|

|

10

|

Scotland

|

-6.8%

|

0.8%

|

|

11

|

Wales

|

-7.1%

|

0.4%

|

|

12

|

North East England

|

-9.0%

|

-3.6%

|

|

13

|

Yorkshire and the Humber

|

-9.1%

|

-0.5%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Nov-24

|

Oct-24

|

|

1

|

Manchester

|

-2.0%

|

-0.1%

|

|

2

|

London

|

-2.1%

|

-2.5%

|

|

2

|

Belfast

|

-2.3%

|

-0.6%

|

|

4

|

Birmingham

|

-4.7%

|

-0.1%

|

|

5

|

Liverpool

|

-5.5%

|

1.3%

|

|

6

|

Edinburgh

|

-5.6%

|

1.0%

|

|

7

|

Nottingham

|

-7.4%

|

-0.4%

|

|

8

|

Bristol

|

-7.8%

|

-7.7%

|

|

9

|

Cardiff

|

-8.6%

|

0.0%

|

|

10

|

Glasgow

|

-9.4%

|

1.6%

|

|

11

|

Leeds

|

-10.8%

|

1.8%

|

-ENDS-

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.

While High Streets, Shopping Centres and Retail Parks are the

main components of the Total Footfall, there are also additional

categories not included as separate indices. These include

outlets, travel hub locations, and free standing locations such

as garden centres.