BRC-SENSORMATIC FOOTFALL MONITOR – September

2024

Covering the five weeks 25 August

2024 – 28 September 2024

According to

BRC-Sensormatic data:

-

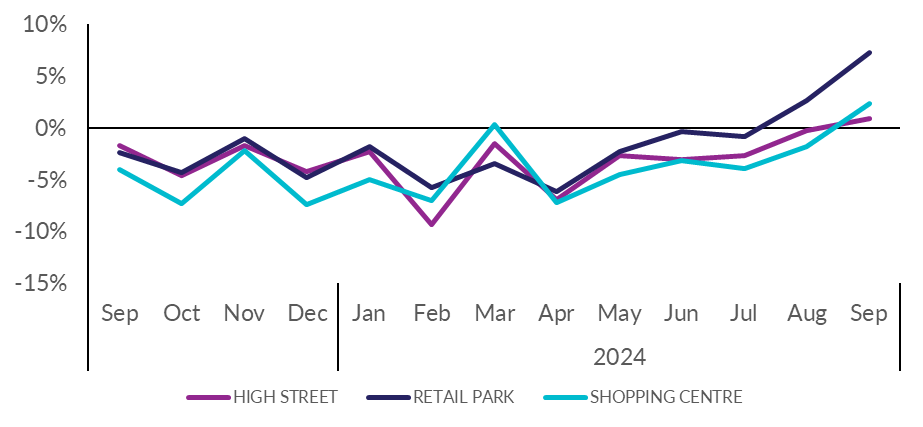

Total

UK footfall increased by 3.3%

in September (YoY), up from -0.4% in August.

-

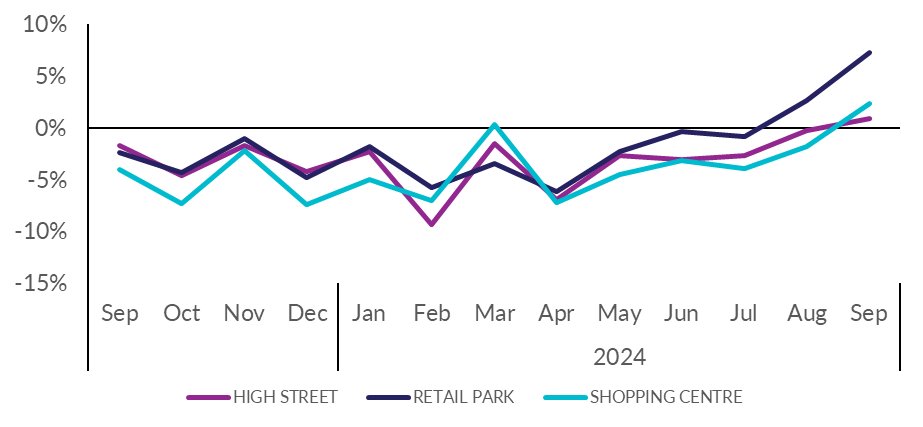

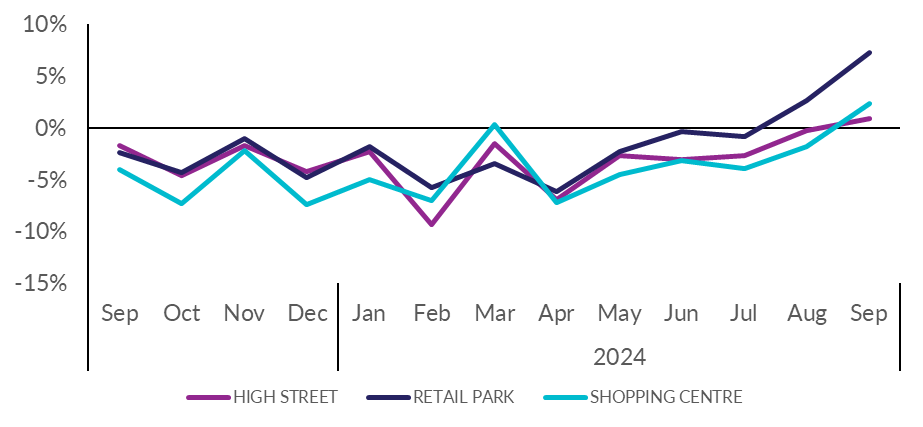

High

Street footfall increased by

0.9% in September (YoY), up from -0.3% in August.

-

Retail

Park footfall increased by

7.3% in September (YoY), up from from +2.6% in August.

-

Shopping

Centre footfall increased by

2.3% in September (YoY), up from -1.8% in August.

- All four devolved nations saw increases in footfall YoY:

-

Northern Ireland increased by 2.5%

YoY

-

Scotland increased by 0.7% YoY

-

England increased by 3.6% YoY

-

Wales increased by 5.4% YoY

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Footfall rose for the first time in over a year as mild

temperatures combined with weak footfall last year led to strong

growth in September. It was neither too hot nor too cold for

customers, leaving retailers in the sweet spot for additional

shopping trips. This compared positively to last year when the

intense heatwave caused many people to stay home and delay

purchases of autumnal clothes and products. Retail parks

continued to perform particularly well as the increased rain

drove some people towards shopping areas with nearby parking.

“While retailers will welcome this autumnal boost, it is the next

few months, in the run up to Christmas, that are most important.

The Chancellor wants to boost confidence and help unlock business

investment. A Retail Business Rates Corrector, a 20% adjustment

to bills for all retail properties, would help mitigate the

disproportionate impact of business rates on retail, driving

investment and helping to rejuvenate high streets. This in turn

would boost shopper footfall and create thriving communities up

and down the country.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic,

commented:

“September saw a long-awaited positive uptick in footfall, with

total shopper numbers returning the first positive year-on-year

performance since July 2023. While the High Street and

Shopping Centres saw improvements compared to last year, Retail

Parks were once again the standout shopping destination, with

their tenant mix of out-of-town supermarkets and discount retail

offerings helping to drive shopper traffic. This

September's growth is built on last year's suppressed footfall

from September 2023's heatwave. While retailers will

welcome the boost, hoping that this translates into sales, many

will still be eyeing it with caution.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Sep-24

|

Aug -24

|

|

1

|

Wales

|

+5.4%

|

-1.8%

|

|

2

|

South East England

|

+5.2%

|

-0.4%

|

|

3

|

East of England

|

+4.7%

|

–

|

|

4

|

North West England

|

+4.7%

|

+0.7%

|

|

5

|

South West England

|

+4.6%

|

-1.7%

|

|

5

|

Yorkshire and the Humber

|

+4.2%

|

-2.2%

|

|

7

|

East Midlands

|

+3.6%

|

-0.1%

|

|

8

|

England

|

+3.6%

|

-0.5%

|

|

9

|

West Midlands

|

+3.0%

|

-0.8%

|

|

10

|

Northern Ireland

|

+2.5%

|

+1.4%

|

|

11

|

London

|

+2.5%

|

+0.8%

|

|

12

|

North East England

|

+1.1%

|

-0.5%

|

|

13

|

Scotland

|

+0.7%

|

+0.7%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Sep-24

|

Aug -24

|

|

1

|

Leeds

|

+6.9%

|

-1.5%

|

|

2

|

Bristol

|

+5.0%

|

-4.2%

|

|

2

|

Cardiff

|

+3.9%

|

-4.1%

|

|

4

|

Belfast

|

+3.7%

|

-0.2%

|

|

5

|

Manchester

|

+3.4%

|

-1.4%

|

|

6

|

Edinburgh

|

+2.8%

|

+2.6%

|

|

7

|

Nottingham

|

+2.6%

|

-3.6%

|

|

8

|

London

|

+2.5%

|

+0.8%

|

|

9

|

Liverpool

|

+1.8%

|

-1.9%

|

|

10

|

Birmingham

|

-0.1%

|

-8.1%

|

|

11

|

Glasgow

|

-1.0%

|

-0.6%

|

-ENDS-

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.

While High Streets, Shopping Centres and Retail Parks are the

main components of the Total Footfall, there are also additional

categories not included as separate indices. These include

outlets, travel hub locations, and free standing locations such

as garden centres.

Chancellor urged to back Scottish retail's efforts to

turn browsing into buying

Covering the five weeks 25 August

2024 – 28 September 2024

According to SRC-Sensormatic data:

-

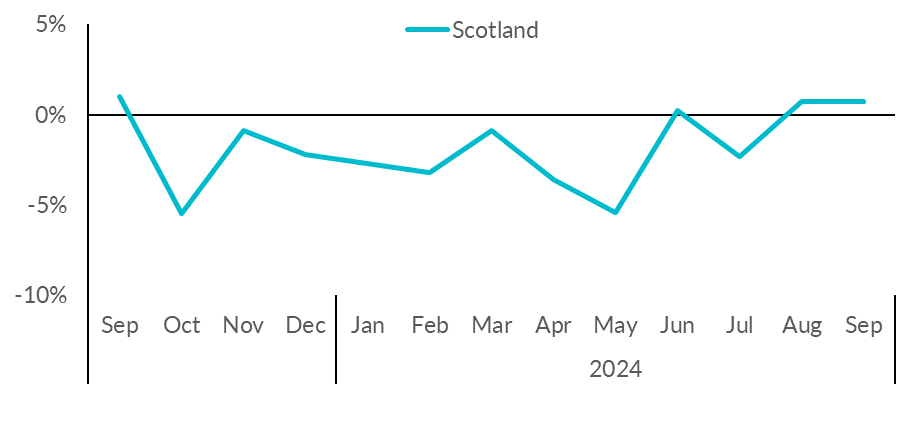

Scottish footfall increased by

0.7% in September (YoY), flat with August, lower than the UK

average increase of 3.3% (YoY).

-

Shopping

Centre footfall decreased by

2.4% in September (YoY) in Scotland, down from -0.6% in August.

- In September, footfall

in Edinburgh increased by

2.8% (YoY),

while Glasgow decreased by

1.0%.

David Lonsdale, Director of the Scottish Retail

Consortium, said:

“September saw a

steady if unspectacular growth in shopper foot-traffic compared

to the previous year. Nonetheless, this is a positive trajectory

- and for a second successive month – particularly ahead of the

so-called Golden Quarter for much of Scotland's retail industry.

Once again Edinburgh was the standout destination, seeing growth

for a fourth month in a row. However, footfall to shopping

centres dipped to their lowest level since the Spring.

“There is a note of caution in that improvements in footfall

haven't always correlated with an increase the value of retail

sales. Frustratingly for retailers more browsing by customers

doesn't necessarily mean more buying. As such, the hoped for

positive knock-on economic impact of an expansion in footfall

cannot be taken for granted. Whilst shop prices are falling,

recent data shows consumer sentiment has waned and some recent

public policy decisions will likely nibble away at disposable

incomes, such as the removal of the peak rail fares discount and

increase in the minimum unit price of alcohol.

“Enhanced levels of consumer spending will be central to

Scotland's economic recovery. Hopefully, the Chancellor will use

her upcoming Budget to inject some much needed confidence back

into the economy and help encourage shoppers to move from window

shopping to the real thing in the Golden Quarter of trading.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“September saw another positive uptick in footfall, building on

the positive year-on-year performance in August, as Back To

School boosted store visits. While across the UK, High

Street and Shopping Centres saw improvements compared to last

year, Retail Parks were once again the standout shopping

destination, with their tenant mix of out-of-town supermarkets

and discount retail offerings helping to drive shopper

traffic. While retailers will welcome this second

consecutive boost to store numbers, many will still be eyeing it

with caution.”

MONTHLY TOTAL SCOTTISH RETAIL FOOTFALL (% CHANGE

YoY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Sep-24

|

Aug -24

|

|

1

|

Wales

|

+5.4%

|

-1.8%

|

|

2

|

South East England

|

+5.2%

|

-0.4%

|

|

3

|

East of England

|

+4.7%

|

–

|

|

4

|

North West England

|

+4.7%

|

+0.7%

|

|

5

|

South West England

|

+4.6%

|

-1.7%

|

|

5

|

Yorkshire and the Humber

|

+4.2%

|

-2.2%

|

|

7

|

East Midlands

|

+3.6%

|

-0.1%

|

|

8

|

England

|

+3.6%

|

-0.5%

|

|

9

|

West Midlands

|

+3.0%

|

-0.8%

|

|

10

|

Northern Ireland

|

+2.5%

|

+1.4%

|

|

11

|

London

|

+2.5%

|

+0.8%

|

|

12

|

North East England

|

+1.1%

|

-0.5%

|

|

13

|

Scotland

|

+0.7%

|

+0.7%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Sep-24

|

Aug -24

|

|

1

|

Leeds

|

+6.9%

|

-1.5%

|

|

2

|

Bristol

|

+5.0%

|

-4.2%

|

|

2

|

Cardiff

|

+3.9%

|

-4.1%

|

|

4

|

Belfast

|

+3.7%

|

-0.2%

|

|

5

|

Manchester

|

+3.4%

|

-1.4%

|

|

6

|

Edinburgh

|

+2.8%

|

+2.6%

|

|

7

|

Nottingham

|

+2.6%

|

-3.6%

|

|

8

|

London

|

+2.5%

|

+0.8%

|

|

9

|

Liverpool

|

+1.8%

|

-1.9%

|

|

10

|

Birmingham

|

-0.1%

|

-8.1%

|

|

11

|

Glasgow

|

-1.0%

|

-0.6%

|

-ENDS-

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.

While High Streets, Shopping Centres and Retail Parks are the

main components of the Total Footfall, there are also additional

categories not included as separate indices. These include

outlets, travel hub locations, and free standing locations such

as garden centres.

Standout September as Wales outperforms on

footfall

Covering the five weeks 25 August

2024 – 28 September 2024

According to WRC-Sensormatic data:

-

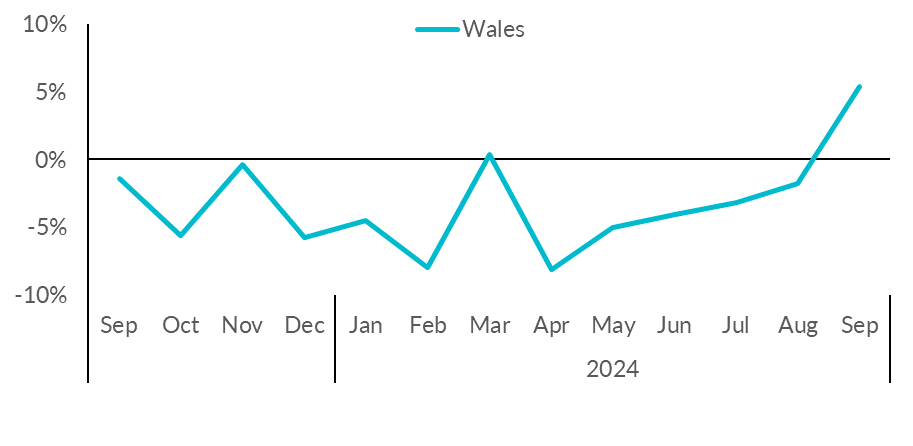

Welsh footfall increased by

5.4% in September (YoY), up from -1.8% in August. This led all

of the UK regions, which on average increased by of 3.3% (YoY).

-

Shopping

Centre footfall decreased by

1.6% in September (YoY) in Wales, up from August's

-5.2%.

- In September, footfall

in Cardiff increased by

3.9% (YoY), up from -4.1% in August.

Sara Jones, Head of the Welsh Retail Consortium,

said:

“Welsh footfall returned its first year on year growth since

March, with a positive start to the autumn shopping period.

Bolstered by return to school preparations shopper numbers were

up 7.2 percent on the preceding month and 5.4 per cent on the

previous year. These standout figures place Wales at the top of

the footfall league, surpassing other UK nations and regions, and

providing the first real sign of positivity for almost two years.

“Whilst the figures paint a glowing picture for September it

remains the case that these are just one month's figures. It will

be a nervous wait for Welsh retailers as they move into the

golden quarter of Christmas shopping, a period which is vital to

their annual performance. Given the relatively lacklustre shopper

numbers throughout 2024, it is hoped that renewed confidence will

return, and footfall growth will be sustained for the remainder

of the year.

“Fundamental to ongoing growth in the retail industry – Wales'

largest private sector employer - will be Government decisions in

the upcoming Autumn statement and Welsh budget. The WRC will

shortly be presenting our own budget recommendations to the Welsh

Government, calling for support on business rates and an easing

of regulatory pressures. By acting on our recommendations a clear

signal can be sent, that Wales is a great place to do business

and can thrive in the years to come..”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“September saw a long-awaited positive uptick in footfall, with

total shopper numbers returning the first positive year-on-year

performance since March 2024, as Back To School boosted store

visits. While across the UK, High Street and Shopping

Centres saw improvements compared to last year, Retail Parks were

once again the standout shopping destination, with their tenant

mix of out-of-town supermarkets and discount retail offerings

helping to drive shopper traffic. This September's growth

is built on last year's suppressed footfall, so while retailers

will welcome the boost, many will still be eyeing it with

caution.”

MONTHLY TOTAL WELSH RETAIL FOOTFALL (% CHANGE

YoY)

UK FOOTFALL BY LOCATION (% CHANGE YoY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Sep-24

|

Aug -24

|

|

1

|

Wales

|

+5.4%

|

-1.8%

|

|

2

|

South East England

|

+5.2%

|

-0.4%

|

|

3

|

East of England

|

+4.7%

|

–

|

|

4

|

North West England

|

+4.7%

|

+0.7%

|

|

5

|

South West England

|

+4.6%

|

-1.7%

|

|

5

|

Yorkshire and the Humber

|

+4.2%

|

-2.2%

|

|

7

|

East Midlands

|

+3.6%

|

-0.1%

|

|

8

|

England

|

+3.6%

|

-0.5%

|

|

9

|

West Midlands

|

+3.0%

|

-0.8%

|

|

10

|

Northern Ireland

|

+2.5%

|

+1.4%

|

|

11

|

London

|

+2.5%

|

+0.8%

|

|

12

|

North East England

|

+1.1%

|

-0.5%

|

|

13

|

Scotland

|

+0.7%

|

+0.7%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Sep-24

|

Aug -24

|

|

1

|

Leeds

|

+6.9%

|

-1.5%

|

|

2

|

Bristol

|

+5.0%

|

-4.2%

|

|

2

|

Cardiff

|

+3.9%

|

-4.1%

|

|

4

|

Belfast

|

+3.7%

|

-0.2%

|

|

5

|

Manchester

|

+3.4%

|

-1.4%

|

|

6

|

Edinburgh

|

+2.8%

|

+2.6%

|

|

7

|

Nottingham

|

+2.6%

|

-3.6%

|

|

8

|

London

|

+2.5%

|

+0.8%

|

|

9

|

Liverpool

|

+1.8%

|

-1.9%

|

|

10

|

Birmingham

|

-0.1%

|

-8.1%

|

|

11

|

Glasgow

|

-1.0%

|

-0.6%

|

-ENDS-

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.

While High Streets, Shopping Centres and Retail Parks are the

main components of the Total Footfall, there are also additional

categories not included as separate indices. These include

outlets, travel hub locations, and free standing locations such

as garden centres.

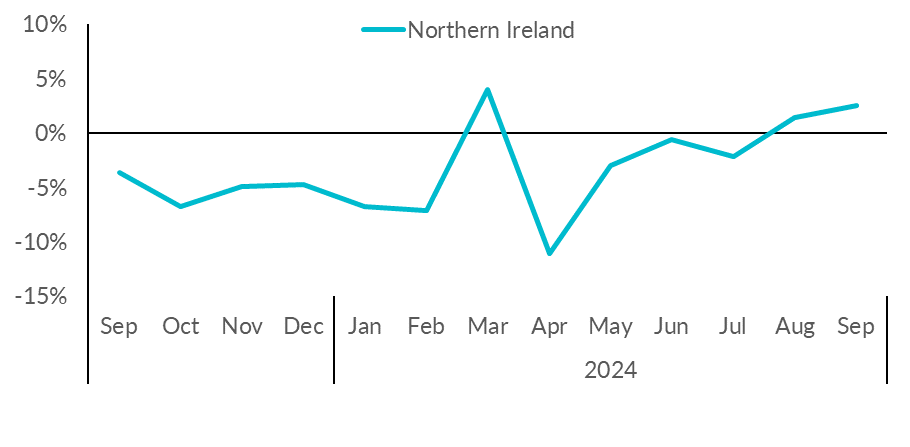

NIRC-SENSORMATIC FOOTFALL MONITOR – September

2024

Covering the five weeks 25 August

2024 – 28 September 2024

According to

NIRC-Sensormatic data:

-

Northern

Ireland footfall increased by

2.5% in September (YoY), up from +1.4% in August. This is the

biggest increase of the four nations and better than the UK

average decrease of -0.4% (YoY).

-

Shopping

Centre footfall decreased by

0.8% in September (YoY) in Northern Ireland; this is up from

-2.4% in August.

- In September, footfall

in Belfast increased by

3.7% (YoY), up from -0.2% in August.

Neil Johnston, Director of the Northern Ireland Retail

Consortium, said:

“September saw a steady if unspectacular growth in shopper

foot-traffic across the UK, including Northern Ireland, compared

to the previous year. The positive footfall figures for Northern

Ireland seem to be driven by Belfast – Northern Ireland footfall

was up 2.5% overall compared to the same period last year while

Belfast was up 3.7%. Across the UK the increase was 3.3%.

“Retail parks seem to be the most vibrant locations at the

moment, and this may be due to investment by retailers in these

locations.

“There is a note of caution in that improvements in footfall

haven't always correlated with an increase in the value of retail

sales. Frustratingly for retailers more browsing by customers

doesn't necessarily mean more buying. As such, the hoped for

positive knock-on economic impact of an expansion in footfall

cannot be taken for granted.

“Enhanced levels of consumer spending will be central to

continuing Northern Ireland's economic recovery. Hopefully, the

Chancellor will use her upcoming Budget to boost confidence in

the economy and help encourage shoppers to move from window

shopping to the real thing in the Golden Quarter of trading.

“Locally we would urge the Finance Minister to boost the health

of our retail hubs across Northern Ireland by moving to cut

business rates and set a path to bringing our business rates

multiplier down in line with England and Wales. Strong retail

centres are crucial to our economy.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“September saw another positive uptick in footfall, building on

the positive year-on-year performance in August, as Back To

School boosted store visits. While across the UK, High

Street and Shopping Centres saw improvements compared to last

year, Retail Parks were once again the standout shopping

destination, with their tenant mix of out-of-town supermarkets

and discount retail offerings helping to drive shopper traffic.

This September's growth is built on last year's suppressed

footfall, so while retailers will welcome this second consecutive

boost to store numbers, many will still be eyeing it with

caution.”

MONTHLY TOTAL NORTHERN IRELAND RETAIL FOOTFALL (%

CHANGE YoY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Sep-24

|

Aug -24

|

|

1

|

Wales

|

+5.4%

|

-1.8%

|

|

2

|

South East England

|

+5.2%

|

-0.4%

|

|

3

|

East of England

|

+4.7%

|

–

|

|

4

|

North West England

|

+4.7%

|

+0.7%

|

|

5

|

South West England

|

+4.6%

|

-1.7%

|

|

5

|

Yorkshire and the Humber

|

+4.2%

|

-2.2%

|

|

7

|

East Midlands

|

+3.6%

|

-0.1%

|

|

8

|

England

|

+3.6%

|

-0.5%

|

|

9

|

West Midlands

|

+3.0%

|

-0.8%

|

|

10

|

Northern Ireland

|

+2.5%

|

+1.4%

|

|

11

|

London

|

+2.5%

|

+0.8%

|

|

12

|

North East England

|

+1.1%

|

-0.5%

|

|

13

|

Scotland

|

+0.7%

|

+0.7%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Sep-24

|

Aug -24

|

|

1

|

Leeds

|

+6.9%

|

-1.5%

|

|

2

|

Bristol

|

+5.0%

|

-4.2%

|

|

2

|

Cardiff

|

+3.9%

|

-4.1%

|

|

4

|

Belfast

|

+3.7%

|

-0.2%

|

|

5

|

Manchester

|

+3.4%

|

-1.4%

|

|

6

|

Edinburgh

|

+2.8%

|

+2.6%

|

|

7

|

Nottingham

|

+2.6%

|

-3.6%

|

|

8

|

London

|

+2.5%

|

+0.8%

|

|

9

|

Liverpool

|

+1.8%

|

-1.9%

|

|

10

|

Birmingham

|

-0.1%

|

-8.1%

|

|

11

|

Glasgow

|

-1.0%

|

-0.6%

|

-ENDS-

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.

While High Streets, Shopping Centres and Retail Parks are the

main components of the Total Footfall, there are also additional

categories not included as separate indices. These include

outlets, travel hub locations, and free standing locations such

as garden centres.