Covering the four weeks 30 June 2024 –

27 July 2024

According to BRC-Sensormatic IQ

data:

-

Total UK footfall decreased by 3.3%

in July (YoY), down from -2.3% in June.

-

High Street footfall increased by

2.7% in July (YoY), up from -3.1% in June.

-

Retail Park footfall decreased by

0.8% in July (YoY), down from -0.4% in June.

-

Shopping Centre footfall

decreased by 3.9% in July (YoY), down from -3.9%

in May.

- All UK nations saw a fall in footfall year on year:

-

Scotland decreased by 2.3% YoY

-

Northern Ireland decreased by 2.2% YoY

-

England decreased by 3.4% YoY – the

largest fall in footfall

-

Wales decreased by 3.2% YoY

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Footfall declined for the twelfth consecutive month, failing to

maintain the buoyancy seen in 2022/23. As summer got into full

swing, many people have chosen to increase their spending on

holidays and leisure activities rather than shopping. Election

week also saw particularly weak footfall, as political

electioneering peaked, creating uncertainty for many consumers.

“With the election now over, many retailers will be making

decisions about how and where to invest in the coming years.

Retailers welcomed Labour's promises to reform both business

rates and planning laws – two major factors that often hold back

much needed local investment. If Labour can address these

effectively, they could help breathe new life into retail

destinations.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“Despite a warmer and drier month compared to the wash-out that

was June, July's footfall faltered with shopper traffic falling

back to the same levels we saw in May. As we approach a

full year of seeing footfall yo-yo in its ongoing recovery, it's

clear the longtail of the cost-of-living crisis is continuing to

rattle consumer confidence and is likely to prompt spending

caution for some time to come, making each in-store conversion

all the harder won. With election fever now over and the

school holidays now in full swing, retailers will be hoping that

spells a positive outlook for store performance in the months to

come.”

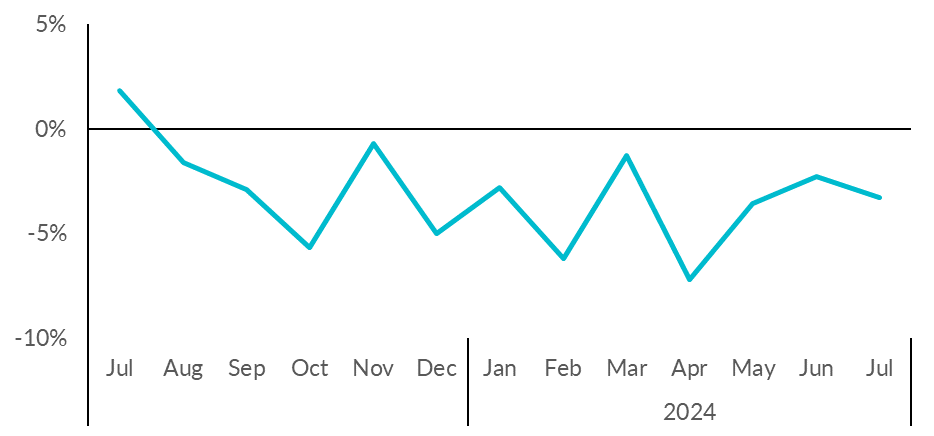

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY

NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Jul-24

|

Jun-24

|

|

1

|

London

|

-1.4%

|

-2.5%

|

|

2

|

North West England

|

-1.8%

|

-0.8%

|

|

3

|

Northern Ireland

|

-2.2%

|

-0.6%

|

|

4

|

Scotland

|

-2.3%

|

+0.2%

|

|

5

|

North East England

|

-2.7%

|

+0.2%

|

|

5

|

Wales

|

-3.2%

|

-4.1%

|

|

7

|

East of England

|

-3.4%

|

-1.4%

|

|

8

|

England

|

-3.4%

|

-2.6%

|

|

9

|

West Midlands

|

-3.6%

|

-4.0%

|

|

10

|

East Midlands

|

-4.1%

|

-3.5%

|

|

11

|

South East England

|

-5.0%

|

-5.0%

|

|

12

|

Yorkshire and the Humber

|

-5.4%

|

-2.1%

|

|

13

|

South West England

|

-6.0%

|

-2.2%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Jul-24

|

Jun-24

|

|

1

|

Edinburgh

|

+1.4%

|

+2.4%

|

|

2

|

Liverpool

|

+0.9%

|

+1.1%

|

|

2

|

Belfast

|

+0.3%

|

+3.7%

|

|

4

|

London

|

-1.4%

|

-2.5%

|

|

5

|

Manchester

|

-2.7%

|

-0.9%

|

|

6

|

Leeds

|

-2.8%

|

-2.1%

|

|

7

|

Cardiff

|

-3.9%

|

-5.1%

|

|

8

|

Nottingham

|

-4.6%

|

-3.1%

|

|

9

|

Glasgow

|

-4.8%

|

+2.2%

|

|

10

|

Birmingham

|

-5.9%

|

-4.0%

|

|

11

|

Bristol

|

-7.1%

|

-3.5%

|

-ENDS-

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.

While High Streets, Shopping Centres and Retail Parks are the

main components of the Total Footfall, there are also additional

categories not included as separate indices. These include

outlets, travel hub locations, and free standing locations such

as garden centres.