Analysis from the TaxPayers’ Alliance (TPA) has revealed that the

average household will pay over £1.2

million in tax in their lifetime, meaning they

would have to work for 19.5 years just

to pay off the taxman. The research is the first part of a series

of papers celebrating 20 years since the group was founded in

2004.

Even before froze income tax thresholds at

April 2021 levels, the average family would pay

almost £588,000 in income tax over

their lifetime. This is alongside

nearly £214,000 in employee and

employer national insurance contributions

and £182,000 in VAT, although this

does not account for the recent 2p cut to national insurance.

Previous TPA research found that the number of people paying

income tax has surged by 4.5 million since 2010, with more than

half of the increase coming since thresholds were frozen.

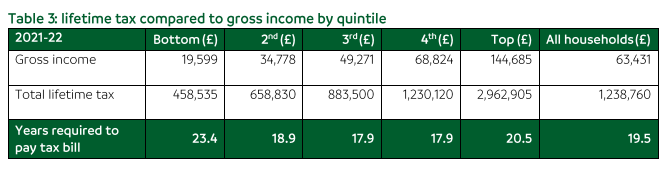

Meanwhile the bottom 20 per cent of households, or families with

a household gross income of £19,599, will work for

almost 23.4 years to pay off their

lifetime tax bill, the longest of any group. The lifetime tax

bill for the top 20 per cent of households, or families with an

income of £144,685, would be £2,962,905 in direct and indirect

taxes, which would take them 20.5 years to pay off.

The figures show that the average lifetime tax bill has only

fallen on four occasions since 1977. During the covid pandemic,

the lifetime tax bill briefly fell from £1.2 million to £1.1

million.

The research also shows it would take more

than 290,000 average households’ total

lifetime taxes to pay for the £360

billion cost of covid. Taxes taken throughout the

working lives of over 10,000 households would cover just a single

year of the foreign aid budget, even at the reduced rate of 0.5

per cent of gross national income.

With the tax burden at a record high, the TaxPayers’ Alliance is

calling on the chancellor to unfreeze tax thresholds and cut

income tax to bring down families’ lifetime tax bills.

CLICK HERE TO READ THE

RESEARCH

Key findings:

- An average household during their lifetime - 45 working years

and 15 years in retirement - will

pay £1,238,760 in direct and indirect

taxes (in 2021-22 prices). The average lifetime tax has almost

doubled in real terms from the amount of tax the average

household paid in 1977.

- The average gross income for a household in 2021-22 was

£63,431. This means that the average household would have to

give 19.5 years’ worth of gross income

to cover a lifetime’s worth of tax.

- Households in the bottom 20 per cent by income will

pay £458,535 in taxes over a lifetime.

The average gross income of those in the bottom 20 per cent of

households was £19,599 in 2021-22. Accordingly, it would take

over 23 years to pay off their tax

bill.

- The top 20 per cent of households in the UK will

pay £2,962,905 in taxes over a

lifetime. The average gross income for these households was

£144,685. For the highest earners, paying off their lifetime tax

would take over 20 years.

- The average lifetime tax has fallen on only four occasions

from the previous year since 1977. These were: 2002-03; 2008-09;

2012-13; and 2020-21.

- An average household over a lifetime will

pay £587,760 in income

tax; £181,590 of

VAT; £173,235 of employee’s national

insurance contributions; £91,230 of

council tax; and £40,350 of employers’

national insurance contributions.

- It would take 290,613 average household lifetime taxes to pay

for the cost of the covid pandemic, more than the entire

population of Greenwich, and over 10,000 to cover the cost of the

UK’s 2022 foreign aid spending.

CLICK HERE TO READ THE

RESEARCH

John O’Connell, chief executive of the TaxPayers'

Alliance, said:

“Taxpayers are spending almost half their working lives just

to pay off the taxman, with most families comfortably tax

millionaires.

“And since thresholds were frozen, this situation will almost

certainly have got worse, as more and more households are dragged

into higher rates of tax.

“The chancellor must use the budget to bring down the

lifetime tax bill, by cutting income tax and unfreezing

thresholds.”