Please note embargo

Covering the five weeks 26 November

– 30 December 2023

According to BRC-Sensormatic IQ data:

-

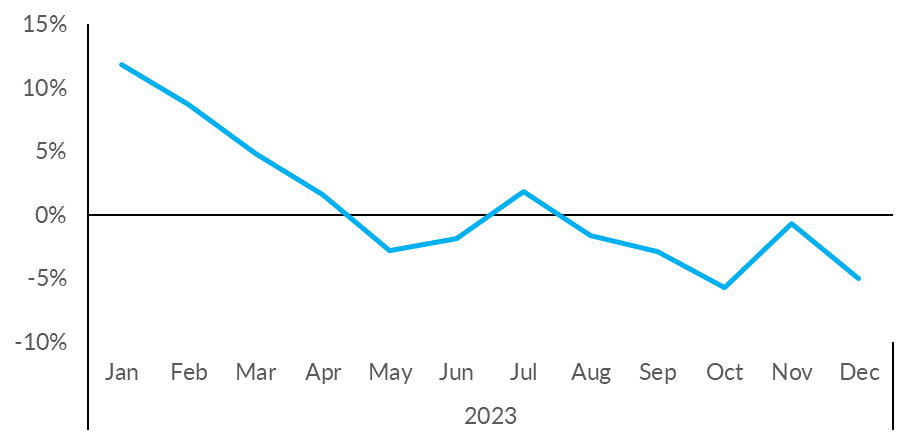

Total

UK footfall decreased by 5.0%

in December (YoY), down from -0.7% in November.

-

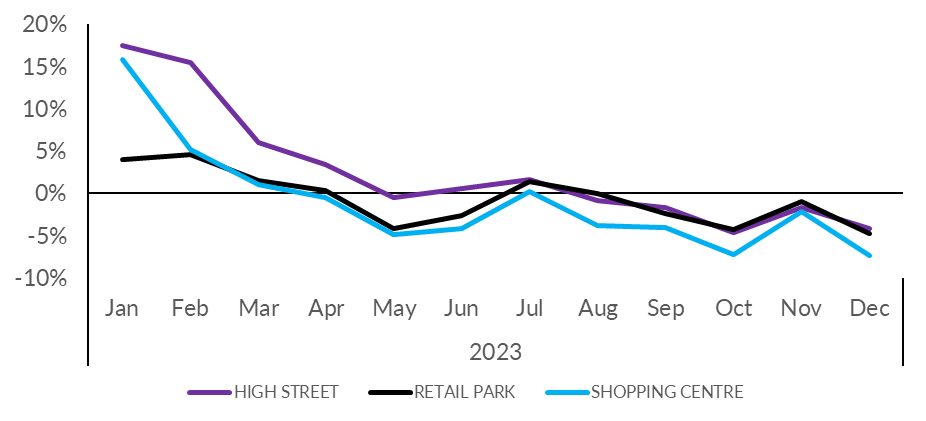

High

Street footfall decreased by

4.2% in December (YoY), down from -1.7% in November.

-

Retail Parks footfall

decreased by 4.8% in December (YoY), down

from -1.0% in November.

-

Shopping

Centre footfall decreased by

7.4% in December (YoY), down from -2.2% in November.

- Of the UK nations, Scotland saw

the least significant YoY drop in footfall, showing a decrease of

2.2%. Northern Ireland saw a YoY drop

in footfall of 4.7%. This was followed

by England and Wales,

both at 5.8%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“December’s heavy rain left many

shoppers reluctant to brave the elements, who instead opted to

browse online before making final purchases, or shop online

altogether. This led to a substantial decline in footfall levels

compared to December 2022, when there was significant pent-up

demand for in-store shopping post Covid-restrictions. Some

cities, such as Edinburgh, bucked the trend, and saw footfall

levels rise in December thanks to recent investment in new,

exciting shopping destinations.”

“With a general election on the cards later this year, we are

calling for the political parties to set out a clear and cohesive

plan for retail in their manifestos. This plan must take account

of the regulatory cost burden and broken business rates system

which are limiting business investment and growth. Ways also need

to be found to create thriving shopping destinations and drive

customer footfall back up again in 2024.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“One of the wettest Decembers

on record combined with dampened consumer confidence and ongoing

spending caution meant some retailers may have been left

disappointed in last month’s footfall performance. While we

saw festive glimmers of shopper traffic peaks in and around

discounting days, such as Boxing Day when footfall improved

+39.2% week-on-week, many may have been waiting for a last-minute

Christmas trading rush that never came. There’s little

doubt that the overall downward year-on-year trajectory in store

visits in December - usually the crescendo of the Golden Quarter

– will have come as a blow. Retailers will be hoping that

demand improves as inflation starts to ease and the impact of the

inflationary spending squeeze on disposable incomes softens.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Dec-23

|

Nov-23

|

|

1

|

London

|

-1.4%

|

-0.4%

|

|

2

|

Scotland

|

-2.2%

|

-0.9%

|

|

3

|

Northern Ireland

|

-4.7%

|

-4.9%

|

|

4

|

South West England

|

-4.9%

|

-0.3%

|

|

5

|

South East England

|

-5.1%

|

-2.4%

|

|

6

|

East of England

|

-5.2%

|

-0.1%

|

|

7

|

Yorkshire and the Humber

|

-5.3%

|

0.5%

|

|

9

|

Wales

|

-5.8%

|

-0.4%

|

|

9

|

England

|

-5.8%

|

-1.0%

|

|

10

|

East Midlands

|

-6.0%

|

-0.1%

|

|

11

|

West Midlands

|

-6.3%

|

1.7%

|

|

12

|

North West England

|

-7.9%

|

-1.2%

|

|

13

|

North East England

|

-8.8%

|

-2.8%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Dec-23

|

Nov-23

|

|

1

|

Edinburgh

|

6.4%

|

5.7%

|

|

2

|

Leeds

|

0.5%

|

3.1%

|

|

3

|

London

|

-1.4%

|

-0.4%

|

|

4

|

Belfast

|

-3.6%

|

-7.6%

|

|

5

|

Birmingham

|

-6.5%

|

2.5%

|

|

6

|

Liverpool

|

-7.2%

|

-2.4%

|

|

7

|

Bristol

|

-7.5%

|

-0.1%

|

|

8

|

Nottingham

|

-8.4%

|

-0.4%

|

|

9

|

Cardiff

|

-8.7%

|

-0.4%

|

|

10

|

Manchester

|

-9.3%

|

0.1%

|

|

11

|

Glasgow

|

-9.6%

|

-4.5%

|

-ENDS-

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.