Sales figures are not adjusted for inflation. Given that both the

November SPI (BRC) and October CPI (ONS) show inflation running

at above normal levels, a portion of the sales growth will be a

reflection of rising prices rather than increased volumes.

Covering the four weeks 29 October – 25 November

2023

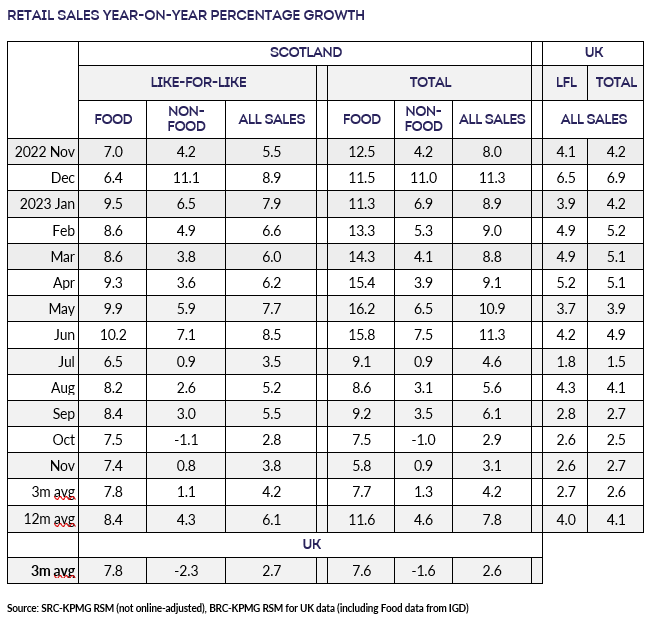

- Total sales in Scotland increased by 3.1% compared with

November 2022, when they had grown 8.0%. This was below the

3-month average increase of 4.2% and below the 12-month average

growth of 7.8%. Adjusted for inflation, the year-on-year decline

was 1.2%.

- Scottish sales increased by 3.8% on a Like-for-like basis

compared with November 2022, when they had increased by 5.5%.

This is below the 3-month average increase of 4.2% and the

12-month average growth of 6.1%.

- Total Food sales increased by 5.8% versus November 2022, when

they had increased by 12.5%. November was below the 3-month

average growth of 7.7% and the 12-month average growth of 11.6%.

The 3-month average was below the UK level of 7.6%.

- Total Non-Food sales increased by 0.9% in November compared

with November 2022, when they had increased by 4.2%. This was

below the 3-month average increase of 1.3% and the 12-month

average of 4.6%.

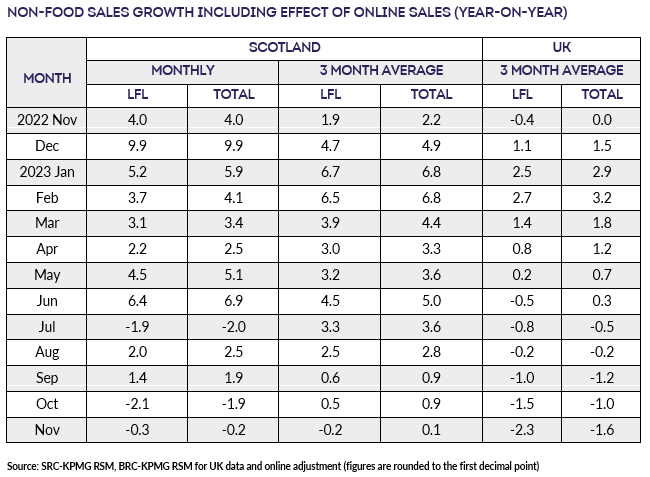

- Adjusted for the estimated effect of Online sales, Total

Non-Food sales decreased by 0.2% in November versus November

2022, when they had increased by 4.0%. This is below the 3-month

average growth of 0.1% and the 12-month average of 3.3%.

Ewan MacDonald-Russell, Deputy Head | Scottish Retail Consortium

"Black Friday sales were a damp squib for Scotland’s retailers as

sales fell in real terms in November. Adjusted for inflation

retail sales fell by 1.2 percent, the fifth successive month of

declining performance; including the first two months of the

‘golden trading quarter’.

“Food sales rose by 5.8 percent, but this was below the

3-month-average as reduced levels of inflation start to feed

through to consumers. Cosmetics and fragrances performed

reasonably well because of early discounting, with perennial

favourite beauty advent calendars proving popular. Shoppers

continue to shy away from larger purchases, and it appears many

are holding back festive gift spending, either hoping for further

discounts ahead of Christmas itself or just cutting back in the

face of the continued cost of living squeeze. If retailers oblige

with discounts, that will further eat into already narrow margins

in what is traditionally the most profitable trading period.

“These figures are concerning for hard-pressed retailers many of

whom desperately need a good last quarter of 2023 to get them

through the traditionally fallow months at the start of next

year. Retailers already know they will be facing large increases

in wage costs in the new year. If the Scottish Government

doesn’t take action in it’s upcoming Budget to meaningfully blunt

a rise in business rates then shops will very likely have to make

very difficult decisions in 2024 to balance the books.”

, Partner, UK Head of

Retail | KPMG

“As Christmas approaches, sales growth in November remained

lacklustre at 3.1% across Scotland, despite retailers making a

significant push with Black Friday deals.

“The growth drivers persist in categories like food and drink,

health, as well as personal care and beauty. This trend indicates

a shift in consumer preferences towards more budget-friendly

gifts, likely as a response to the cost-of-living crisis

affecting many households. In the final month of the year,

economic conditions continue to test consumer resilience, and

with sales growth struggling, the emphasis on price as the

primary purchasing driver is evident. We are likely to see a

prolonged and strategically targeted period of discounting as

retailers vie for a diminishing pool of consumer spending and aim

to clear their stock.

“The critical golden quarter in Scotland has already experienced

two months with sales growth below 3%, making it a weak Christmas

trading period. The prospect of excess stock remaining unsold

before Christmas raises the possibility of substantial January

sales, potentially exerting even more pressure on already tight

profit margins. Looking ahead to the early months of 2024, the

challenges are expected to persist, posing a threat to the sector

and potentially leading to more casualties, especially for online

retailers facing over 28 consecutive months of sales decline.”