Covering the four weeks 29 October – 25

November 2023

According to BRC-Sensormatic IQ

data:

-

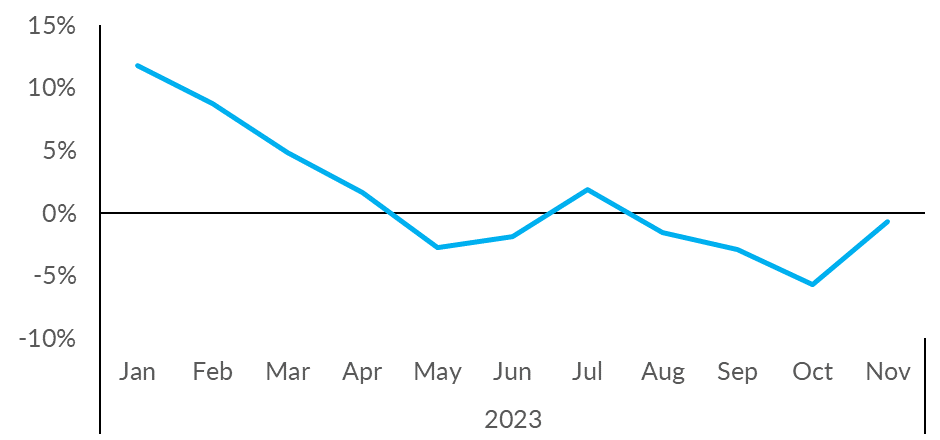

Total UK footfall decreased by 0.7%

in November(YoY), an improvement on -5.7% in October.

-

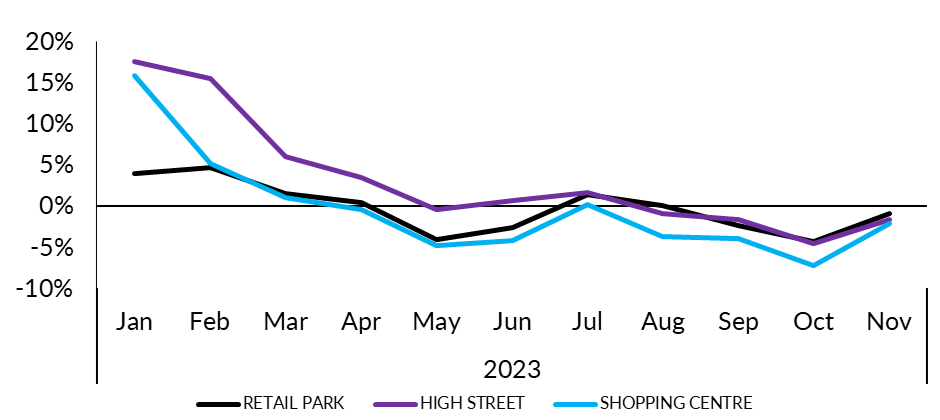

High Street footfall decreased by

1.7% in November(YoY), an improvement on -4.6% in

October.

-

Retail Parks footfall decreased

by 1.0% in November(YoY), an improvement on -4.3% in

October.

-

Shopping Centre footfall

decreased by 2.2% in November(YoY), an improvement

on -7.3% in October.

- Of the UK nations, Wales saw the least

significant YoY drop in footfall, showing a decrease of 0.4%.

Scotland saw a YoY drop in footfall of 0.9%.

This was followed by England at 1.0% and

Northern Ireland at 4.9%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“A slight uptick in consumer confidence, as well as easing

inflationary pressures and more predictable weather, led to an

improvement in footfall compared to the previous month. After a

slow October start, the month-long Black Friday sales helped to

get shoppers out to their town and city centres. While all parts

of the UK saw footfall drop in October; both West Midlands and

Yorkshire managed positive growth in November.”

“The extensive cost-pressures on the retail industry over the

last two years have limited investment and driven up prices at

many shopping destinations. The Chancellor’s failure to commit to

a business rates freeze in his recent Autumn Statement will

inflict hundreds of millions of pounds in additional costs. This

will inevitably slow the decline in inflation, as well as

limiting long term investment and limiting any upside from

improvements in UK footfall.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“Despite disruption from Storm

Ciaràn earlier in the month, November’s footfall rallied, buoyed

by Black Friday trading and retailers offering extended discounts

to spark early Christmas spend and secure festive share of

wallet. Last month, footfall recovered to its highest

performance levels since July, however, it’s worth noting that,

while welcome, this recent boost to retailers has been driven by

price and promotions sensitive shopping behaviours.

Discounting events have proved a major draw, with footfall on

Black Friday rising +52.4% week-on-week for example. We

have also seen that improvements in total retail footfall last

month were significantly shored up by outlet store visits, as

consumers try to make spend go further. Undoubtedly,

footfall’s recovery in November will allow retailers to look

ahead to Christmas trading with more confidence, but the

challenge will be not just encouraging ongoing spend into

December when disposable incomes remain squeezed, but also

ensuring discounting is optimised to protect margin.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Nov-23

|

Oct-23

|

|

1

|

West Midlands

|

1.7%

|

-8.2%

|

|

2

|

Yorkshire and the Humber

|

0.5%

|

-10.2%

|

|

3

|

East Midlands

|

-0.1%

|

-7.5%

|

|

3

|

East of England

|

-0.1%

|

-3.6%

|

|

5

|

South West England

|

-0.3%

|

-6.0%

|

|

6

|

London

|

-0.4%

|

-2.9%

|

|

6

|

Wales

|

-0.4%

|

-5.6%

|

|

8

|

Scotland

|

-0.9%

|

-5.5%

|

|

9

|

England

|

-1.0%

|

-5.3%

|

|

10

|

North West England

|

-1.2%

|

-6.1%

|

|

11

|

South East England

|

-2.4%

|

-5.2%

|

|

12

|

North East England

|

-2.8%

|

-6.0%

|

|

13

|

Northern Ireland

|

-4.9%

|

-6.8%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Nov-23

|

Oct-23

|

|

1

|

Edinburgh

|

5.7%

|

0.5%

|

|

2

|

Leeds

|

3.1%

|

-9.7%

|

|

3

|

Birmingham

|

2.5%

|

-7.9%

|

|

4

|

Manchester

|

0.1%

|

-5.2%

|

|

5

|

Bristol

|

-0.1%

|

-3.2%

|

|

6

|

Cardiff

|

-0.4%

|

-6.5%

|

|

6

|

London

|

-0.4%

|

-2.9%

|

|

6

|

Nottingham

|

-0.4%

|

-6.3%

|

|

9

|

Liverpool

|

-2.4%

|

-3.5%

|

|

10

|

Glasgow

|

-4.5%

|

-8.9%

|

|

11

|

Belfast

|

-7.6%

|

-3.2%

|