Period Covered: 01 – 07

November 2023

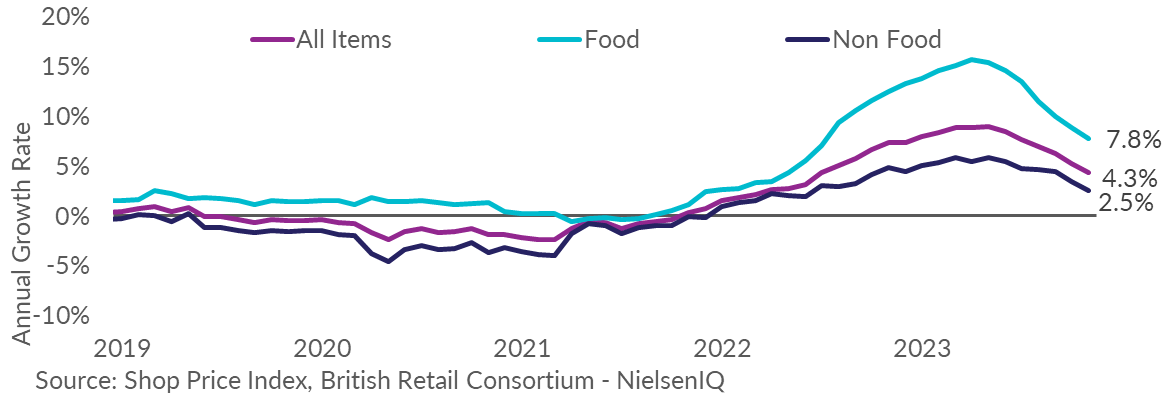

- Shop Price annual inflation decelerated further to 4.3% in

November, down from 5.2% in October. This is below the 3-month

average rate of 5.3%. Shop price growth is at its lowest since

June 2022.

- Non-Food inflation fell to 2.5% in November, down from 3.4%

in October. This is below the 3-month average rate of 3.5%.

Inflation is its lowest since June 2022.

- Food inflation decelerated to 7.8% in November, down

from 8.8% in October. This is below the 3-month average rate of

8.9% and is the seventh consecutive deceleration in the food

category. Inflation is its lowest since July 2022.

- Fresh Food inflation slowed further in November, to 6.7%,

down from 8.3% in October. This is below the 3-month average rate

of 8.3%. Inflation is at its lowest since June 2022.

- Ambient Food inflation decelerated to 9.2% in November, down

from 9.5% in October. This is below the 3-month average rate of

9.7% and is the lowest since October 2022.

|

|

OVERALL SPI

|

FOOD

|

NON-FOOD

|

|

% Change

|

On last year

|

On last month

|

On last year

|

On last month

|

On last year

|

On last month

|

|

Nov-23

|

4.3

|

0.0

|

7.8

|

0.3

|

2.5

|

-0.1

|

|

Oct-23

|

5.2

|

0.3

|

8.8

|

0.4

|

3.4

|

0.2

|

Note: Month-on-month % change refers to changes in the

level of prices.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Shop price inflation eased for the sixth month

in a row as retailers compete fiercely to bring prices down for

customers ahead of Christmas. Food inflation eased, thanks to

lower domestic energy prices reducing overall input costs,

particularly for dairy products. Ambient food inflation slowed

but remained higher than fresh food due to a larger proportion of

goods being imported to the UK and impacted by the weak pound.

While health and beauty products saw price cuts as retailers rush

to shift stock Christmas, clothing prices increased as some

retailers continued to hold off on promotional activity.”

“Retailers are committed to delivering an affordable Christmas

for their customers. They face new headwinds in 2024 - from

government-imposed increases in business rates bills to the

hidden costs of complying with new regulations. Combining these

with the biggest rise to the National Living Wage on record will

likely stall or even reverse progress made thus far on bringing

down inflation, particularly in food.”