Retailers are calling on the Government to review its plans to

introduce a deposit return scheme (DRS – a bottle recycling

scheme) for drink containers as new research from the British

Retail Consortium shows that the scheme is likely to cost the

industry at least £1.8bn a year from 2025, with startup costs,

such as buying machines, hitting businesses much earlier.

Worse yet, this figure does not include the hundreds of millions

of pounds required from industry to set up a body to run the

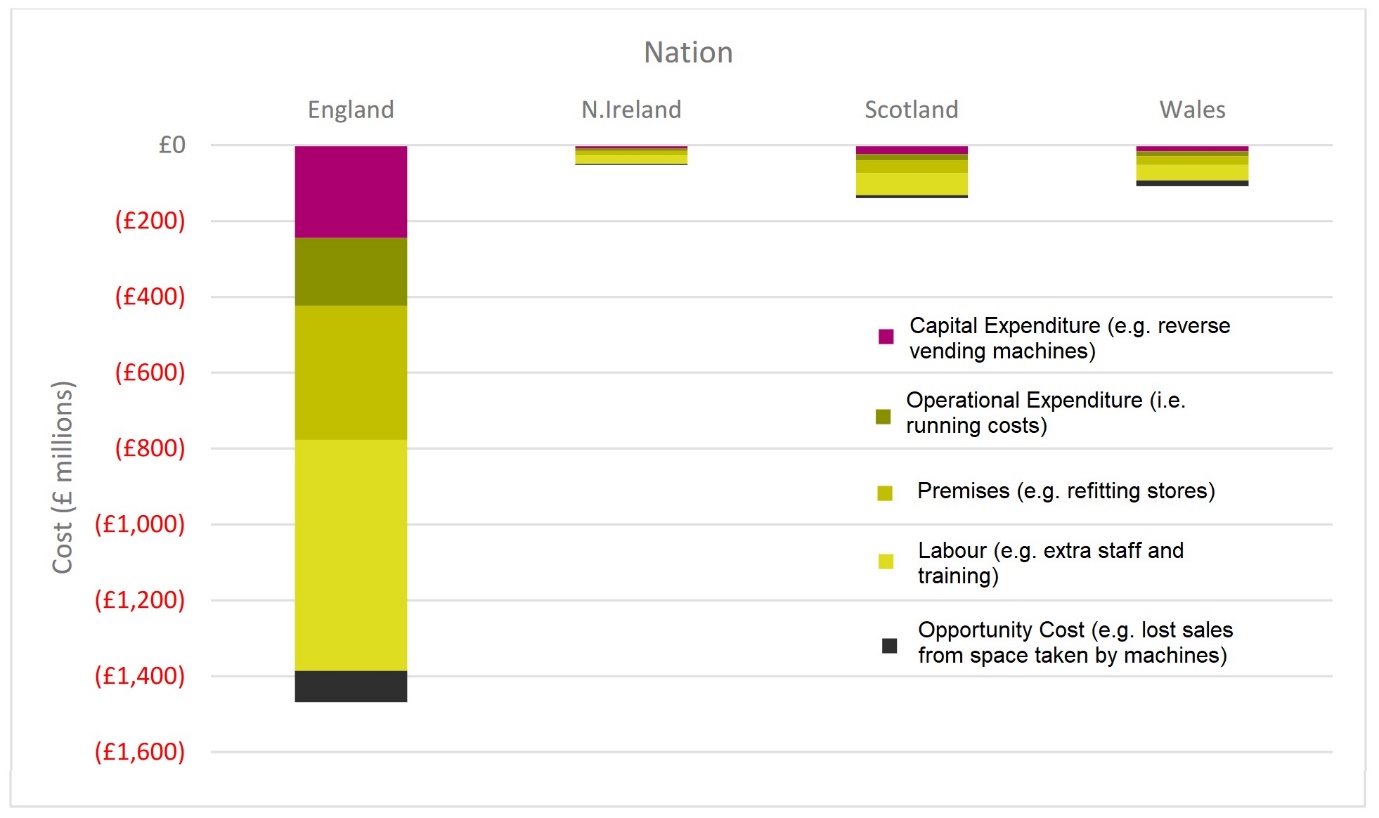

scheme. The current £1.8bn per year estimate includes; capital

costs, including buying and installing Return Vending Machines

(RVM); labour costs, including staff training and time for

processing returns; and other operating costs, including service

and maintenance for RVMs, IT costs and cleaning of containers

used for collection.

Annual cost of DRS in each of the four UK

nations

Time is needed to rethink current plans to prevent the

introduction of an unnecessarily complex and costly scheme. In

Scotland, the rushed implementation of a similar DRS scheme

collapsed after governments failed to deliver a meaningful plan

or realistic timelines for its introduction. This has left

industry footing the bill for tens of millions in sunk costs.

Without significant revision, the UK scheme risks running into

many of the same problems as in Scotland.

Government’s ambitious target of eliminating all avoidable waste

by 2050, and all avoidable plastic waste by 2042, is supported by

three pillars within its Resource and Waste Strategy: its

packaging levy - Extended Producer Responsibility (EPR), the

consistent collections of household and business recycling in

England , and DRS. Retailers believe that the sequencing of these

three reforms is essential. Reforms to household recycling

collection and EPR must first be introduced together, and only

then will it be clear on the exact role of a DRS in further

improving recycling rates.

Government’s recent decision to delay the implementation of EPR

has provided an important opportunity to redesign aspects of this

policy, which will see industry pay 100% of the costs of

collecting and recycling the packaging they produce. It will also

soften the inflationary aspect of this policy, which will add an

estimated £2bn per year on its own.

Margins remain slim and have significantly tightened in the last

year, as confirmed by the recent Competition and Markets

Authority report. While retailers may be able to absorb some of

the costs of implementing these new policies, it is inevitable

that introducing EPR and DRS together would place upward pressure

on consumer prices.

Andrew Opie, Director of Food & Sustainability at the

British Retail Consortium, said:

“The proposed Deposit Return Scheme is costly, complicated and

cannot deliver the step change in recycling needed to justify it.

By driving up costs by almost £2 billion per year the government

risks pushing up prices for ordinary households, just as

inflation is coming down. Government must first introduce its

household collection and packaging levy reforms so that it can

assess the best way forward on a DRS. On its current course, it

will be consumers who will pay the price of this unnecessarily

hasty, expensive and complex scheme.”