The Competition and Markets Authority (CMA) has provisionally

found that 5 major banks – Citi, Deutsche Bank, HSBC, Morgan

Stanley and Royal Bank of Canada – each unlawfully shared

competitively sensitive information by participating in one or

more series of one-to-one conversations in chatrooms. The alleged

behaviour took place at varying times between 2009 and 2013 (see

Table 1 below).

The information exchanges took place in one-to-one Bloomberg

chatrooms between a small number of traders who worked at the

banks and related to the buying and selling of UK government

bonds – specifically, gilts and gilt asset swaps. This included

details on pricing and other aspects of their trading strategies.

The exchanges of information occurred in the context of, some or

all of:

- the sale of gilts by the UK Debt Management Office via

auctions on behalf of HM Treasury;

- the subsequent buying and selling of gilts and gilt asset

swaps;

- buy-back auctions of gilts by the Bank of England (for

example, for quantitative easing). The contacts between Deutsche

Bank and HSBC did not involve any conduct in relation to buy-back

auctions.

By unlawfully exchanging competitively sensitive information

rather than fully competing, the banks involved in these

arrangements could have denied the full benefits of competition

to those they traded with – including, among others, pension

funds, the UK Debt Management Office (which sells gilts by

auction), and ultimately HM Treasury and UK taxpayers.

Deutsche Bank alerted the CMA to its participation in the alleged

unlawful behaviour under the CMA’s leniency policy, and Citi

applied for leniency during the CMA’s investigation. Both banks

have admitted their involvement in anti-competitive activity and,

providing they continue to cooperate and comply with the

conditions of leniency, Deutsche Bank will not be fined and any

fine that Citi receives will be discounted.

Citi has also entered into a settlement agreement with the CMA

and, providing it complies with the terms of settlement, will

receive a further discount to any fine imposed.

The CMA’s probe is ongoing and if the CMA reaches a final

conclusion that any 2 or more of the banks engaged in

anti-competitive activity, the CMA will publish an infringement

decision and may issue fines.

Michael Grenfell, Executive Director of Enforcement at the CMA,

said:

Our provisional decision has found that, in the aftermath of the

global financial crisis, 5 global banks broke competition law by

taking part in a series of one-to-one online exchanges of

competitively sensitive information on pricing and other aspects

of their trading strategies on UK bonds. This could have denied

taxpayers, pension savers and financial institutions the benefits

of full competition for these products, including the

minimisation of borrowing costs.

A properly functioning, competitive bond market benefits tens of

millions of taxpayers and pension savers as well as being at the

heart of the UK’s reputation as a global financial hub. These

alleged activities are therefore very serious and warrant the

detailed investigation we have undertaken. While both Deutsche

Bank and Citi have admitted their involvement in anti-competitive

conduct, we will now consider further representations from the

parties before reaching a final decision.

The CMA’s findings are provisional. Deutsche Bank and Citi have

admitted to participating in the alleged one-to-one conversations

that apply to them. HSBC, Morgan Stanley and Royal Bank of Canada

have not admitted any wrongdoing. At this stage, no assumption

should be made that any of the banks have broken the law.

More information on this investigation is available on the

CMA case page.

Notes to editors:

-

The CMA is investigating suspected anti-competitive

arrangements prohibited by the Chapter I prohibition of the

Competition Act 1998.

-

The statement of objections in this case has been addressed

to the following entities: Citigroup Global Markets Limited

and its ultimate parent company Citigroup Inc. (together

‘Citi’), Deutsche Bank Aktiengesellschaft, HSBC Bank Plc and

its ultimate parent company HSBC Holdings Plc (together

‘HSBC’), Morgan Stanley & Co. International Plc and its

ultimate parent company Morgan Stanley (together ‘Morgan

Stanley’), and RBC Europe Limited and its ultimate parent

company Royal Bank of Canada (together ‘Royal Bank of

Canada’).

-

The UK Debt Management Office, the Bank of England and HM

Treasury are not under investigation. The UK Debt Management

Office, on behalf of HM Treasury, and the Bank of England

have assisted the CMA with the investigation by responding to

information requests.

-

Bloomberg chatrooms are a means of electronic communication

through which participants can exchange messages. Although

the information exchanged through certain Bloomberg chatrooms

forms part of the CMA’s investigation, Bloomberg is not under

investigation.

-

A statement of objections gives parties notice of a proposed

infringement decision under the competition law prohibitions

in the Competition Act 1998. Parties have the opportunity to

make representations on the matters set out in the statement

of objections. Any such representations will be considered by

the CMA before any final decision is made. The

final decision is taken by a 3-member case decision group,

which is separate from the case investigation team and was

not involved in the decision to issue the statement of

objections.

-

Under the CMA’s leniency policy, a business that has been

involved in cartel activity may be granted immunity from

penalties or a reduction in penalty in return for reporting

the cartel activity and assisting the CMA with its

investigation. In this case, Deutsche Bank first, and

subsequently Citi, reported their involvement in the alleged

conduct under the CMA’s leniency policy. Provided they

continue to co-operate and comply with the other conditions

of the CMA’s leniency policy, Deutsche Bank will benefit from

immunity from fines and Citi will benefit from a discount on

any fine.

-

A party under investigation by the CMA may enter into a

settlement agreement if it is prepared to admit that it has

breached competition law and is willing to pay a fine and

agree to a streamlined administrative procedure for the

remainder of the investigation. Citi has entered into a

settlement agreement with the CMA, as well as applying for

leniency. Providing it complies with the terms of settlement,

Citi will receive a further discount to any fine imposed.

-

A gilt is a UK government bond issued by HM Treasury through

the UK Debt Management Office (‘DMO’). Gilts are issued to

finance the UK government’s cash requirements. That means

that individuals and businesses who invest in gilts lend

money to the government. In return, the government promises

to pay the investors a cash interest payment (the ‘coupon’)

up until the gilt’s redemption date (‘maturity’) when the

nominal amount invested is paid back to the investor. This

case concerns conventional gilts only i.e. gilts with a

fixed-rate of interest. Gilts are commonly issued through

auction by the DMO to gilt-edged market makers (‘GEMMs’). All

5 banks under investigation by the CMA are GEMMs. Once

issued, gilts can be traded up to their redemption date and

GEMMs must be ready to buy and sell gilts.

-

In 2009, in response to the financial crisis, the Bank of

England adopted a quantitative easing policy to stimulate the

UK economy, part of which involved the Bank of England buying

assets, the majority of which were gilts. The Bank of England

conducted regular so-called buy-back auctions at certain

points during the relevant period to purchase gilts through

an asset purchase facility set up as a subsidiary of the Bank

of England. It was in the context of some of these buy-back

auctions that some of the exchanges of information in

question occurred. The alleged one-to-one conversations

between Deutsche Bank and HSBC did not involve any conduct in

the context of buy-back auctions.

-

The CMA and the Financial Conduct Authority have concurrent

functions to enforce competition law in the financial

services sector. It has been agreed (pursuant to regulation 4

of the Competition Act 1998 (Concurrency) Regulations 2014)

that the CMA will exercise those functions in relation to

this investigation.

-

For media enquiries contact the CMA press office on 0203 738

6460 or press@cma.gov.uk

-

Anyone who has information about a cartel is encouraged to

call the CMA cartels hotline on 0203 738 6888 or

email cartelshotline@cma.gov.uk.

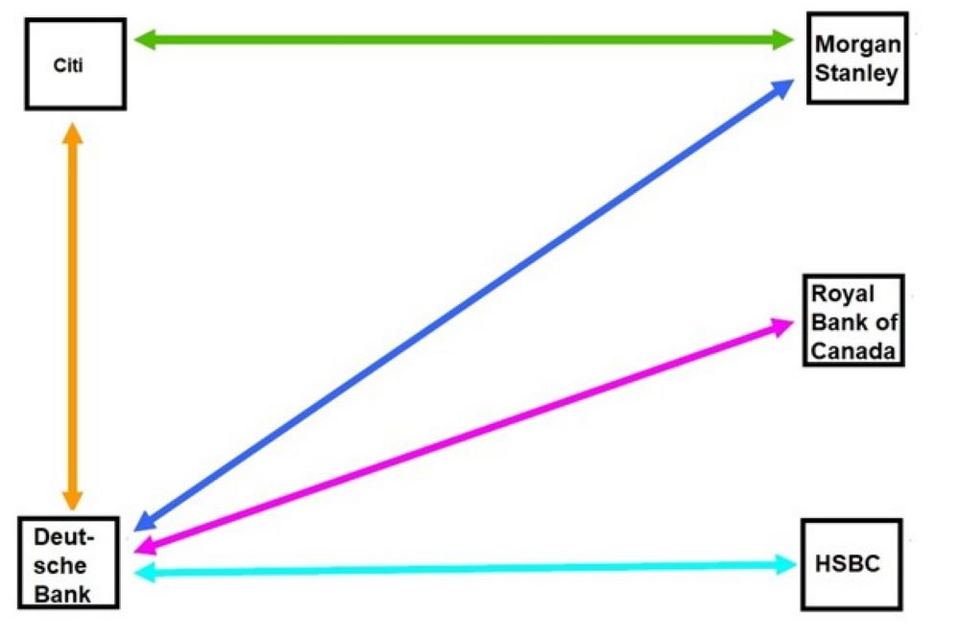

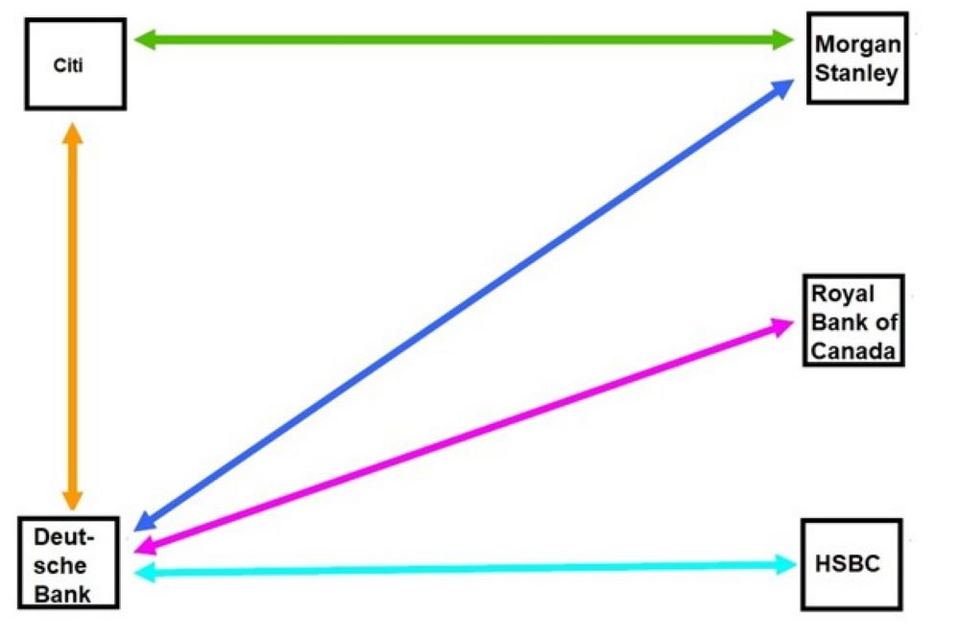

Figure 1 - Relevant Parties to each of the 5 alleged

series of one-to-one conversations

Image credit: CMA

Table 1: Duration of each of the alleged series of

one-to-one conversations

|

Alleged one-to-one conversations

|

Duration

|

|

Citi and Deutsche Bank

|

Less than 1 year

|

|

Citi and Morgan Stanley

|

Less than 1 year

|

|

Deutsche Bank and HSBC

|

Less than 1 year

|

|

Deutsche Bank and Morgan Stanley

|

More than 1 year

|

|

Deutsche Bank and Royal Bank of Canada

|

More than 3 years

|