- The majority (61%) of the public agrees that benefits should

go up in line with inflation, in first polling carried out on the

issue.

- New analysis shows that the average working age couple on

benefits with two children will lose over £300 per year from

their incomes as of next April – when many are already unable to

afford essentials.

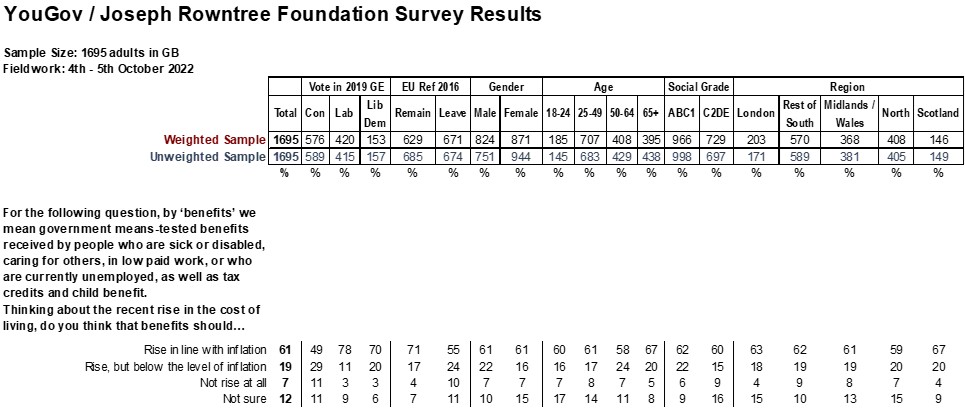

Polling by YouGov for the Joseph Rowntree Foundation this week

found that 61% of the public agreed that benefits should go up in

line with inflation, including half (49%) of 2019 Conservative

voters. Just one in five (19%) instead believe there should be a

rise below inflation, as has been proposed by the Government,

with only 7% believing there shouldn’t be a rise at all.

This represents a firm majority on an issue which has only been

in the public eye for just over a week, and reflects a longer

term trend around views on social security and the need for the

system to provide people with enough to live on.

The suggested increase of 5.4%, in line with earnings, would

amount to the biggest permanent real-terms cut to the basic rate

of benefits ever made in a single year, according to JRF analysis

released last week.

These benefits are those received by people who are too sick and

disabled to work, those looking for work and those working but on

low earnings, as well as those receiving child benefit.

Only a quarter of the public do not think that benefits should

rise with inflation – sending a clear message to the government

that there is support to make sure the lowest incomes keep up

with prices.

Just 19% said they should go up below inflation and 7% said they

shouldn’t go up at all, making 26% who were against an inflation

rise. The majority in favour of fully uprating in line with

inflation is clear across all regions, age groups and income

groups, with 67% of the over 65s in favour.

The poll was of 1695 people

across the UK and was carried out during the Conservative Party

conference on Tuesday and Wednesday of this week (4/5 October).

At the same time, JRF’s latest analysis of the impact of the

proposed real-terms cut shows that the average working age couple

with two children receiving benefits will lose over £300 per year

from their incomes after housing costs as of next April – at a

time when we know many are already struggling to afford the

essentials.

|

|

2023/24 Average net disposable income after housing costs

|

|

Working-age household on benefits

|

with benefits uprated by inflation (10%)

|

with benefits uprated by earnings (5.4%)

|

Average loss £/y

|

|

Lone parent 1 child

|

16,129

|

15,775

|

-

354

|

|

Couple 2 children

|

34,031

|

33,719

|

-

312

|

|

Single no children

|

9,361

|

9,175

|

-

186

|

|

Couple no children

|

17,920

|

17,604

|

-

316

|

Rebecca McDonald, Chief Economist at the Joseph Rowntree

Foundation said:

“The majority of the public have taken a clear view already, and

firmly oppose government suggestions that they are considering

the biggest permanent real-terms cut to the basic rate of

benefits ever made in a single year. This is all the more

decisive when you consider that the issue has only been in the

public eye since the government first floated the idea for the

real-terms cut less than a fortnight ago.

“The majority in favour of uprating in line with inflation, as

promised by then-Chancellor earlier in the year, runs

across all age groups, income groups and regions. The Prime

Minister must surely realise that her refusal to confirm the

uplift is completely out of step with public opinion and the

times in which we are living.

“Pressing ahead with this move in the face of public opposition

would be morally indefensible and would target spending cuts at

those on the lowest incomes, many of whom cannot afford the

essentials as it is. It would also terrify millions who have

already been enduring a cost of living emergency for months.”

ENDS

Notes to Editors

Full polling results:

- The poll was of 1695 people across the UK and was carried out

online by YouGov during the Conservative Party conference on

Tuesday and Wednesday of this week (4/5 October).

- All figures, unless otherwise stated, are from YouGov

Plc. Total sample size was 1,695 adults. Fieldwork was

undertaken between 4th and 5th of October 2022. The survey

was carried out online. The figures have been weighted and are

representative of all GB adults (aged 18+).