During 2020/21 much of retail bounced between being open and

closed, significantly impacting sales and changing consumer

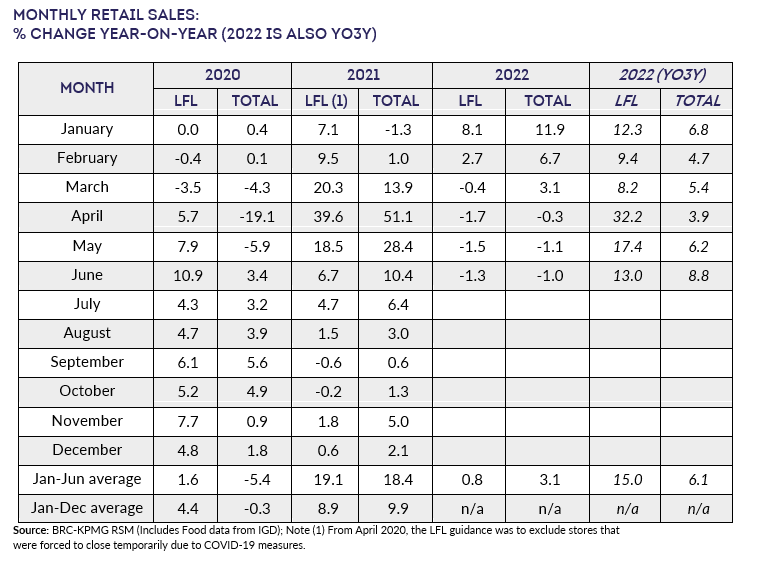

behaviours. We are now at a stage where year-on-year comparisons

are all post the third lockdown, meaning we will no longer be

providing Year-on-3-year (Yo3Y) comparisons in the bullets. Total

sales on the Yo3Y basis can still be found in the first table.

Sales figures are not adjusted for inflation. Given that both the

June SPI (BRC) and May CPI (ONS) show inflation running at

historically high levels, the small drop in sales masked a much

larger drop in volumes once inflation is accounted for.

Covering the five weeks 29 May – 2 July

2022

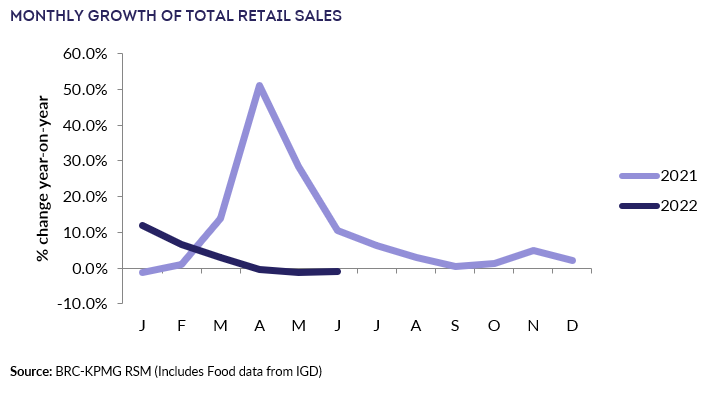

- On a Total basis, sales decreased by 1.0% in June, against an

increase of 10.4% in June 2021. This is below the 3-month average

decline of 0.8% and the 12-month average growth of 3.0%.

- UK retail sales decreased 1.3% on a Like-for-like basis from

June 2021, when they had increased 6.7%. This was above the

3-month average decline of 1.5% and below the 12-month average

growth of 1.0%.

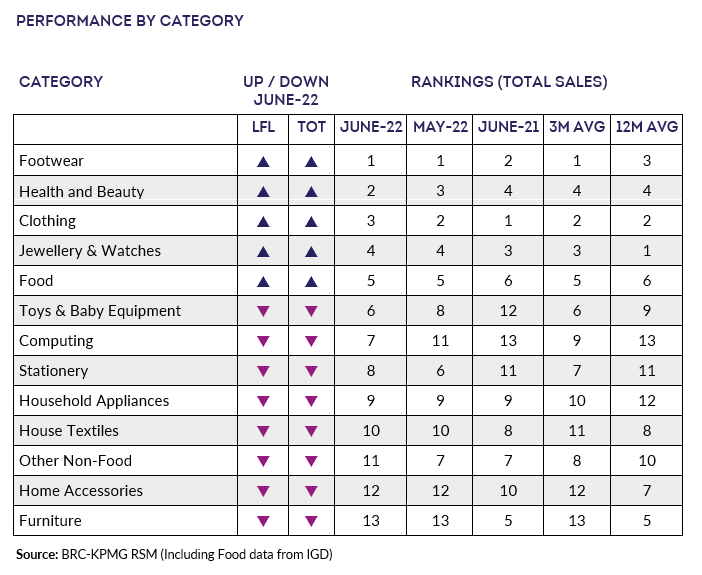

- Over the three months to June, Food sales increased 2.2% on a

Total basis and 1.6% on a Like-for-like basis. This is above the

12-month Total average growth of 0.6%. For the month of June,

Food was in growth year-on-year.

- Over the three-months to June, Non-Food retail sales

decreased by 3.3% on a Total basis and 4.2% on a like-for-like

basis. This is below the 12-month Total average growth of 5.0%.

For the month of June, Non-Food was in decline year-on-year.

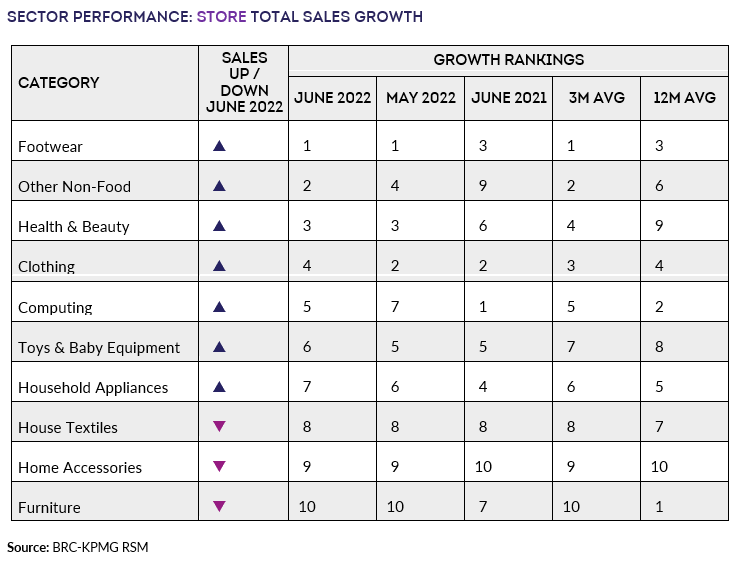

- Over the three months to June, In-Store sales of Non-Food

items increased 2.2% on a Total basis and 0.6% on a Like-for-like

basis since June 2021. This is below the 12-month growth of

35.5%.

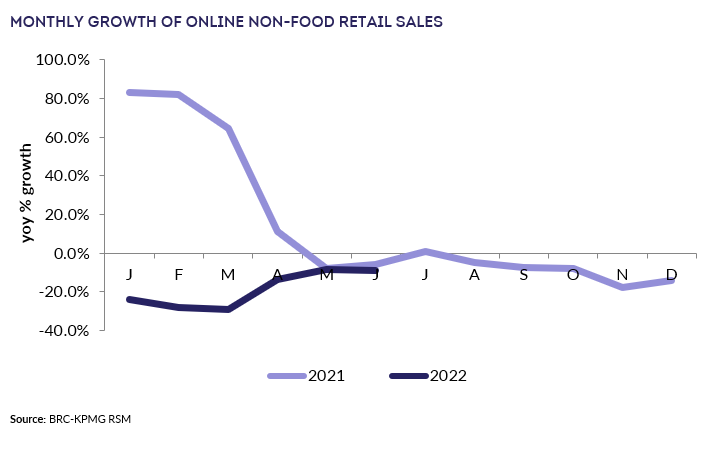

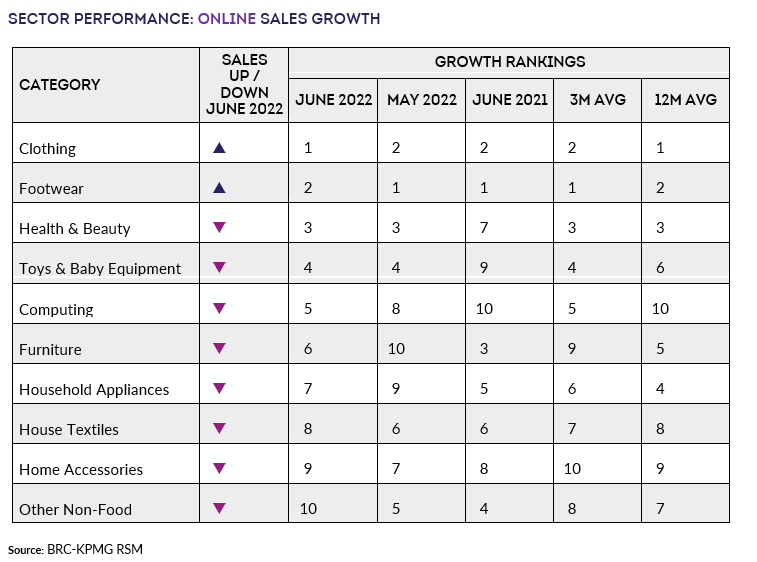

- Online Non-Food sales decreased by 9.1% in June, against a

decline of 5.9% in June 2021. This is above the 3-mth average

decline of 10.3%.

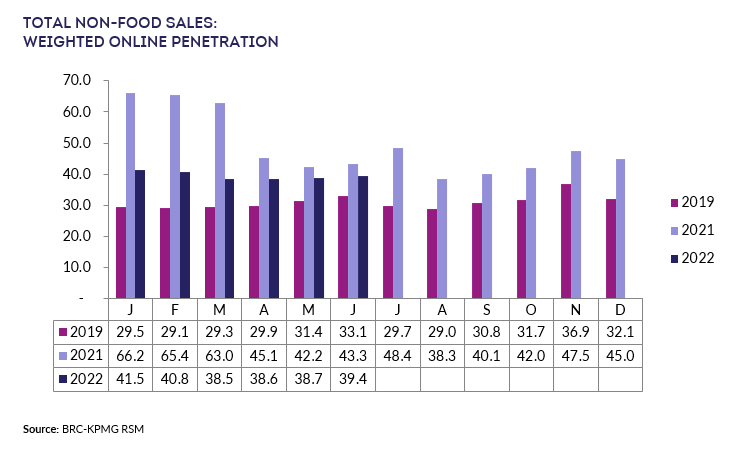

- The Non-Food Online penetration rate decreased from 43.3% in

June 2021 to 39.4% this June.

Helen Dickinson OBE, Chief Executive | British Retail

Consortium

“Sales volumes are falling to a rate not seen since the depths of

the pandemic, as inflation continues to bite, and households cut

back spending. Discretionary purchases were hit hard, especially

white goods and homeware, while consumers also traded down to

cheaper brands in food and non-food alike. While the Jubilee

weekend gave food sales a temporary boost, and fashion sales

benefited from the summer holiday and wedding season, this was

not enough to counter the substantial slowdown in consumer

spending.

“Retailers are caught between significant rising costs in their

supply chains and protecting their customers from price rises.

The government needs to get creative and find ways to help

relieve some of this cost pressure – the upcoming consultation on

transitional relief is a golden opportunity to ensure that

retailers aren't overpaying on their business rates bills.

Government action on transitional relief would make a meaningful

difference to retailers’ costs and ease pressure on prices for

customers.”

, UK Head of Retail at

KPMG | KPMG

“Retail sales continued

to slide for the third month in a row, albeit down just 1% on

what was a strong June 2021 and against a backdrop of

unprecedented price rises on the high street.

“Online shopping continued to move in reverse with total sales

down 9% as non-food purchases related to the home, such as

furniture, home appliances and computing, suffered the biggest

falls in online spending. The jubilee weekend, which saw

street parties across the UK, provided some relief for food and

drink retailers as sales grew by nearly 1.5% year on year,

despite the rising cost across most items.

“As the cost living crisis continues to deepen, retailers face

walking a fine line between protecting margins and further

denting consumer confidence by passing on price rises whilst

negotiating with their suppliers to share the cost increases.

Cost and efficiency will dominate retailers’ agendas as they are

forced to make some tough decisions on which products make it to

the shelves in order to remain price competitive for

consumers. With a long run of hot weather predicted and

many consumers choosing to holiday at home this summer, retailers

will be hoping that the feel-good factor begins to improve

confidence amongst some shoppers – as presently overall

confidence levels are lower than sales may suggest.”

Food & Drink sector performance | Susan Barratt, CEO

| IGD

“Food and drink sales fluctuated week by week in June, and with

volume sales down and value sales up, we can clearly see

inflation coming through. However, the overall downward sales

trend for volumes means the outlook continues to be challenging,

although good weather might provide a welcome boost in July.

“IGD’s Shopper Confidence Index reached a new record low in June

as shoppers contend with the cost-of-living crisis. We’re

forecasting that food inflation will reach 15% this summer and

our ShopperVista research shows that shoppers are increasingly

trying to save money in every part of their lives.

Unsurprisingly, shopping habits are changing; some 60% of

shoppers are now spending time to save money, up from 55% in

March. With record petrol prices, being able to walk to a grocery

store is also increasingly important with 27% of shoppers

agreeing this is a driver of store choice, compared to 24% in

May.”