During the pandemic much of retail bounced between being open and

closed, significantly impacting sales and changing consumer

behaviours. In March 2020, non-essential retail stores began to

close and in March 2021, Scottish retail was in lockdown, pushing

many consumers to buy goods online. In this context, all

comparisons are provided on a year-on-3-year

(Yo3Y) basis, we have also included comparisons

with March 2021 (YoY), where relevant. This will be

clearly signposted below.

Sales figures are not adjusted for inflation. Given that both the

March SPI (BRC) and February CPI (ONS) show inflation running at

historically high levels, a portion of the sales growth will be a

reflection of rising prices rather than increased volumes.

Covering the five weeks 27 February – 2 April

2022

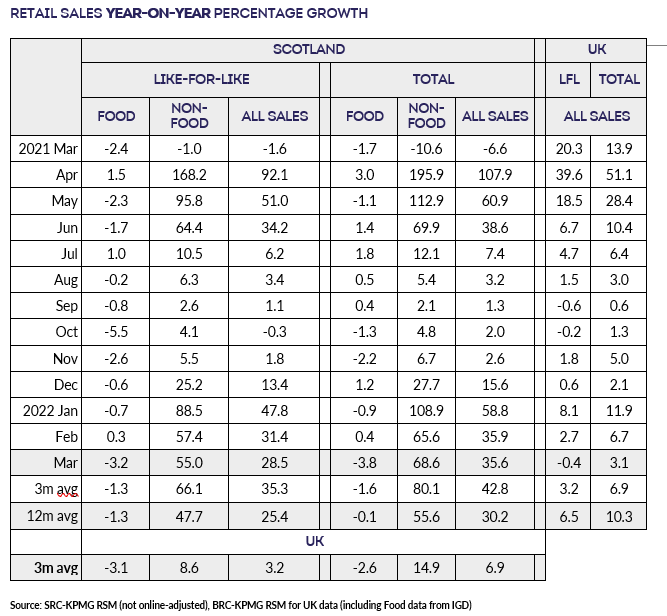

- Total sales in Scotland increased by 0.6% compared with March

2019 (Yo3Y), when they had grown by 0.3%. This was above both the

3-month and the 12-month average decreases of 3.2% and 7.3%,

respectively.

- Scottish sales increased by 0.7% on a Like-for-like basis

compared with March 2019 (Yo3Y), when they had decreased by 0.2%.

This is above the 3-month average decrease of 2.1% and the

12-month average decrease of 4.7%.

- Total Food sales increased 6.0% versus March 2019 (Yo3Y),

when they had decreased by 0.2%. March was below the 3-month

average growth of 6.2% and above the 12-month average growth of

4.1%. The 3-month average was below the UK level of 9.2% on a

3-year basis.

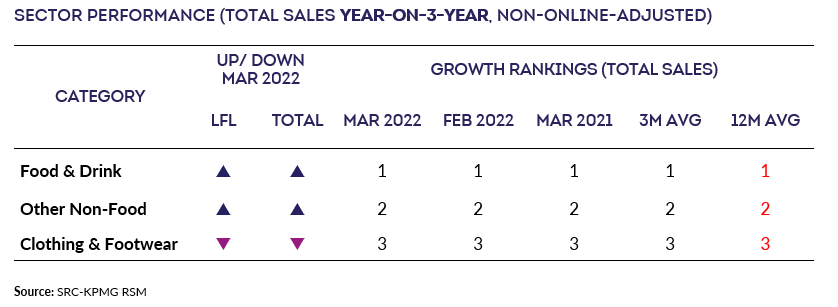

- Total Non-Food sales decreased by 3.9% in March compared with

March 2019 (Yo3Y), when they had increased by 0.7%. This was

above the 3-month average decrease of 11.0% and the 12-month

average decrease of 16.9%.

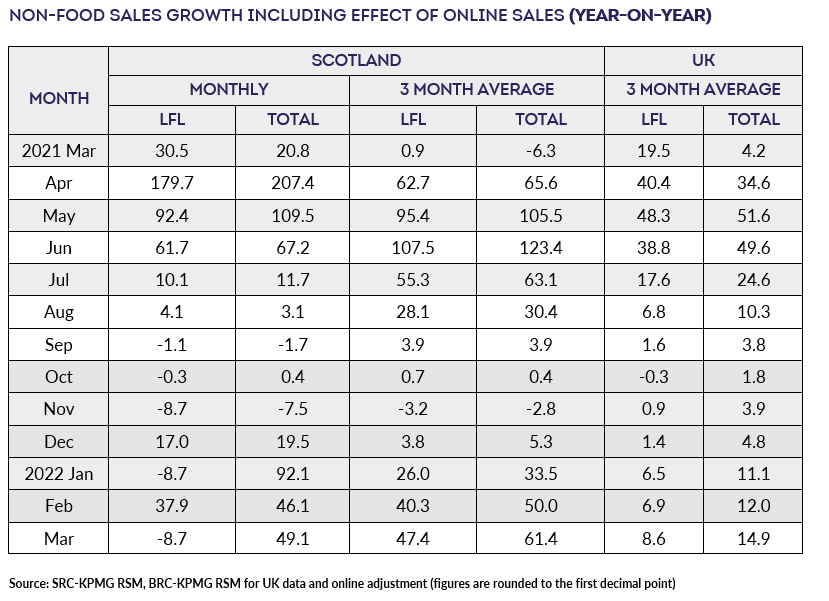

- Adjusted for the estimated effect of Online sales, Total

Non-Food sales decreased by 23.4% in March versus March 2019

(Yo3Y), when they had increased by 1.3%. This is above the

3-month average decline of 29.6% and the 12-month average

decrease of 24.0%.

Ewan MacDonald-Russell, Head of Policy | Scottish Retail

Consortium

“March sales sparkled compared to recent months as shoppers

returned to spending. This is the first time sales have been

close to pre-pandemic levels since the Covid crisis hit and

coincides with the removal of nearly all Scottish Covid

restrictions. However, these improved figures are at least in

part a result of rising shop prices as retailers grapple with a

host of inflationary costs.

“Food sales rose by six percent in March driven by higher

inflation alongside customers focusing more on eating at home

than at eateries. The first Mother’s Day in three years where

Scots could visit family led to strong food sales as well as a

boost for fashion and beauty lines. Retailers also noted the

endemic supply challenges had eased slightly this month; helping

furniture and electrical shops.

“Whilst these sales figures are encouraging, the economic storm

clouds continue to concern retailers. Costs continue to rise and

will worsen in April as non-domestic rates bills return for many

retailers. Rising inflation means prices are likely to continue

rising, which will put immense pressure on households

discretionary spending which has significant implications for

many retailers.”

, Partner, UK Head of

Retail | KPMG

“Retailers will be glad to see sales in

Scotland reach pre-pandemic levels for the first time since the

health crisis began. While this is promising, it’s too early to

call this a return to normality given the cloud of geopolitical

and macro-economic uncertainty which has the potential to dampen

consumer confidence and spending power in the months ahead.

“As households feel the pressure, retailers are facing their own

battle with rising costs and inflation, and are walking a

tightrope between absorbing rising costs themselves or passing

these on to consumers. Successful retailers will continue to

maintain a clear understanding of their customer, what they want

to buy and how, whilst balancing attention on areas that can

yield cost and efficiency gains. It remains to be seen whether or

not consumers will reduce physical and virtual spending to offset

rising household bills and reduced household incomes.”