Period Covered: 01 – 07 March

2022

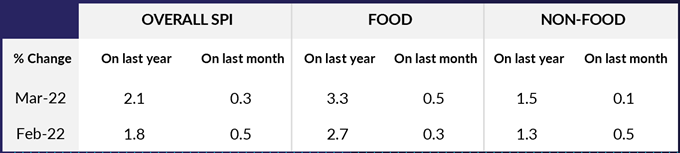

- Shop Price annual inflation accelerated to 2.1% in March, up

from 1.8% in February. This is above the 12- and 6-month average

price increases of 0.1% and 1.1%, respectively. This marks the

highest rate of inflation since September 2011.

- Food inflation accelerated to 3.3% in March, up from 2.7% in

February. This is above the 12- and 6-month average price growth

rates of 1.0% and 2.2%, respectively. This is the highest

inflation rate since March 2013.

- Non-Food inflation accelerated to 1.5% in March, up from 1.3%

in February. This is above the 12- and 6-month average price

decrease of 0.4% and increase of 0.4%, respectively. This

marks the highest rate of inflation since February 2011.

- Fresh Food inflation accelerated in March to 3.5%, up from

3.3% in February. This is above the 12- and 6-month average price

growth rates of 0.8% and 2.4%, respectively. This is the highest

inflation rate since March 2013.

- Ambient Food inflation accelerated to 3.0% in March, up from

2.0% in February. This is above the 12- and 6-month average price

increases of 1.2% and 1.8%, respectively. This is the highest

rate of increase since April 2019.

Helen Dickinson OBE, Chief Executive of the British

Retail Consortium, said:

“Consumers were hit once again by rising prices, with March

seeing the fifth consecutive month of inflation. There have been

mounting cost pressures throughout the supply chain for some

time, including rising wages, input costs, global commodity

prices, energy, and transport. Many of these costs are beginning

to be exacerbated by the situation in Ukraine, but the full

impact on prices is yet to be seen. Wheat prices have risen

sharply, while the rise in oil prices has not only impacted

domestic energy costs, but also the costs of fertiliser and

transporting goods.

“Our Shop Price Index has been rising more modestly than other

inflation measures as retailers were able to limit price rises on

many essential goods. By keeping the prices of key items down and

expanding value ranges, retailers are trying to support customers

most affected by the cost-of-living squeeze, many of whom will

face higher energy prices and National Insurance Contributions

from 1 April. With overall inflation likely to rise even higher

according to the Bank of England, consumers will not have an easy

ride this year. The war in Ukraine, and volatility in commodity

markets is likely to further dampen consumer confidence in the

coming months."

Mike Watkins, Head of Retailer and Business Insight,

NielsenIQ, said:

“With cost-of-living increases accelerating, the next few months

will be a difficult time for consumers. Rising food prices

will start to impact what’s put in the shopping basket so

supermarkets will need to adapt ranges to help shoppers manage

what they spend on their weekly groceries. Whilst high street

retailers will be competing for discretionary spend that’s coming

under increasing pressure”