Conservative response to public sector finances

Sir MP, Shadow

Chancellor, said:

“Labour have borrowed £112.1 billion so far this year - the fifth

highest borrowing on record. Record high taxes and irresponsible

spending have weakened the economy.

“With youth unemployment now higher than in Europe, inflation

above target and the economy stagnant, is

right: Labour have “no growth strategy”. Neither Labour nor

Reform have the serious answers to stabilise the public finances.

“Only the Conservatives have a leader with a backbone, the plan

and the team to get Britain working again.”

ENDS

Notes to Editors:

Labour have made irresponsible choices:

-

Labour's hiked taxes by £26 billion – pushing the

tax burden to a historic high. Despite her pledge not

to ‘come back for more',

increased taxes by £26 billion, pushing the tax burden to a

historic high of 38.3 per cent of GDP (OBR, Economic and

Fiscal Outlook, 26 November 2025, archived).

-

Welfare spending will reach £406 billion by the

end of the scorecard after Labour abandoned their welfare

reforms. Labour's failure to reform welfare means

welfare spending will reach £406 billion by the end of the

scorecard (OBR, Economic and Fiscal Outlook, 26

November 2025, link).

As a result, the economy is weaker:

-

Economic growth has remained sluggish. After a year of

sluggish growth, GDP growth was just 0.1 per cent in the three

months to December, after a fall of 0.1 per cent in the three

months to November (ONS, GDP monthly estimate, UK: December

2025, 12 February 2026, link).

-

admitted Labour have ‘no growth strategy at all'. On

28 March 2025,

admitted to his mentor Peter that

Labour have ‘no growth strategy at all'. This was two

days after

Spring Statement, where

claimed ‘we on this side of the house are serious about

taking the action needed to grow our economy' (HM Treasury,

Spring Statement 2025 speech, 26 March 2025,

link).

-

Inflation is above target. Having inherited

inflation bang on the 2.0 per cent target, new figures show it

rose by 3.0 per cent in the 12 months to January 2026, meaning

inflation has exceeded the Bank of England's target every month

since Labour's first Budget (ONS, Consumer Price Inflation,

UK: January 2026, 18 February 2026, link).

-

The unemployment rate is 5.1 per cent, its highest

level since the pandemic. The unemployment rate for 16

and over reached 5.2 per cent in October to December 2025, up

from 4.2 per cent at the election. Additionally, the November

2025 Economic and Fiscal Outlook raised the forecast

unemployment rate for each year from 2026 through 2029 (ONS,

Labour market overview, UK: February 2026, 17 February

2026, link).

-

The 16-24 youth unemployment rate is 16.1 per cent,

up 2.7 percentage points on Labour's watch.The 16-24

unemployment rate was 16.1 per cent in September to November

2025, up from 13.4 in April to June 2024 when the

Conservatives left office (ONS, Unemployment rate: UK:

All: Aged 16-24, 20 January 2026, link).

Institute for Fiscal

Studies

Responding to today's ONS figures on the public finances, Nick

Ridpath, Research Economist at the Institute for Fiscal Studies,

said:

“Today's data on the public

finances is particularly important, given the

outsized impact of

January's self-assessment returns on

revenues and borrowing for the year as a

whole. Income tax receipts had been a little

disappointing over 2025, lagging

behind forecasts even as inflation and wage growth

exceeded expectations. But today's data shows that

self-assessment revenues in January were almost £2

billion (6%) higher than forecast. The

government's plan to run a current budget surplus from 2028-29

onwards is reliant on marked reductions in borrowing over the

next few years – reductions that will be far easier to achieve

if tax revenues continue to come in

strongly.”

Today, the Office for National

Statistics published new figures on government revenues, spending

and borrowing:

-

The government normally runs a

surplus in January. In other words, it raises more than it

spends. Today's figures show that the surplus in January was

£30 billion. This is more than double the

figure for the same month last year,

and a £6 billion improvement

on OBR's forecast from November. Much of

the gap stems from significantly lower debt interest spending

in January: the government spent £2.3 billion

servicing its debt last month, around £4

billion below what was forecast by the

OBR.

-

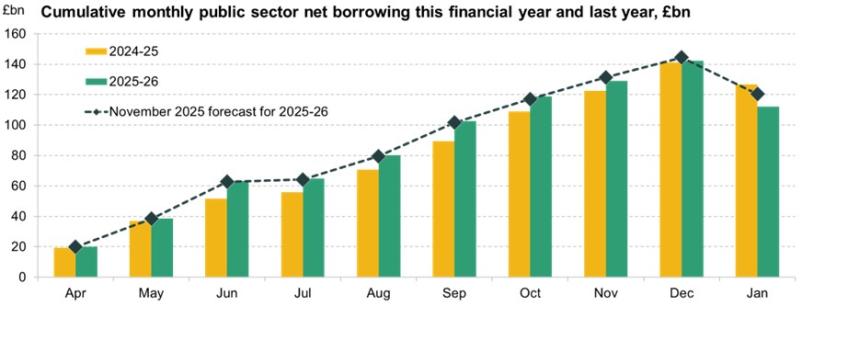

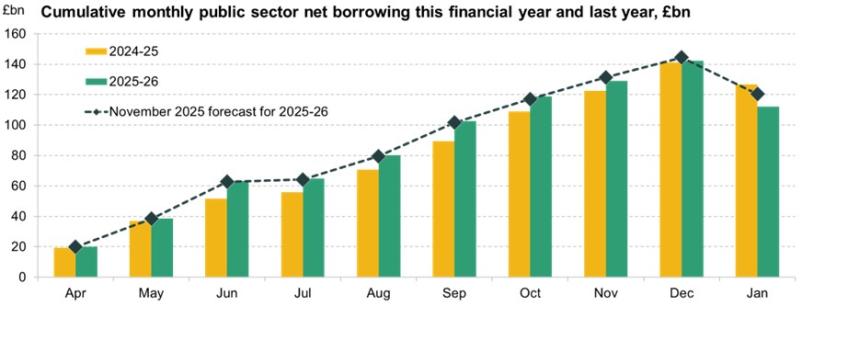

Government borrowing is expected

to be lower this year than last, as the

government takes further steps towards its target

for current budget surplus by 2029-30. Cumulative

borrowing over the first ten months of this

year is £15 billion lower than last

year, meaning that borrowing is coming

down even faster than

expected

-

Public finance data from January

is particularly important, as it is

when a large share of self-assessment

income tax is

paid. Income tax receipts have been

disappointing up to this point in

the financial year, lagging

behind forecasts despite inflation and

wage growth surpassing

expectations. Today's data shows that for the

second straight month, income tax receipts have

surpassed the forecast produced only back in

November. This may be a welcome sign that

government receipts are starting to get the boost from

inflation and wage growth earlier in the

year.

These figures will be revised and

revised again, and so we should not place too much weight on

figures from any single month. All the same, out-turn

data does provide important insights into the state of

the economy and public finances, and points to issues that

could affect the Office for Budget Responsibility's forecast

in a couple of weeks time.

Figure 1. Cumulative monthly

public sector net borrowing, outturns and OBR

forecast