-

Consumers swap credit for debit cards due to higher

interest rates

-

Cash used for just under one fifth of

transactions

-

Fees paid to bank and card schemes over £1.4

billion

Today, The British Retail Consortium (BRC) has published its

annual BRC Payments Survey,

showing the changing way in which people made payments in 2024.

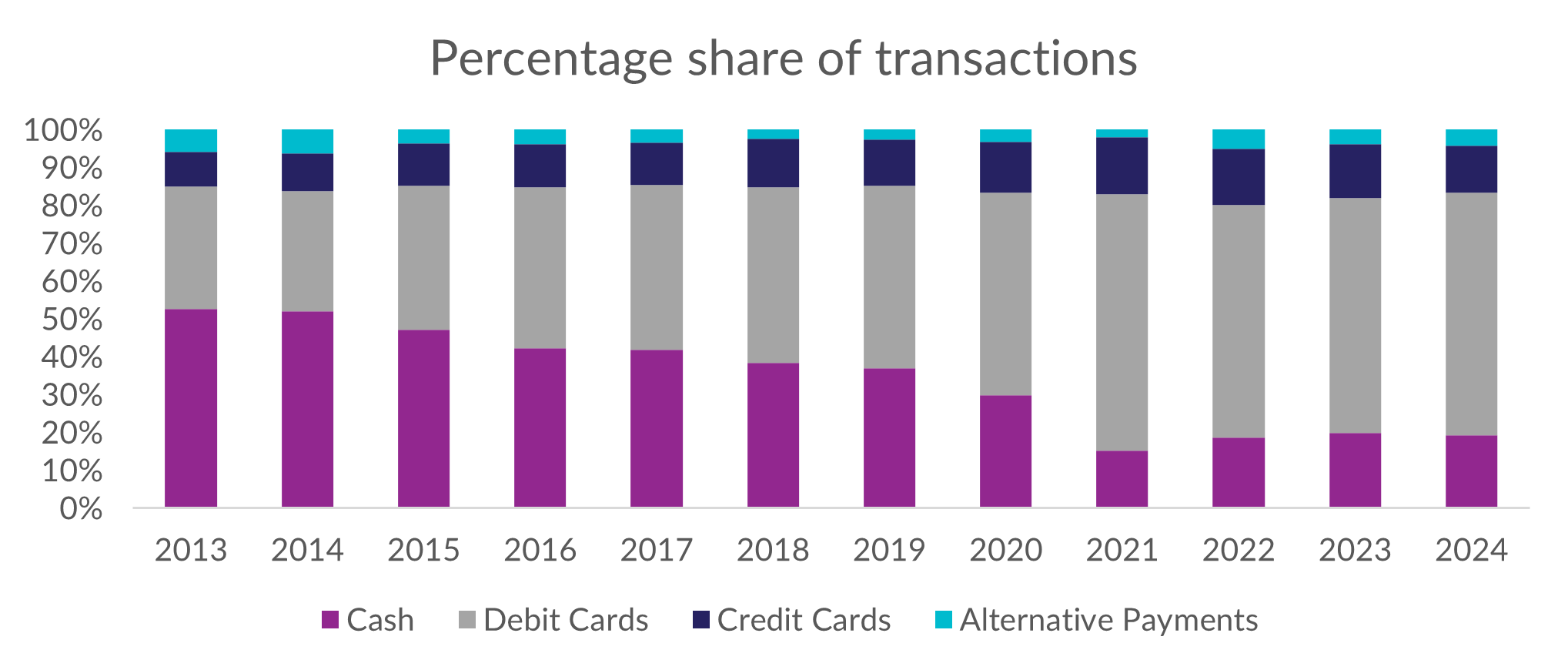

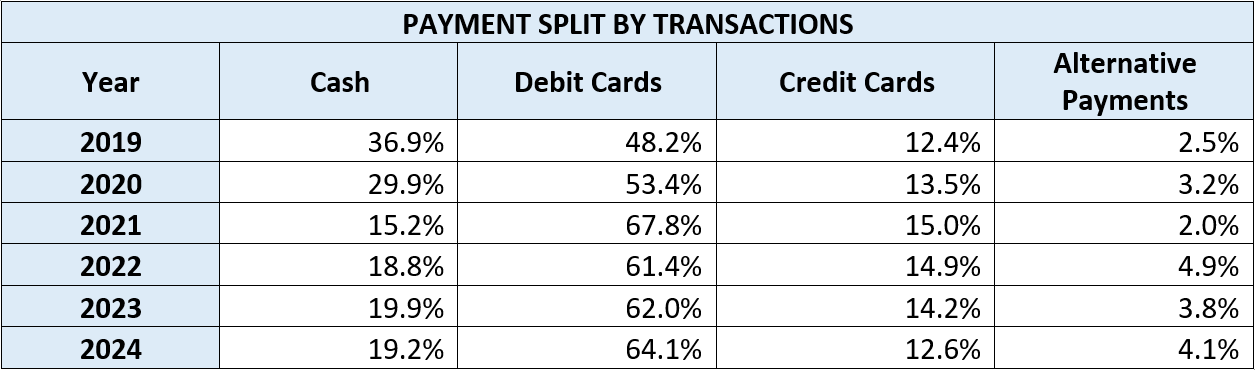

This year's survey reveals a significant decline in the use of

credit cards, from 14.2% of transactions to 12.6%. With higher

interest rates making credit cards a more expensive way to shop,

consumers turned to debit cards where usage increased from 62.0%

to 64.0% of transactions.

As the cost of living crisis eased, some customers returned to

old habits. The weekly shop showed signs of a comeback with

consumers making fewer but larger transactions. The total number

of transactions fell from 20.9 billion to 20.4 billion while the

average transaction value rose across all payment types.

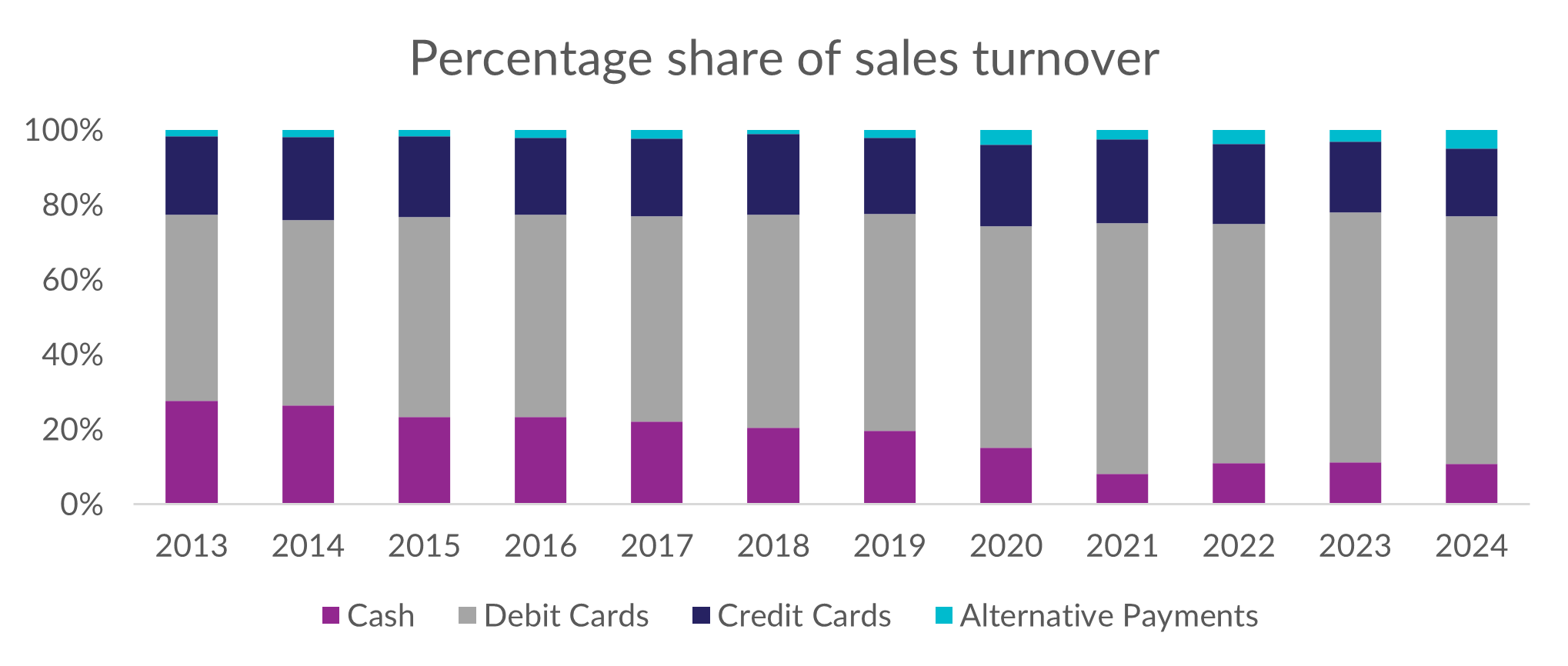

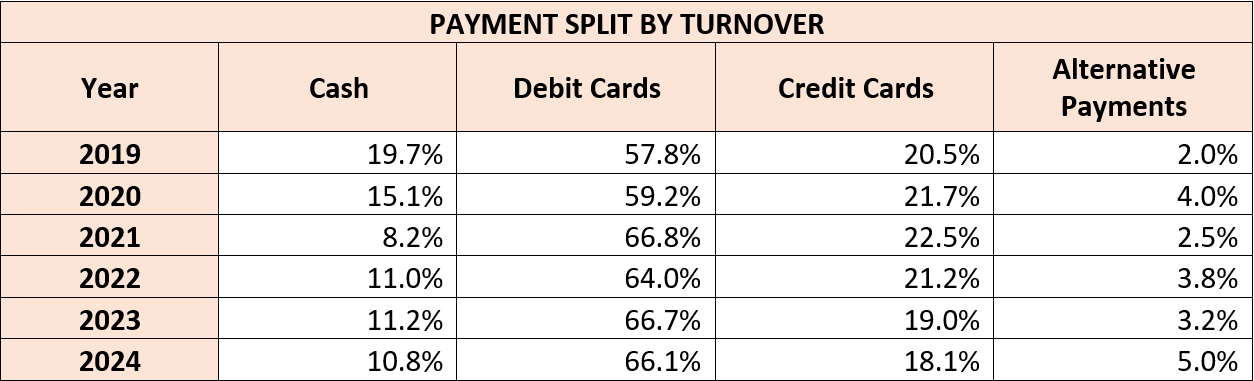

While cash usage declined it still remains an important payment

method for many customers, accounting for almost a fifth (19.2%)

of all transactions, though the average transaction value was

significantly smaller than other payment methods. Despite their

declining popularity, for larger transactions, consumers

preferred using credit cards which offer additional protections

for shoppers.

More shoppers were exploring less traditional payment methods

than ever before, particularly for larger transactions. This

included the use of gift vouchers, PayPal and Buy Now Pay Later.

Retailers and the BRC have long called out the significant,

unjustified rise in the cost of processing card payments. Total

card fees fell slightly in 2024 compared with 2023. However, at

£1.48 billion, the fees paid by retailers have more than doubled

since 2019. In April, the Payments System Regulator proposed

increasing transparency on fees charged to merchants and

acquirers. This falls well short of what is needed. The BRC is

calling for:

-

Meaningful reform from the PSR on card fees: A

long term price cap to meaningfully lower scheme and processing

fees and bring lasting reform to the market.

-

A Commercial Cards Market Review: Given the 8%

rise in commercial card fees (by turnover), we call on the PSR

to initiate a market review into Commercial Card interchange

fees to ensure the whole payment market is functioning

effectively.

-

Open banking: We want to see the growth of

Open Banking in the UK, so that it can be a viable alternative

to cards both online and at point of sale, at a fairer price to

retailers.

Chris Owen, Payments Policy Advisor at the British Retail

Consortium said:

“As interest rates peaked in 2024, the use of credit cards fell

as customers switched to lower interest forms of payment.

However, with cards still accounting for the vast majority of

transactions and card fees now more than double the level they

were six years ago, only a long-term cap on card fees would bring

much needed relief to retailers. Looking ahead, as the PSR

transitions into the Financial Conduct Authority next year, it is

vital that the FCA carries this work forward, delivering fairness

and transparency in a market long hampered by competition issues

and unjustified fee increases.”

-ENDS-

Notes:

- BRC Payments Survey can be found here: https://brc.org.uk/media/1sellpis/brc-payments-survey-2025.pdf

- Data for the BRC Payments Survey was gathered in 2025 and

covers the 2024 calendar year. Retailers participating in the

survey accounted for 34% of all UK retail annual sales turnover.

- We have adjusted and improved our methodology this year. We

have re-run all previous years' data so all figures used in this

year's survey account for the new methodology.

- Download the BRC Payments Survey 2025:

- Definitions:

- Card Schemes – Payment networks e.g. Visa, Mastercard and

American Express

- Scheme fees – fees paid by retailers to the card schemes

- Interchange fees – fees paid by retailers to the issuing

companies e.g. Barclaycard, Santander, Capital One. The rates

paid are set by the card schemes.

- Commercial cards – Cards used by businesses to make

purchases on behalf of a company.