Covering the 4 weeks 2 - 29 November 2025

- Total sales in Scotland increased by 0.1% compared with

November 2024, when they had decreased by 2.9%. This was below

the 3-month average increase of 1.1% and below the 12-month

average increase of 0.9%. Adjusted for inflation, there was a

year-on-year decrease of 0.5%.

- Total Food sales in Scotland increased by 0.7% compared with

November 2024, when they had increased by 0.6%. This was below

the 3-month average increase of 1.5% and above the 12-month

average increase of 0.3%.

- Total Non-Food sales in Scotland decreased by 0.5% compared

with November 2024, when they had decreased by 5.8%. This was

below the 3-month average increase of 0.8% and below the 12-month

average increase of 1.4%.

- Adjusted for the effect of online sales, Non-Food sales in

Scotland decreased by 0.4% compared with November 2024, when they

had decreased by 10.8%. This was below the 3-month average

increase of 0.9% and below the 12-month average increase of 2.3%.

Ewan MacDonald-Russell, Deputy Head of the Scottish

Retail Consortium, said:

“Scottish retail hopes of a strong end to 2025 are hanging by a

thread after disappointing November retail sales. Adjusted for

inflation sales fell by 0.5 percent; despite the inclusion of

Black Friday.

“Fashion, beauty, and electrical sales were all mediocre as

nervousness about the economy and poor weather kept shoppers at

home. Food sales were also disappointing, albeit that is

partly a consequence of strong competition between grocery

retailers keeping down prices.

“Retailers are now on tenterhooks for a last-minute surge in

Christmas sales to round off what will otherwise be a humdrum

year. However, if sales don't materialise then retailers

last hope will be the Scottish Government's Budget in January. If

the Finance Secretary doesn't deliver a business rates model

which is at least as competitive as the new lower rates in

England, then it will be a long winter for retailers.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“Scotland's retailers will be disappointed that Black Friday

period promotions failed to deliver the boost that they were

hoping for, with household costs and nervousness about the

economy continuing to impact discretionary buying. But, as

the Christmas decorations go up, hopefully retail sales growth

does too - ending 2025 with some festive cheer for the sector.”

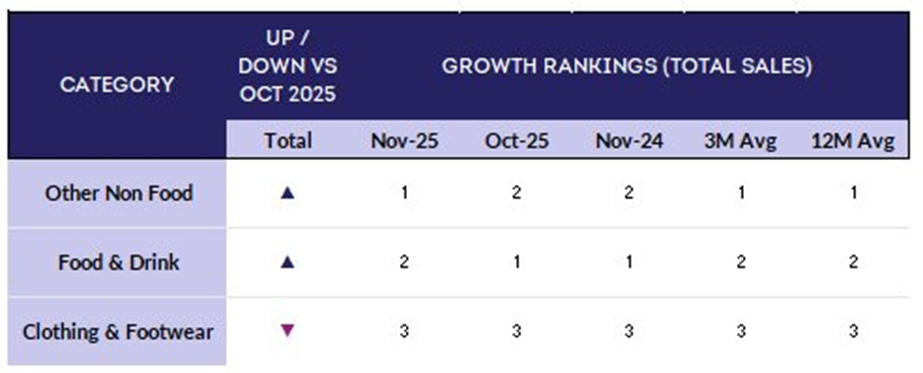

MONTHLY RETAIL SALES YEAR-ON-YEAR PERCENTAGE GROWTH

RANKING BY CATEGORY

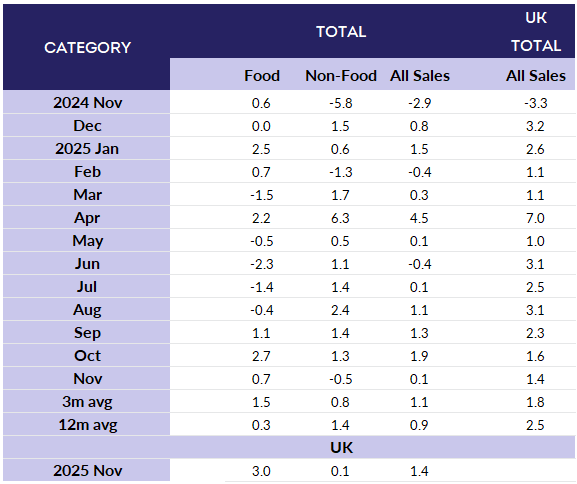

MONTHLY RETAIL SALES YEAR-ON-YEAR PERCENTAGE GROWTH BY

CATEGORY

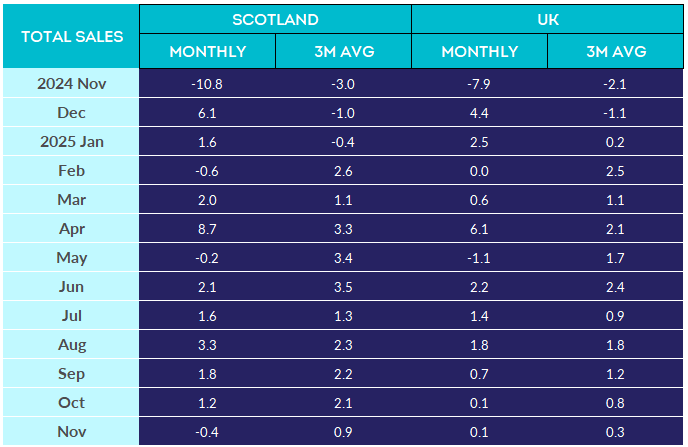

NON-FOOD MONTHLY RETAIL SALES YEAR-ON-YEAR PERCENTAGE

GROWTH, INCLUDING EFFECT OF ONLINE SALES

-ENDS-