Covering the 4 weeks 2 - 29 November 2025

-

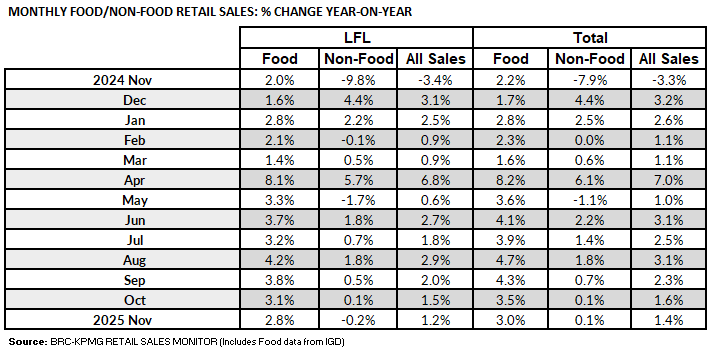

UK Total retail sales increased by

1.4% year on year in November, against a decline of

3.3% in November 2024. This was below the 12-month

average growth of 2.5%.

|

-

Food sales increased by 3.0% year on

year in November, against a growth of 2.2% in November

2024. This was below the 12-month average growth of

3.6%.

|

-

Non-Food sales increased by 0.1% year

on year in November, against a decline of 7.9% in

November 2024. This was below the 12-month average

growth of 1.6%.

|

-

In-Store Non-Food sales decreased by

0.3% year on year in November, against a decline of

6.2% in November 2024. This was below the 12-month

average growth of 1%.

|

-

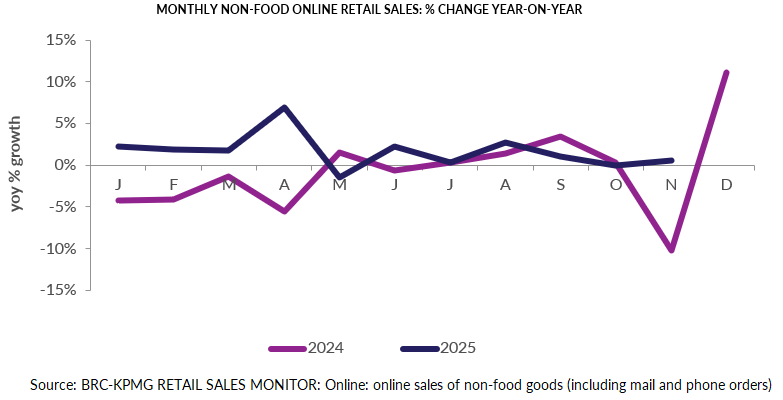

Online Non-Food sales increased by

0.5% year on year in November, against a decline of

10.3% in November 2024. This was below the 12-month

average growth of 2.5%.

|

-

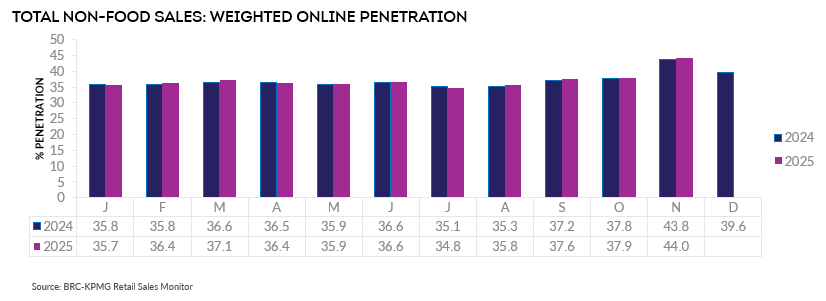

The online penetration rate (the

proportion of Non-Food items bought online) increased

to 44% in November from 43.8% in November 2024. This

was above the 12-month average of 37.3%.

|

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

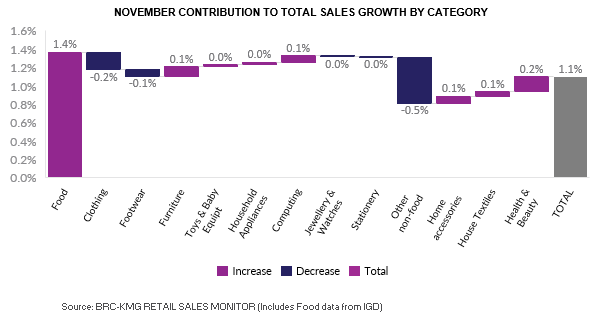

“Pre-Budget jitters among shoppers meant the month of Black

Friday did not deliver as strongly as retailers had hoped or the

economy needed. Sales growth was the weakest in six months,

despite the elevated inflation. Not unexpectedly, online

dominated, with the proportion of non-food bought online reaching

its highest level since 2022. Many consumers took advantage of

promotions, with homeware and upholstery selling well ahead of

festive hosting. Fashion lagged, especially with the mild first

half of November dampening demand for winterwear.

“Retailers continue to invest in Christmas offerings, building up

stock levels, and promoting festive products. It has been a

difficult year as retailers grappled with ever-rising cost

pressures. Looking ahead to 2026, it is time public policy

started prioritising measures to revive consumer confidence and

keep costs of doing business down so retailers can focus on

growth strategies to maximise their contribution to economic

recovery.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“November delivered some growth in retail sales, but many

retailers will be disappointed that Black Friday period

promotions failed to deliver the bigger boost that they were

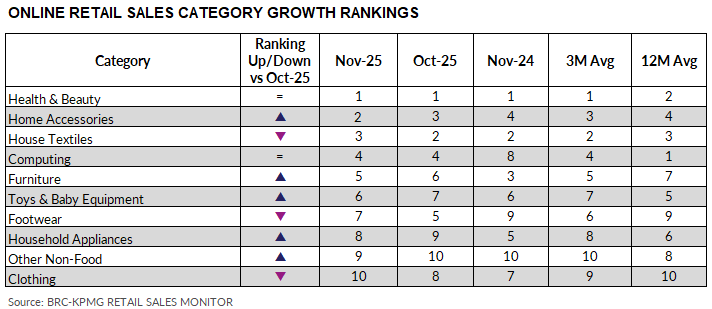

hoping for. While the likes of computing and household

appliances outperformed Black Friday week last year, total

non-food sales growth across all categories was minimal overall.

“Rising household costs and nervousness about the economy

continue to impact discretionary buying. But retailers will be

hoping that Budget clarity has now provided more certainty for

consumers about their ability to spend in the months ahead.

And as the Christmas decorations go up, hopefully retail sales

growth does too, ending 2025 with some festive cheer for the

sector.”

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“Confidence remains fragile following the Budget, with the

away-from-home market most exposed to reduced demand. In the

run-up to Christmas, shoppers are expected to make selective

trade-ups, balancing affordability with indulgence. Retailers

that combine strong value with premium options will be best

placed to win. As January arrives, expect a pullback on

discretionary spending alongside a renewed focus on healthier

choices.”