Public Sector Finances:

September 2025

Public Sector Finances, Appendix

A: September 2025

Public Sector Finances, Appendix

M: September 2025

Public Sector Finances, Appendix

N: September 2025

Details

The public sector finances statistical bulletin is published

jointly by the Office for National Statistics (ONS) and HM Treasury on a

monthly basis and provides the latest available estimates for key

public sector finance statistics, such as public sector net

borrowing, public sector net debt and public sector current

budget deficit/surplus.

The bulletin is structured with the latest headline figures,

revisions and information on recent events and/or methodological

changes which impact on the statistics, located at the front of

the bulletin.

Following this there is some contextual information for users and

then more detailed information on each of the key aggregates.

Historic data on public sector net debt and public sector net

borrowing have been included to put the latest figures in

context. More detailed notes on the publication are located

towards the end of the bulletin.

HM Treasury is no longer producing the public sector finances

databank. For information on the key fiscal aggregates:

Go to the OBR for outturn and

projected numbers for the key fiscal aggregates in financial

years.

Go to the

ONS for

outturn data of the key fiscal aggregates in quarters, financial

years and on a monthly basis.

Go to the

ONS for a

breakdown on receipts and expenditure.

Chief Secretary to the

Treasury

Chief Secretary to the Treasury

said:

“Currently we spend £1 in every £10 of taxpayer money on the

interest of our national debt. That money should be going to our

schools, hospitals, police and armed forces. That is why we are

set to deliver the largest primary deficit reduction in both the

G7 and G20 over the next five years - to get borrowing costs

down.

“At the Budget next week, the Chancellor will set out how we will

take the fair choices to deliver on the public's priorities to

cut NHS waiting lists, cut debt and cut the cost of living.”

Conservative

Party

Sir MP, Shadow

Chancellor of the Exchequer, said:

“Borrowing so far this year has been the highest on record

outside the pandemic.

“If Labour had any backbone, they would control spending to avoid

tax rises next week. While Labour plan to spend more and more,

Conservatives would cut the deficit and cut taxes with our Golden

Economic Rule and our £47 billion savings plan.

“Only the Conservatives have a leader with the backbone, the

team, and the clear plan to control spending, live within our

means, and reduce taxes – delivering a stronger economy.”

ENDS

Notes to

Editors:

Labour inherited a recovering economy:

-

Labour inherited the fastest growing economy in

the G7. Labour inherited the fastest growing economy

in the G7 when 0.7 per cent growth was recorded between January

and March 2024 (ONS, GDP Quarterly national Accounts, UK:

January to March 2024, 28 June 2024, link).

-

Labour inherited inflation at two per

cent. After inflation reached 11.1 per cent in

October 2022 in the wake of the pandemic and Russia's illegal

invasion of Ukraine, it was brought down to 2.0 per cent by

June 2024 – bang on the Bank of England's target (ONS,

Consumer price inflation time series (MM23), 17 July

2024, link).

-

Labour inherited falling borrowing and a budget

deficit of 4.4 per cent – less than half of what it

was in 2010. Labour leftPublic Sector Net

Borrowing at 10.3 per cent of GDP in 2010, they inherited it at

4.4 per cent, forecast to fall 1.2 per cent by 2028-29 (OBR,

Public finances databank 2023-24, 25 April 2024,

link).

Labour's first Budget trapped Britain in a doom loop

of high spending, more borrowing and higher

taxes:

-

Labour increased spending by half a trillion

pounds. Labour plan to spend half a trillion

pounds – £485 billion – more over the course of the Parliament

than the plans they inherited, despite Rachel Reeves' claim

Labour's policies were ‘fully costed, fully funded and

deliverable within [our] inheritance' (OBR, Economic and

Fiscal Outlook, 26 March 2025, link; BBC

Breakfast, 8 February 2024,

archived).

-

Labour ‘fiddled the figures' to borrow more,

doubling the deficit. Despite promising not to

‘fiddle the figures', Labour announced a new fiscal rule,

increasing Public Sector Net Borrowing from £39.4 billion to

£77.4 billion in 2028-29 – doubling the deficit (OBR,

Economic and Fiscal Outlook, 30 October 2025, link; OBR,

Economic and Fiscal Outlook, 26 March 2025, link).

-

Labour hiked taxes to a ‘historic

high'. Labour's last Budget raised taxes by £40

billion – far above the £7 billion of tax hikes in their

manifesto – pushing the tax burden to a historic high of 37.7

per cent of GDP. Despite their manifesto pledge to avoid tax

hikes on ‘working people',

introduced a Jobs Tax that the independent Institute for

Fiscal Studies (IFS) said will be paid for ‘largely by working

people' and increase the cost of employment by £900 for the

average worker (OBR, Economic and Fiscal Outlook, 26

March 2025, link; The Labour

Party, Change, 13 June 2024, link; IFS, IFS

Initial Response to Autumn Budget 2024, 30 October 2024,

link).

The Conservatives will stabilise the public finances

– allowing us to cut tax:

-

We will deliver £47 billion of savings.

Under our Golden Economic Rule, for every pound saved,

at least half will go to cutting the deficit, with the

remainder being used to getting our economy moving. We will

deliver these savings by:

- Cutting welfare spending (£23 billion)

- Reducing the size of the Civil Service (£8 billion)

- Cutting spending on social housing for foreign nationals

(£3.9 billion)

- Reducing the cost of the asylum system (£3.5 billion)

- Abolishing Net Zero schemes (£1.6 billion)

- Cutting back on overseas aid (£7 billion)

-

This means we can cut tax. At

Conservative Party Conference, we announced our plan to:

-

Abolish Stamp Duty on primary

residences, helping more families achieve the dream of home

ownership. Under our plan, Stamp Duty Land Tax,

which is paid when you buy a property or land in England and

Northern Ireland, will be abolished for primary residences

(GOV.UK, Stamp Duty Land Tax, accessed 20 November

2025, link).

-

Abolish Business Rates for

Retail, Hospitality and Leisure businesses, benefitting

250,000 businesses and reviving our high streets. We

would introduce permanent 100 per cent business rates relief

for Retail, Hospitality and Leisure businesses – benefitting

250,000 businesses (HMT, Press Release, 13 November

2024, link).

-

Introduce a £5,000 First Jobs

Bonus, backing the next

generation. Under our plan, the first £5,000 of

National Insurance paid by any British citizen starting their

first job will be placed into a personal savings account –

earmarked for a first home deposit or future savings.

Institute for Fiscal

Studies

Responding to today's ONS figures on the public finances, Nick

Ridpath, Research Economist at the Institute for Fiscal Studies,

said:

“Today's figures show that government

borrowing has continued to exceed the OBR's forecast

for the year to date, to the

tune of around £10 billion. This overshoot

is driven by a combination of

lower-than-expected tax receipts

and higher-than-expected borrowing by councils and

other bodies outside of central government

control. What this highlights

is that forecasts for the level of borrowing

this year are subject to considerable uncertainty, never mind

those for borrowing in four or five

years' time. Operating with minimal

fiscal margin for error is risky, and this is

one reason why the Chancellor might

sensibly take steps to increase her so-called

‘fiscal headroom' at next week's

Budget.”

Today, the Office for National

Statistics published new figures on government revenues,

spending, and borrowing, which means we now have provisional

public data on the public finances for the first seven months of

the 2025-26 financial year. This is the last such data

release before next Wednesday's

Budget.

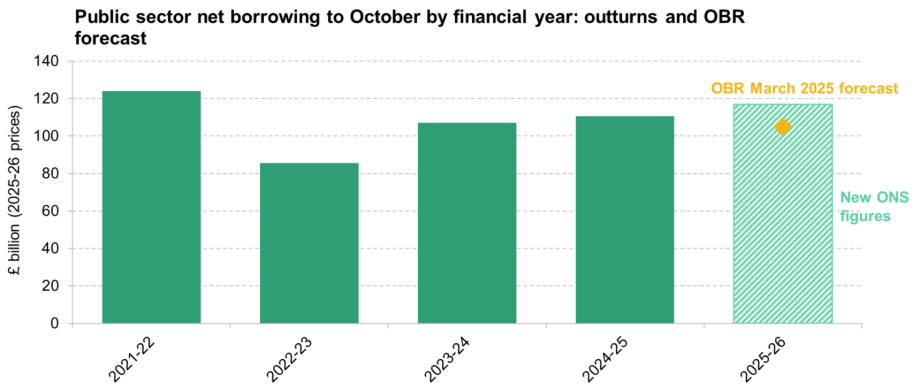

-

In the seven months up to October

in the financial year 2025-26, public sector net

borrowing was £116.8 billion, £9.9 billion (9%)

more than expected at the OBR's March forecast and

£9.0 billion (8%) more than the £107.8 billion that

the government borrowed in the first seven months of

2024-25. Around one-third of this overshoot stems

from higher-than-expected borrowing by local

authorities, likely reflecting high spending on

support for children with special educational

needs.

-

The government might have hoped

that higher-than-expected inflation this

year would have fed through into higher

tax receipts, especially from VAT. So far, though,

there is no sign of VAT receipts exceeding expectations,

with accrued VAT receipts net of refunds

up to

October remaining slightly below

forecast. Income tax receipts are also

running slightly below forecast. Overall central

government receipts for the financial

year up to October are £2.8 billion below

forecast.

This data will be subject to revision,

and we should not over-read into monthly fluctuations. Today's

release does, nonetheless, highlight important context for

next week's Budget: uncertainty around tax revenues,

pressures on public spending, and stubbornly high

costs of servicing government debt. IFS researchers

will give their verdict on the Chancellor's

announcements at an online event at 10:30 next

Thursday.

Figure 1 Borrowing up to

October by financial year: outturns and March 2025

Forecast

Source: ONS Public Finance

Statistics, November 2025, and OBR Economic and Fiscal Outlook,

March 2025