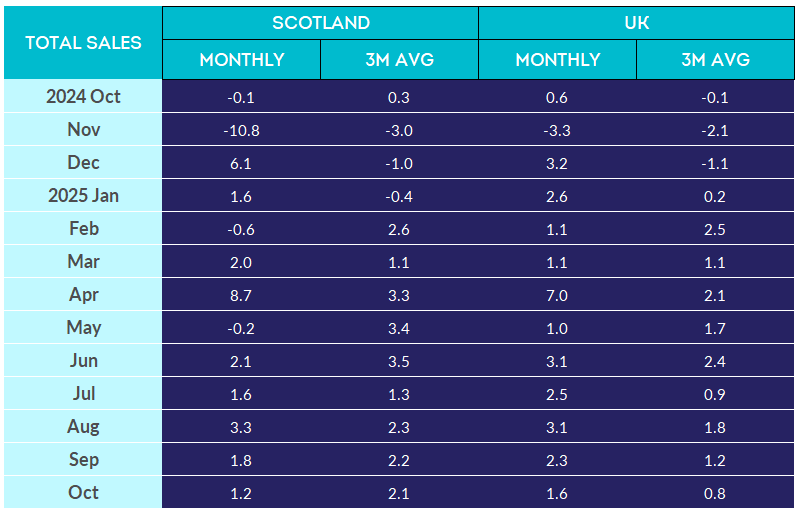

Covering the 4 weeks 5 October – 1 November 2025

- Total sales in Scotland increased by 1.9% compared with

October 2024, when they had decreased by 0.7%. This was above the

3-month average increase of 1.4% and above the 12-month average

increase of 0.7%. Adjusted for inflation, there was a

year-on-year increase of 1.0%.

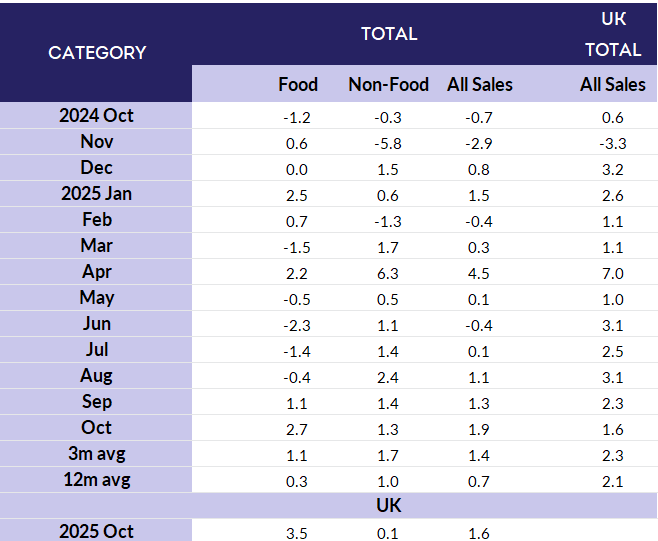

- Total Food sales in Scotland increased by 2.7% compared with

October 2024, when they had decreased by 1.2%. This was above the

3-month average increase of 1.1% and above the 12-month average

increase of 0.3%.

- Total Non-Food sales in Scotland increased by 1.3% compared

with October 2024, when they had decreased by 0.3%. This was

below the 3-month average increase of 1.7% and above the 12-month

average increase of 1.0%.

- Adjusted for the effect of online sales, Non-Food sales in

Scotland increased by 1.2% compared with October 2024, when they

had decreased by 0.1%. This was below the 3-month average

increase of 2.1% and below the 12-month average increase of 1.5%.

David Lonsdale, Director, Scottish Retail Consortium,

said:

“October saw a modest but welcome further improvement in Scottish

retail sales which edged up for a fourth consecutive month. This

was the best monthly performance since April and an encouraging

start to the golden quarter of trading, albeit to an extent was

driven by shop price inflation rather than increased sales

volumes.

“Homeware and furniture fared well as did food and

festive-related purchases of decorations and items such as

wrapping paper. However, clothing retailers reported challenges

selling winter clothing due to the variable weather and Halloween

related purchases were so-so. Sales of electrical goods

underwhelmed, perhaps reflecting consumers holding back in

anticipation of Black Friday discounting.

“With Christmas just around the corner we ought to be seeing a

more confident mood amongst Scotland's retailers. However, twin

threats are to the fore. Firstly, consumer confidence remains

shaky and won't be helped by mooted increases in personal

taxation which would lessen the amount people have available to

spend in shops. The second threat is the risk of inaction on

business rates. Wales and England are cutting business rates for

shops permanently from April but there is an absence of any plan

here in Scotland. Without a rates reduction for all retailers

here in Scotland there could well be direct consequences for

commercial investment and the state of our high streets, as

destinations elsewhere in GB become considerably more attractive

and cost-effective locations to invest in.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“With Black Friday sales already getting underway and Christmas

displays also now up in many stores, Scotland's retailers are

aiming to increase the sales growth seen in recent months.

Our own research indicates that the majority of shoppers are

considering purchases over the Black Friday period, and that AI

will play a growing role in how consumers search for and find

promotional offers or gifts. This tech evolution presents

both challenges and benefits to retailers trying to capture these

tech savvy shoppers.”

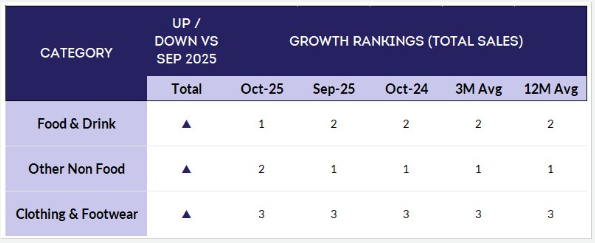

MONTHLY RETAIL SALES YEAR-ON-YEAR PERCENTAGE GROWTH

RANKING BY CATEGORY

MONTHLY RETAIL SALES YEAR-ON-YEAR PERCENTAGE GROWTH BY

CATEGORY

NON-FOOD MONTHLY RETAIL SALES YEAR-ON-YEAR PERCENTAGE

GROWTH, INCLUDING EFFECT OF ONLINE SALES