Fieldwork conducted on 7-10 October

2025

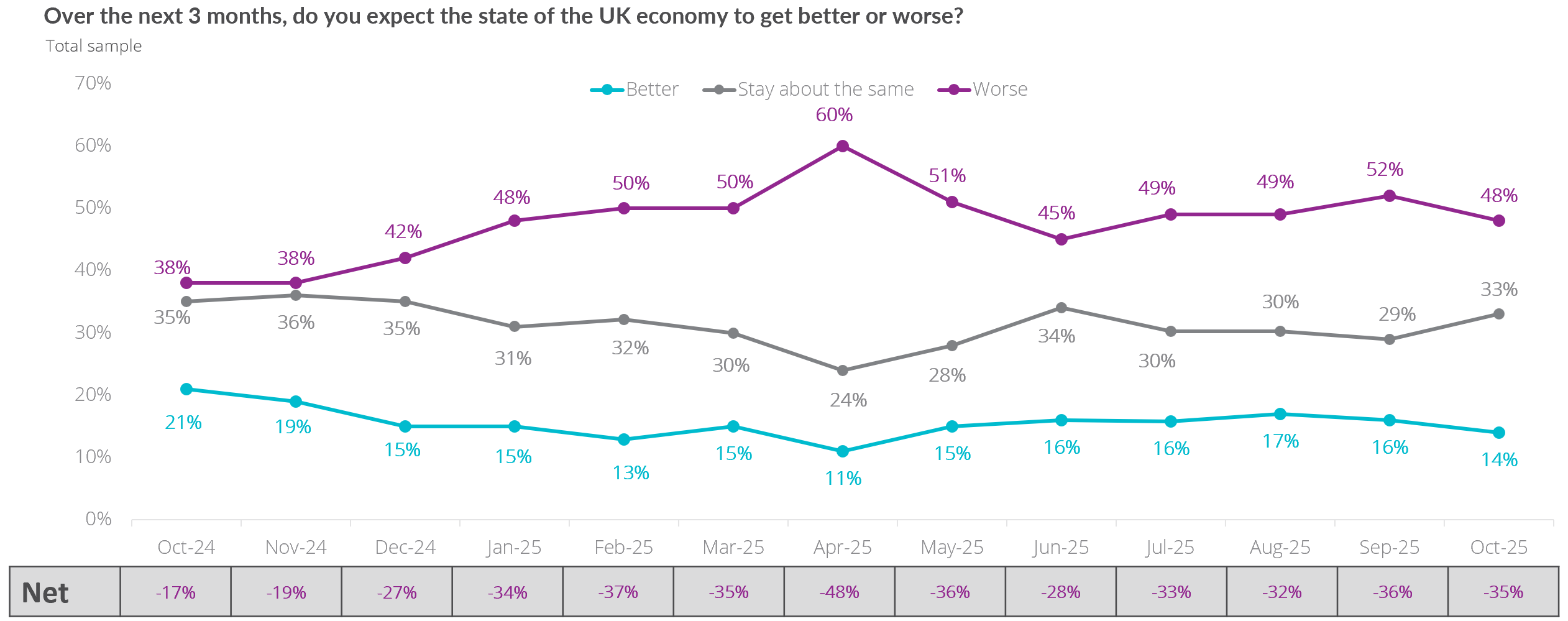

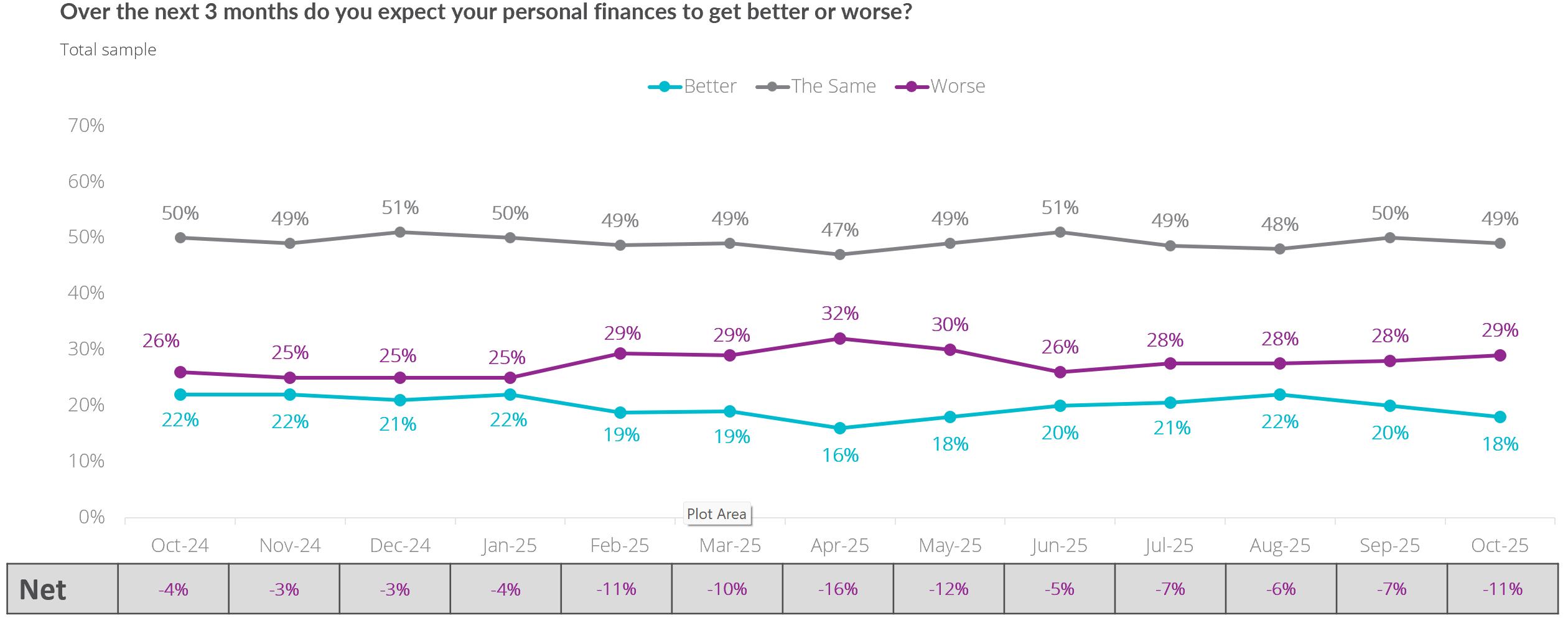

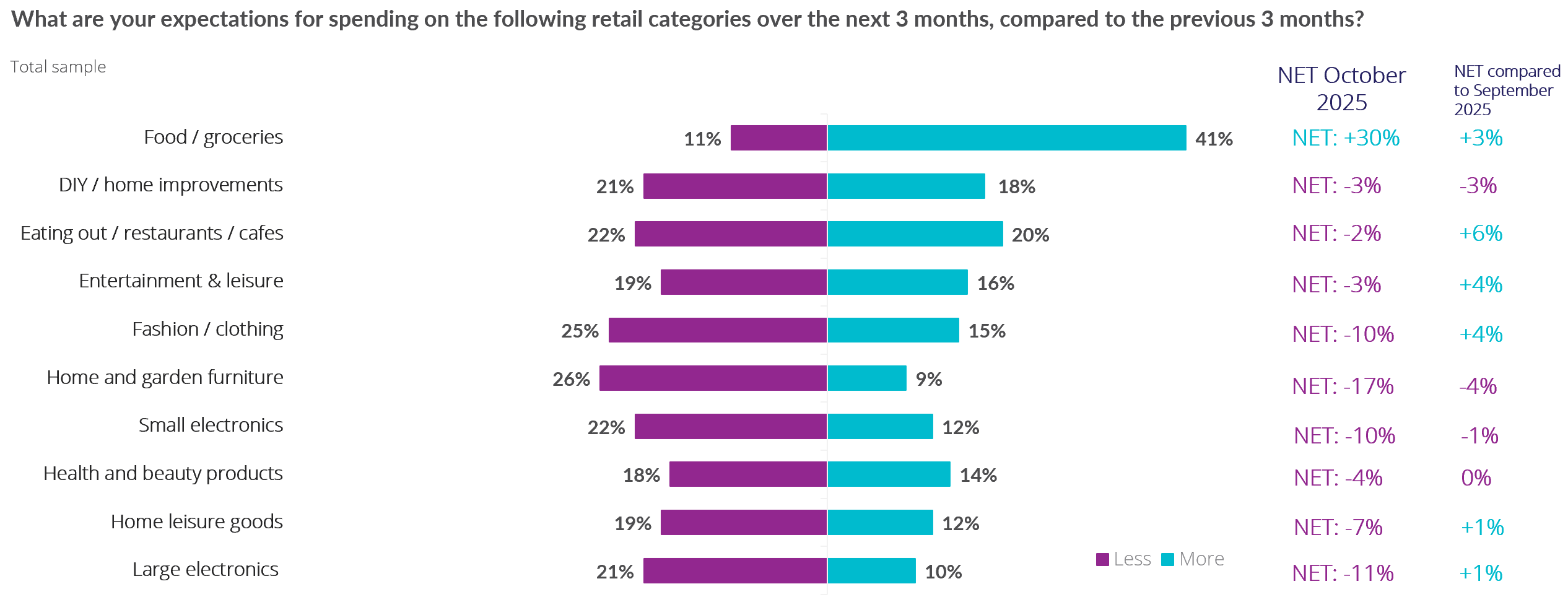

According to BRC-Opinium data, consumer expectations

over the next three months of:

-

The state of the economy slightly improved to

-35 in October, up from -36 in September.

-

Their personal financial situation worsened to

-11 in October, down from -7 in September.

-

Their personal spending on retail rose to +14

in October, up from +5 in September.

-

Their personal spending overall rose to +18 in

October, up from +14 in September.

-

Their personal saving fell to -9 in October,

down from 0 in September.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“With Christmas now around the corner, expectations of spending,

particularly on retail goods, rose sharply, with a corresponding

drop in expected savings. This effect was pronounced among

Millennials and Gen X, the generations most likely to have

children living at home. Worries about the cost of Christmas,

coupled with concerns about potential tax rises in the upcoming

Budget are likely to have contributed to the drop in sentiment

around personal finances, which fell into double digits for the

first time since May.

“While the prospect of Christmas may have boosted expectations of

grocery spending, the general rise in food prices has meant many

families are struggling with the rising cost of living. Retailers

are doing what they can to limit price rises, but high costs from

the last Budget – including increased employment and packaging

taxes – are still filtering through into inflation. The Budget is

an important opportunity to relieve some of these cost pressures

– particularly the disproportionate burden of business rates on

the retail industry.”

Consumer expectations for the state of the economy

over the next three months:

Consumer expectations for their personal financial

situation over the next three months:

Consumer expectations of spending over the next three

months by category:

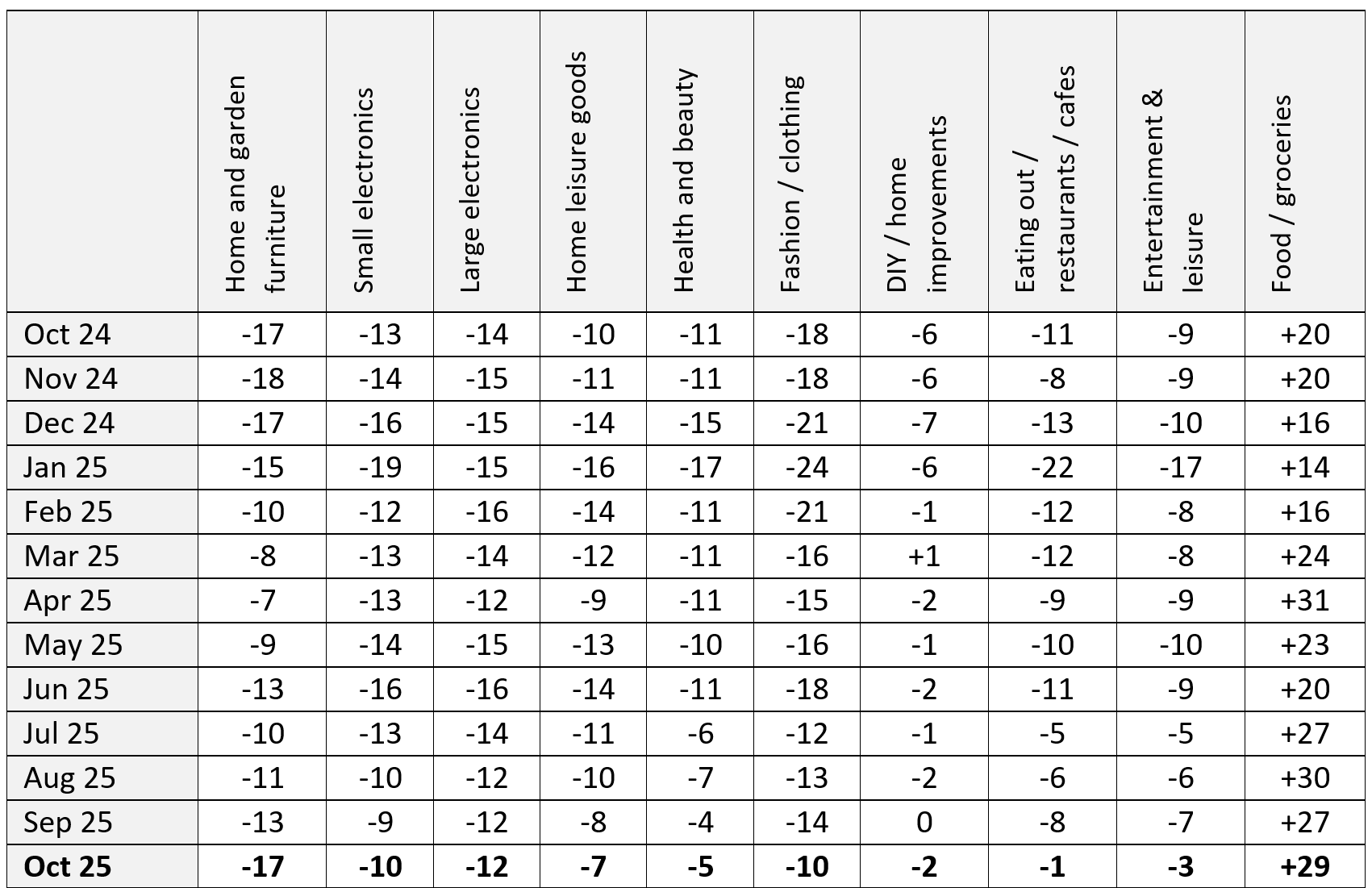

Consumer NET expectations of spending over the next

three months by category:

-ENDS-

The BRC sent this release to our "Monitors" and "General

Retail" media list. To check/update what media lists you are on,

please contact us below.

Methodology:

Fieldwork conducted by Opinium for the BRC. Sample included 2,000

UK adults and results have been weighted and assigned a net

score. The better/worse figures in the graphs are rounded, while

net scores are calculated from precise figures. Questions were:

- Over the next 3 months, do you expect your personal finances

to get better or worse?

- Over the next 3 months, do you expect the state of the UK

economy to get better or worse?

- What do you plan to do in relation to your spending over the

next 3 months?

- Reflecting on your retail spend across different categories,

overall do you expect to spend more or less on retail items over

the next 3 months?

- What are your expectations for saving over the next 3 months?

- What are your expectations for spending on the following

retail categories over the next three months compared to the

previous 3 months?

If you would like the results of the questions by Gender,

Generation, Location, Working status, or Income, please contact

the Press Office. Generations are defined as: Gen Z (18-27),

Millenial (28-43), Gen X (44-59), and Boomer (60-78).