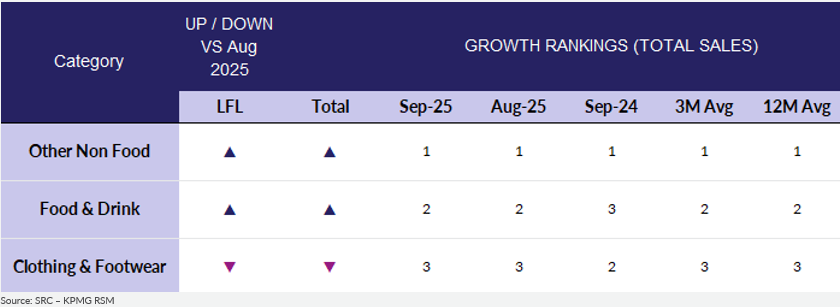

Covering the 5 weeks 31 August – 04 October 2025

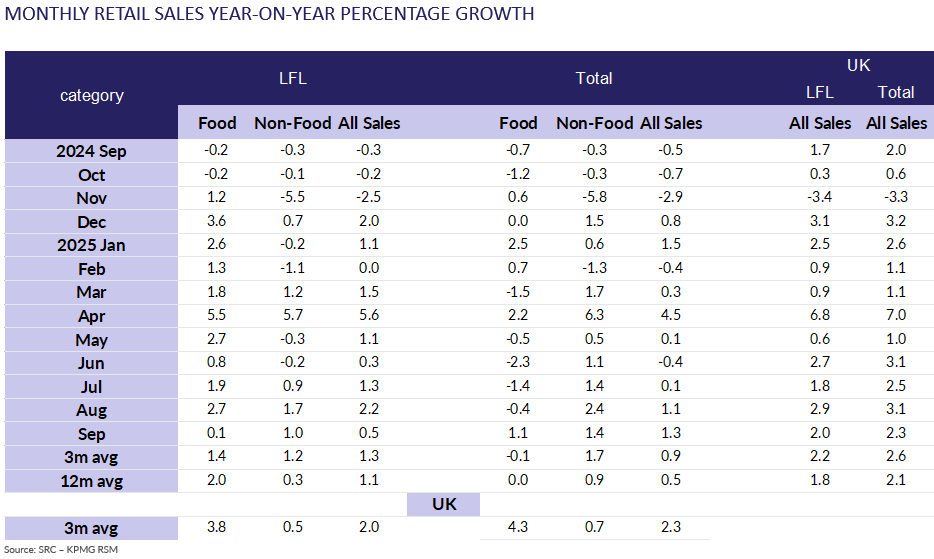

- Total sales in Scotland increased by 1.3% compared with

September 2024, when they had decreased by 0.5%. This was above

the 3-month average increase of 0.9% and above the 12-month

average increase of 0.5%. Adjusted for inflation, there was a

year-on-year decrease of 0.1%.

- Total Food sales in Scotland increased by 1.1% compared with

September 2024, when they had decreased by 0.7%. This was above

the 3-month average decrease of 0.1% and above the 12-month

average of 0%.

- Scottish Sales increased by 0.5% on a like-for-like basis

compared with September 2024, when they had decreased by 0.3%.

This was below the 3-month average increase of 1.3% and below the

12-month average increase of 1.1%.

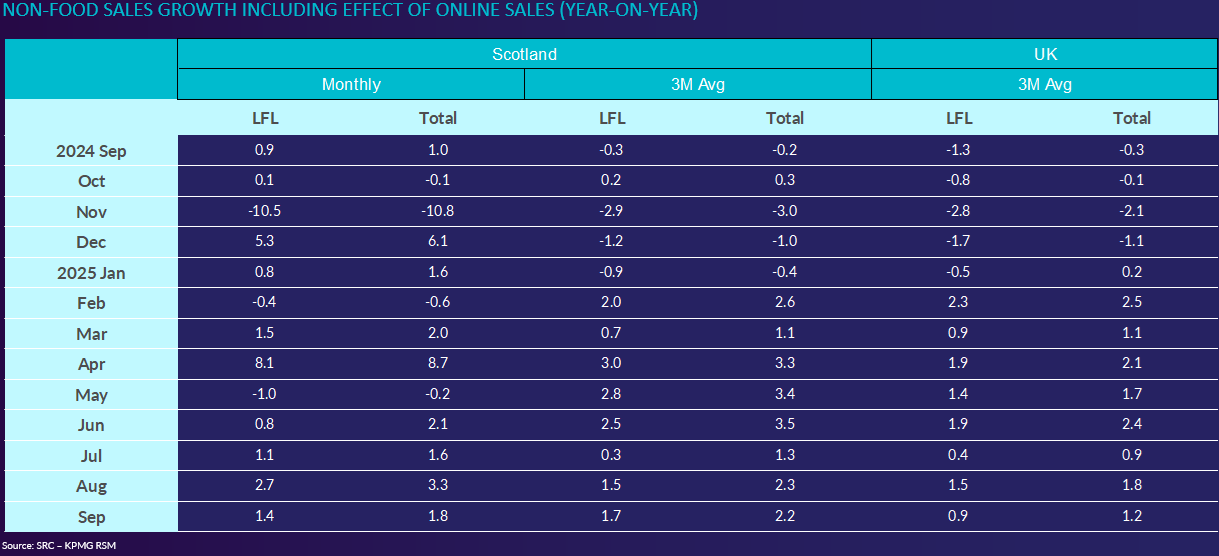

- Total Non-Food sales in Scotland increased by 1.4% compared

with September 2024, when they had decreased by 0.3%. This was

below the 3-month average increase of 1.7% and above the 12-month

average increase of 0.9%.

- Adjusted for the effect of online sales, Non-Food sales in

Scotland increased by 1.8% compared with September 2024, when

they had increased by 1%. This was below the 3-month average

increase of 2.2% and above the 12-month average increase of 1.4%.

Ewan MacDonald-Russell, Deputy Head of the Scottish

Retail Consortium, said:

"Retail sales rose in line with shop price inflation in September

as shoppers kept a canny eye on their finances. This is the third

successive month of positive improving retail sales and the best

monthly figure since April and hopefully signals some appetite

from consumers ahead of the crucial Golden Trading Quarter

starting in October.

"Furniture did well across the month alongside this years' strong

categories of gaming, health and beauty, and toys. Conversely

fashion lines struggled as the combination of warmer weather and

Storm Amy deterred high street shoppers from updating their

wardrobes; albeit retailers will hope that spending is deferred

rather than cancelled.

"The tough truth is retailers are having to run very fast just to

keep pace with the very significant public policy costs imposed

on them in last year's UK and Scottish Budgets. With inflation

still increasing and little sign of the long-promised uplift in

economic growth as much pressure as ever will fall on strong

trading over the crucial Christmas period.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“Overall sales grew in September, driven largely by household

goods and increased mobile phone sales, as prominent brands

launched new models. However, non-food sales are only

growing by around 1.7% on average over the last quarter in

Scotland, indicating that spending continues to be very targeted

as consumers remain cautious. As we enter the ‘golden'

quarter for the sector, retailers are planning product ranges and

promotions to try and increase that rate of sales growth.”