The Shop Price Index has been renamed the Shop Price

Monitor. This makes the name consistent with other BRC economic

monitors. No data has been changed in this renaming.

Period Covered: 01 – 07

September 2025

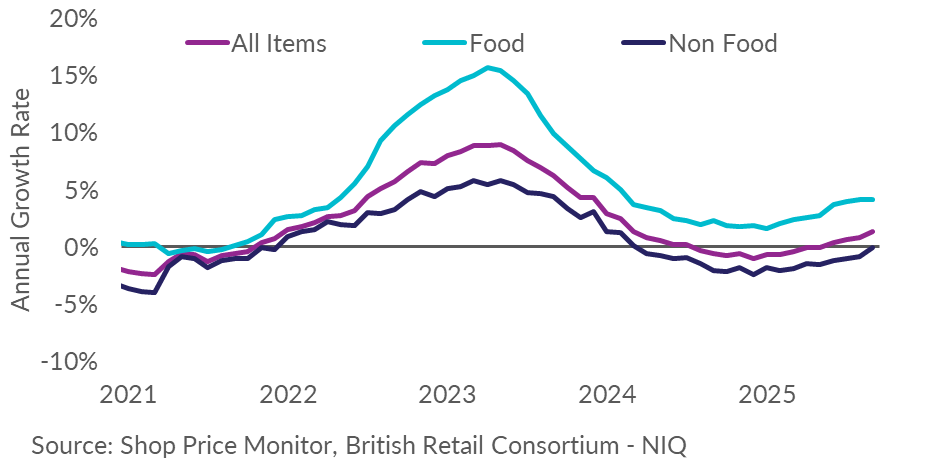

- Shop price inflation increased to 1.4% year on year in

September, against growth of 0.9% in August. This is above the

3-month average of 1.0%.

- Non-Food inflation increased to -0.1% year on year in

September, against a decline of -0.8% in August. This is above

the 3-month average of -0.6%.

- Food inflation was unchanged at 4.2% year on year in

September, against growth of 4.2% in August. This is above the

3-month average of 4.1%.

- Fresh Food inflation was unchanged at 4.1% year on year in

September, against growth of 4.1% in August. This is above the

3-month average of 3.8%.

- Ambient Food inflation was unchanged at 4.2% year on year in

September, against growth of 4.2% in August. This is below the

3-month average of 4.5%.

|

|

OVERALL SPM

|

FOOD

|

NON-FOOD

|

|

% Change

|

On last year

|

On last month

|

On last year

|

On last month

|

On last year

|

On last month

|

|

Sep-25

|

1.4

|

0.2

|

4.2

|

0.2

|

-0.1

|

0.3

|

|

Aug-25

|

0.9

|

0.2

|

4.2

|

0.4

|

-0.8

|

0.0

|

Note: Month-on-month % change refers to changes in the

level of prices.

Helen Dickinson, Chief Executive of the BRC,

said:

“A year and a half of non-food deflation looks set to come to an

end, as inflationary pressures spread beyond food. DIY and gardening saw rising

prices, while some back-to-school categories continued to see

reductions as retailers offered promotions on electricals such as

laptops ahead of the new academic year. Food inflation

held steady after seven consecutive months of rises but increased

labour and energy costs continue to push up input prices for many

farmers, particularly of cattle, with dairy and beef prices

remaining high.

“Households are finding shopping increasingly expensive. The

impact on retailers and their supply chain of both global factors

and higher national insurance and wage costs is playing out in

prices for consumers. The new packaging tax, set to take effect

in October, will put further upward pressure on inflation. While

retailers continue to absorb higher costs as much as possible and

deliver value to customers, any further tax rises in the upcoming

Budget would keep shop prices higher for longer. Ultimately, it

is British households who will bear the consequences—positive or

negative—of the Chancellor's decisions.”

Mike Watkins, Head of Retailer and Business Insight, NIQ,

said:

“With inflationary pressures persisting, many

shoppers remain concerned about their personal finances and are

becoming increasingly price-sensitive. As a result, retailers are

likely to continue offering promotions and deals in the coming

weeks to help maintain sales momentum.”