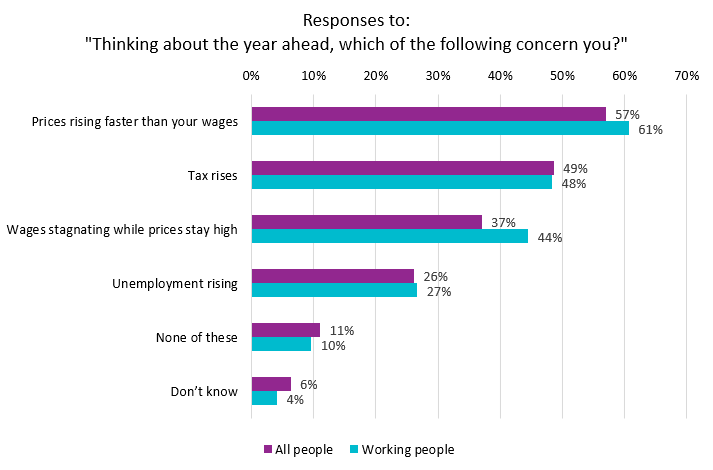

A new survey by the British Retail Consortium (BRC) suggests

growing concerns about the cost of living in the year ahead. The

survey of 2,000 people, conducted by Opinium, found people's

biggest concern was “prices rising faster than wages”, with 57%

of respondents agreeing (61% among working people). This was

higher than concerns around tax rises (49%) and rising

unemployment (26%).

The latest figures by the ONS show that inflation is now 3.8%,

almost double the Bank of England's target of 2%. This was even

higher for food inflation, which rose to 4.9%, the highest level

since the cost of living crisis in 2022/23.

Retail price inflation has been rising steadily over the last

year, accelerated by the impact of the previous Budget, which

significantly increased employment costs, as well as introducing

a new packaging tax on retail businesses.

Last week, the Bank of England held off from an interest rate cut

on fears that rising food prices were putting upwards pressure on

headline inflation. The last Budget added £7 billion to retailers

costs as a result of rises to employer NICs, higher NLW and a new

packaging tax, so it was no surprise that the latest MPC

minutes blamed rising food prices on “labour costs and

costs associated with new packaging regulation” as well as higher

commodity prices.

The BRC is warning that food inflation will rise and remain above

5% well into 2026 if the retail industry is hit by further tax

rises at the Autumn Budget. The Government has pledged to bring

down business rates for retail, hospitality and leisure premises,

but around 4,000 large shops could actually see their rates rise,

if they are included in the Government's new business rates

surtax for properties with a rateable value over £500,000.

Helen Dickinson, Chief Executive at the British Retail

Consortium, said:

“The Government risks losing the battle against inflation and

working families are understandably worried. With many people

barely recovering from the last cost of living crisis, the

Chancellor will want to protect households and enable retailers

to continue doing everything they can to hold back prices.

“The Treasury is currently finalising its plans to support the

high street, including a much-needed reduction in business rates

for retail, hospitality and leisure premises. However, the

biggest risk to food prices would be to include large shops –

including supermarkets – in the new surtax on large properties.

This would effectively be robbing Peter to pay Paul, increasing

costs on these businesses even further and forcing them to raise

the prices paid by customers. Removing all shops from the surtax

can be done without any cost to the taxpayer, and would

demonstrate the Chancellor's commitment to bring down inflation.”

-ENDS-

Survey Methodology:

Polling conducted by Opinium for the BRC. Sample included 2,000

UK adults and results have been weighted and assigned a net

score. Respondents were asked “Thinking about the year ahead,

which of the following concern you. Please tick all that

apply.”

Business Rates Reform - Background:

- Currently, all non-domestic premises pay Business Rates (or

Non-Domestic Rates in Scotland). They are calculated by

Multiplier (tax rate) x Rateable Value of a property. In England,

the multipliers are 55.5p (in the pound) for most business

premises, and 49.9p for small business premises (rateable value

under £51,000).

- Labour came into Government with a pledge to reform business

rates. They are planning a permanent reduction in the business

rates multiplier for retail, hospitality and leisure (RHL)

premises, with a rateable value of under £500,000. We do not yet

know what the new lower multipliers will be for RHL premises.

- This will be paid for by the introduction of a new, higher,

multiplier for all premises with a rateable value of over

£500,000. We do not yet know how much the new multiplier is.

- The BRC has calculated that shops could be excluded from the

higher multiplier (RV>£500k), with only a slight increase to

the multiplier for all other large properties in this bracket

(e.g. large office blocks).