Fieldwork conducted on 2-5 September

2025

According to BRC-Opinium data, consumer expectations

over the next three months of:

-

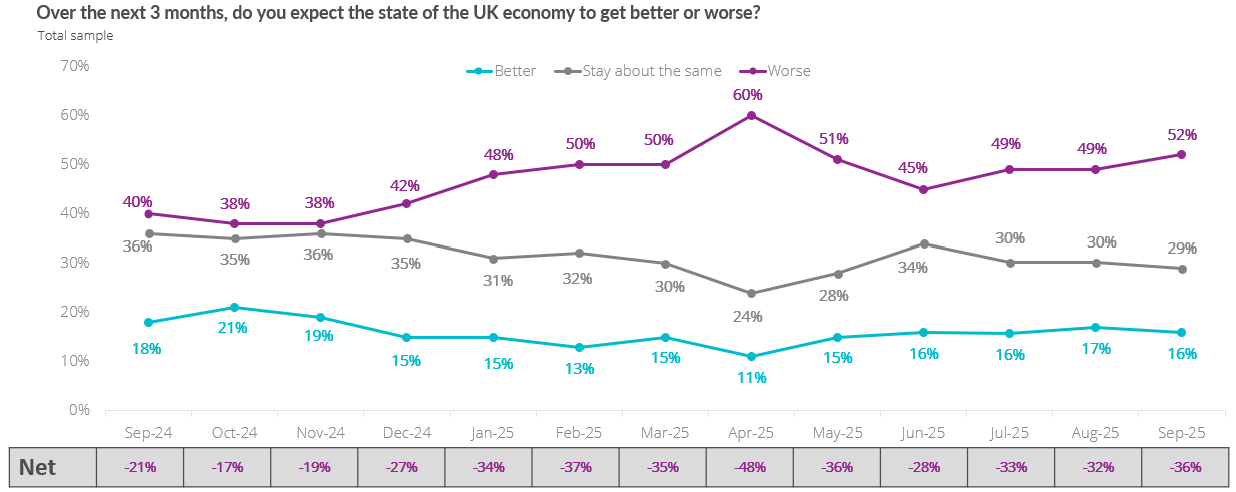

The state of the economy worsened to -36 in

September, down from -32 in August.

-

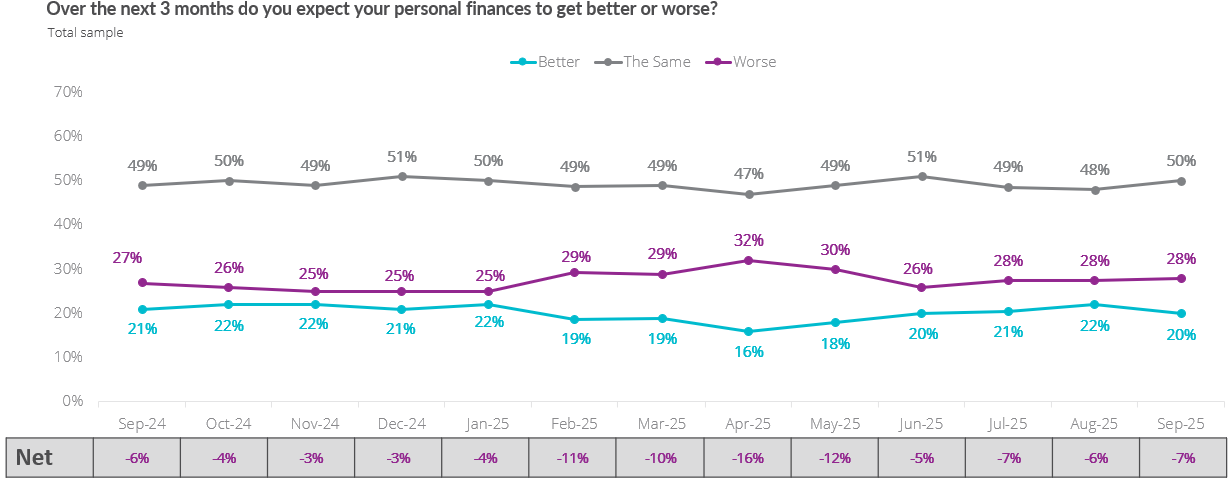

Their personal financial situation slightly

worsened to -7 in September, down from -6 in August.

-

Their personal spending on retail rose

slightly to +5 in September, up from +4 in August.

-

Their personal spending overall fell slightly

to +14 in September, down from +16 in August.

-

Their personal saving fell to 0 in August,

down from +2 in September.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Confidence among Millennials fell dramatically this month, as

their expectations for both the economy and their own finances

fell by double digits. The same generation also cut spending

expectations for the months ahead, though this was largely offset

by improvements for Gen Z, who remain the most optimistic.

Worries about the Budget, combined with the increase in the cost

of living, have eroded confidence, with little sign that

inflation will come down soon.

“Inflation is now one of the biggest concerns among the public,

with food inflation expected to rise to 6% by the end of the

year. All eyes are now firmly locked on the 26 November, and what

the Chancellor will announce. The Government can help mitigate

inflation, improve the cost of living, and raise consumer

confidence, by ensuring the upcoming business rates reforms offer

a meaningful reduction to retail business rates, while ensuring

no shop pays more as a result.”

Consumer expectations for the state of the economy

over the next three months:

Consumer expectations for their personal financial

situation over the next three months:

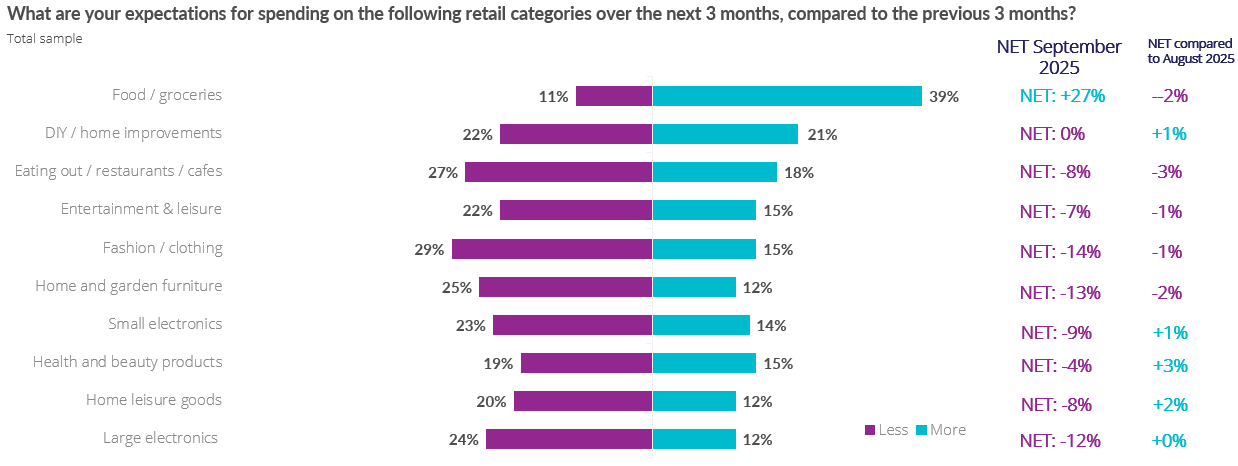

Consumer expectations of spending over the next three

months by category:

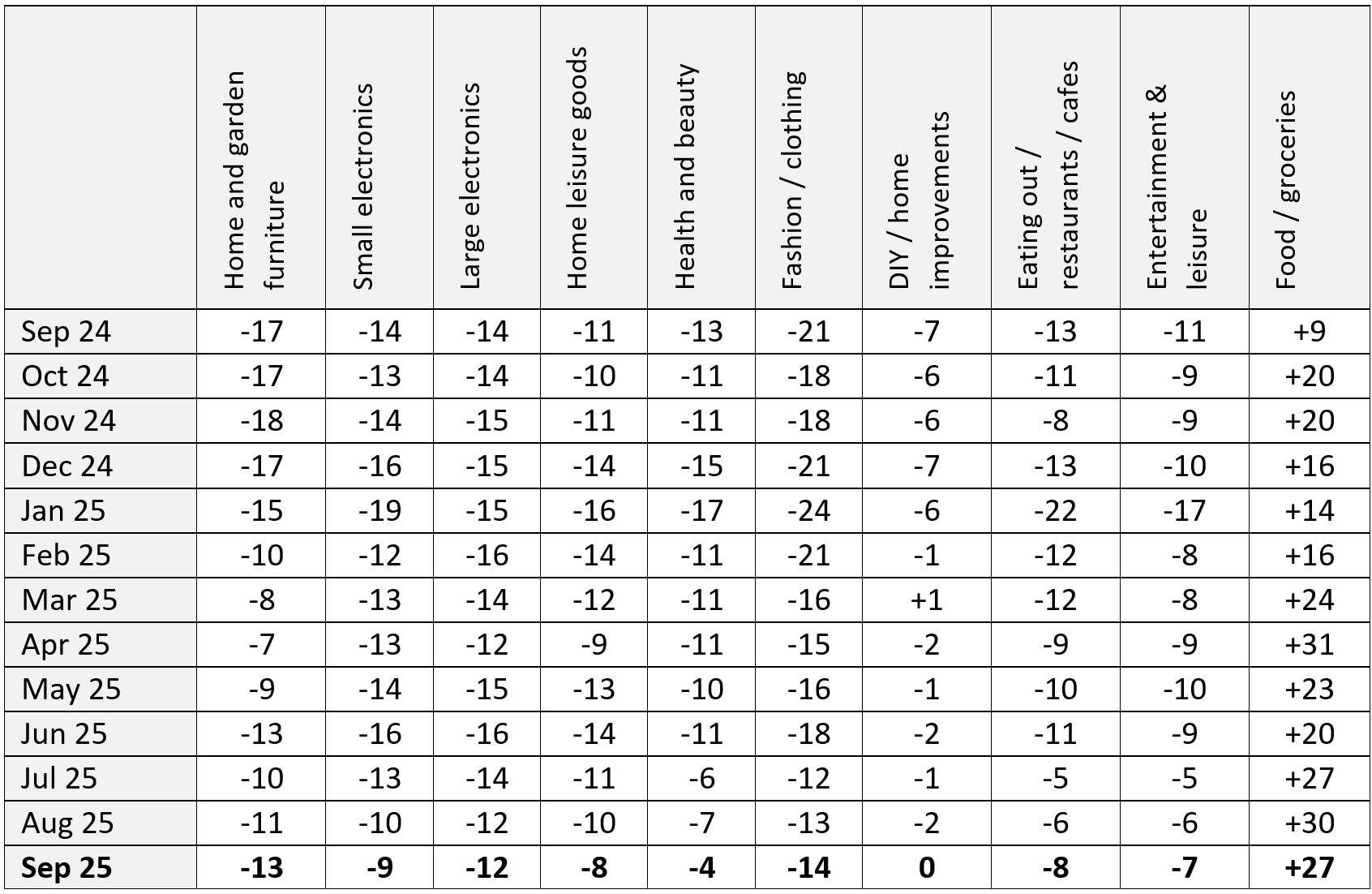

Consumer NET expectations of spending over the next

three months by category:

-ENDS-

Methodology:

Fieldwork conducted by Opinium for the BRC. Sample included 2,000

UK adults and results have been weighted and assigned a net

score. The better/worse figures in the graphs are rounded, while

net scores are calculated from precise figures. Questions were:

- Over the next 3 months, do you expect your personal finances

to get better or worse?

- Over the next 3 months, do you expect the state of the UK

economy to get better or worse?

- What do you plan to do in relation to your spending over the

next 3 months?

- Reflecting on your retail spend across different categories,

overall do you expect to spend more or less on retail items over

the next 3 months?

- What are your expectations for saving over the next 3 months?

- What are your expectations for spending on the following

retail categories over the next three months compared to the

previous 3 months?

If you would like the results of the questions by Gender,

Generation, Location, Working status, or Income, please contact

the Press Office. Generations are defined as: Gen Z (18-27),

Millenial (28-43), Gen X (44-59), and Boomer (60-78).