Covering the four weeks 03 - 30 August

2025

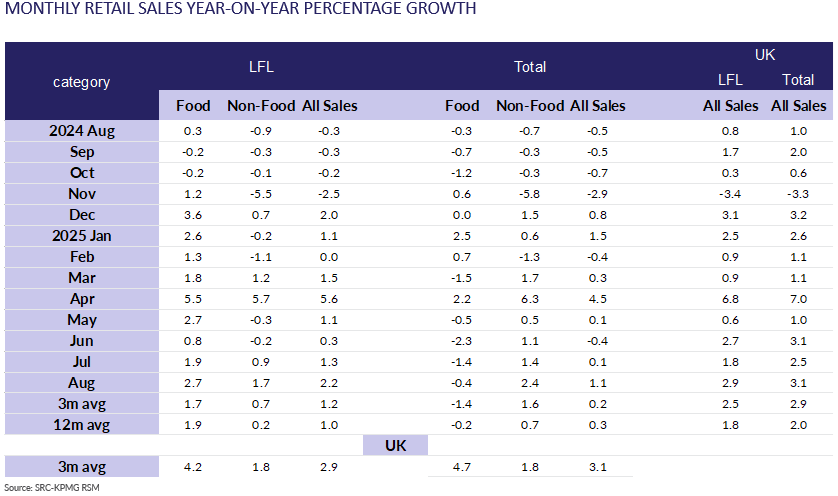

- Total sales in Scotland increased by 1.1% compared with

August 2024, when they had decreased by 0.5%. This was above the

3-month average increase of 0.2% and above the 12-month average

increase of 0.3%. Adjusted for inflation, there was a

year-on-year increase of 0.3%.

- Total Food sales in Scotland decreased by 0.4% compared with

August 2024, when they had decreased by 0.3%. This was above the

3-month average decrease of 1.4% and below the 12-month average

decrease of 0.2%.

- Scottish Sales increased by 2.2% on a like-for-like basis

compared with August 2024, when they had decreased by 0.3%. This

was above the 3-month average increase of 1.2% and above the

12-month average increase of 1%.

- Total Non-Food sales in Scotland increased by 2.4% compared

with August 2024, when they had decreased by 0.7%. This was above

the 3-month average increase of 1.6% and above the 12-month

average increase of 0.7%.

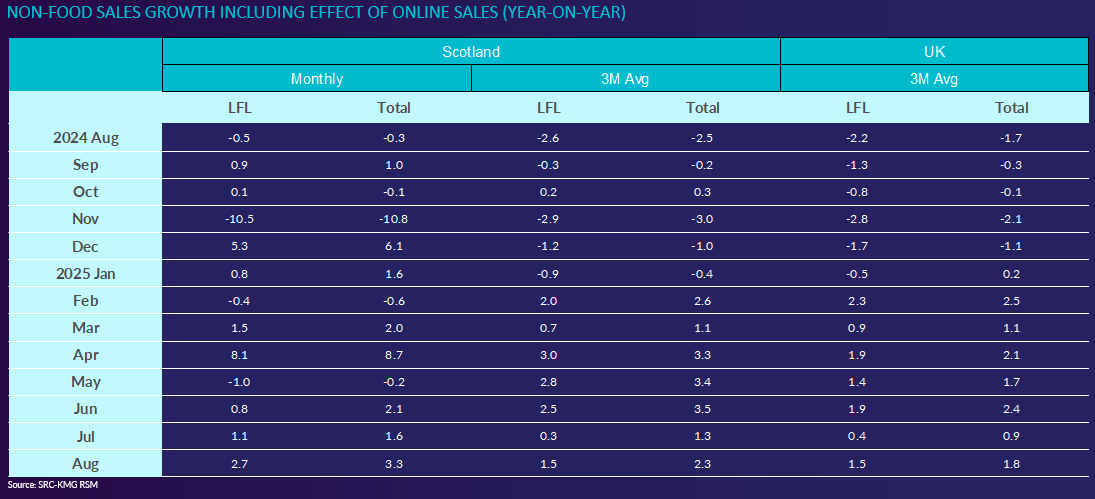

- Adjusted for the effect of online sales, Non-Food sales in

Scotland increased by 3.3% compared with August 2024, when they

had decreased by 0.3%. This was above the 3-month average

increase of 2.3% and above the 12-month average increase of 1.4%.

David Lonsdale, Director, Scottish Retail Consortium,

said:

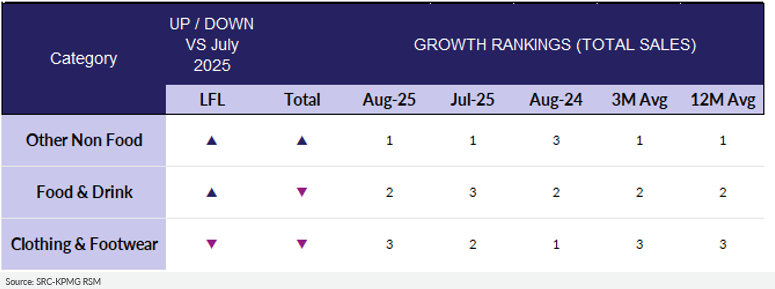

“Scottish retail sales grew during August, a decent performance

after an underwhelming three months. This was the best monthly

growth since April and was driven by sales of non-food products

and underpinned by both a rise in online purchases and an

improvement in shopper footfall.

“With pupils and students returning after the summer break to

schools, colleges, and universities; sales of computing related

items performed well, as did gaming consoles. Furniture fared

well too, in particular beds and bedside cabinets. Health and

beauty categories continued their run of positive growth and DIY

products also saw an uplift. Meanwhile, the total value of sales

of clothing and footwear sales weakened as shoppers opted for

pre-loved items instead of new.

“The modest growth in retail sales is encouraging with the

critical golden quarter of trading coming into view. However,

shopkeepers are being presented with a tricky balancing act as

they contend simultaneously with spiralling government-mandated

cost pressures. Retailers will be looking for some relief on the

latter when the Chancellor and Finance Secretary present their

respective Budgets before the end of the year.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“The high summer temperatures continued throughout August, with

retail sales also on the rise.

Non-food goods grew around 2%, with moderate growth in the

housing market helping to continue the upturn in home related

purchases.

“Sales of many home goods have been seeing monthly increases

since the spike in property transactions ahead of the Stamp Duty

changes in April. Home appliances, accessories, and DIY and

garden goods all saw sales growth in August. New product

launches also boosted mobile phone sales, with computing related

purchases rising ahead of the new school year.

“Retailers will be reflecting upon their summer performance and

what has and hasn't sold well, as they plan their stock levels

for the final ‘golden' quarter of the year that includes Black

Friday and Christmas.”