SRC-KPMG SCOTTISH RETAIL SALES MONITOR

– JULY 2025

Covering the four weeks 06 July - 02 August

2025

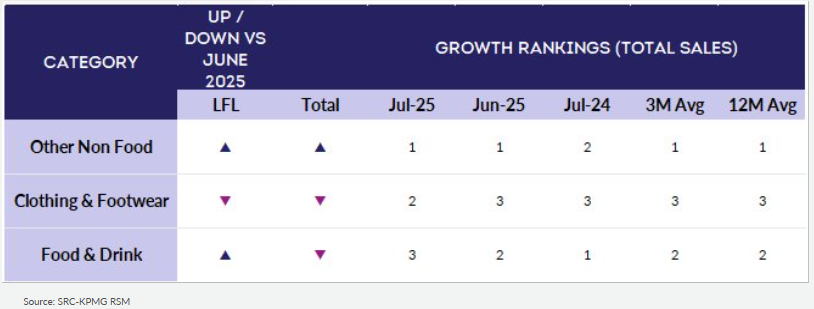

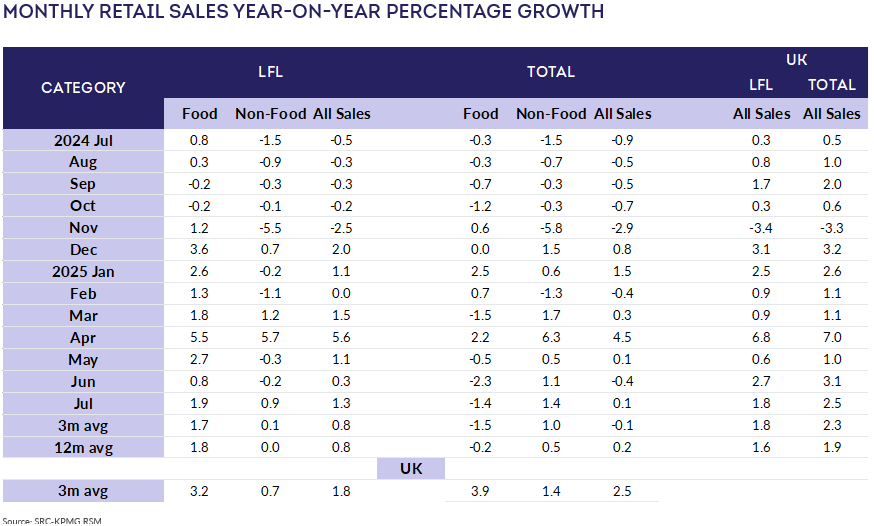

- Total sales in Scotland increased by 0.1% compared with July

2024, when they had decreased by 0.9%. This was above the 3-month

average decrease of 0.1% and below the 12-month average increase

of 0.2%. Adjusted for inflation, there was a year-on-year

decrease of 0.5%.

- Total Food sales in Scotland decreased by 1.4% compared with

July 2024, when they had decreased by 0.3%. This was above the

3-month average decrease of 1.5% and below the 12-month average

decrease of 0.2%.

- Scottish Sales increased by 1.3% on a like-for-like basis

compared with July 2024, when they had decreased by 0.5%. This

was above the 3-month average increase of 0.8% and above the

12-month average increase of 0.8%.

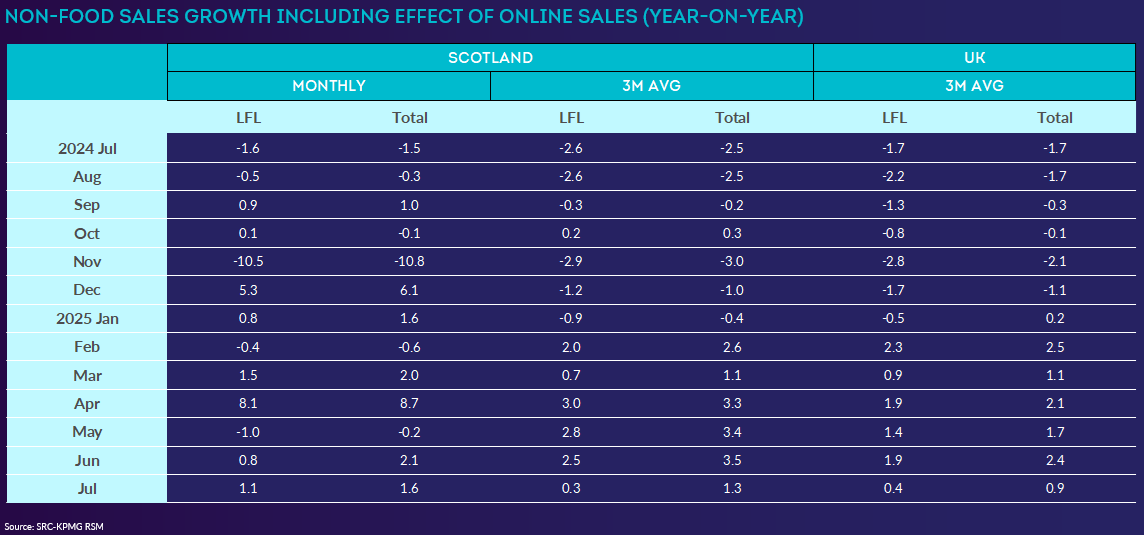

- Total Non-Food sales in Scotland increased by 1.4% compared

with July 2024, when they had decreased by 1.5%. This was above

the 3-month average increase of 1% and above the 12-month average

increase of 0.5%.

- Adjusted for the effect of online sales, Non-Food sales in

Scotland increased by 1.6% compared with July 2024, when they had

decreased by 1.5%. This was above the 3-month average increase of

1.3% and above the 12-month average increase of 1.1%.

Ewan MacDonald-Russell, Deputy Head of the Scottish

Retail Consortium, said:

"July was a lacklustre month for Scottish retailers as sales

again disappointed. When adjusted for inflation retail sales in

Scotland fell by 0.5 percent. That's a slight improvement on

June's figures, but demonstrates shoppers continue to cut back on

shopping as economic uncertainty continues to rise.

"Within the general disappointment there were some bright spots.

Food sales shone in the opening half of the month as Scots took

advantage of the warm weather to cook barbeque and summer meals.

Phone sales did well, as did some toys and furniture ranges.

Against that televisions continue to disappoint, with few

households investing in high-end entertainment despite the summer

plethora of sporting events. Fashion ranges performed poorly,

albeit the likelihood is shoppers did their summer wardrobe

shopping earlier in the year when the sunshine emerged.

"The harsh truth is Scots are holding back spending as worries

about the economy grow. That is leaving shops in the lurch -

facing higher costs as a consequence of last year's UK Government

Budget without the growth needed to pay those bills. With little

sight the economic weather will brighten many retailers,

especially those on the high street, face increasingly

unpalatable choices in the coming months."

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“The UK's fifth warmest July on Met Office record brought a boost

to home appliance and food and drink sales. But rising inflation

was also a driver of the latter and monthly non-food sales are

only growing at around 1% on average at present. With employment

costs having risen and inflation both a business and consumer

side pressure, it remains a challenging trading environment for

many retailers.

“While the majority of consumers that KPMG surveys are confident

in their ability to balance their monthly household budgets, big

ticket purchases are more considered in the context of rising

essential costs and ongoing caution about the economy and labour

market. Holidays are the priority for many this summer but those

heading away have had to account for a higher cost of travel.

Consequently, spending in some areas of the retail sector remains

subdued and competition for consumer spend will remain fierce.”