-

Two-thirds of CFOs expect further price rises

-

Majority are pessimistic about trading

conditions

-

Almost nine in ten cited tax and regulatory burden as a

top concern

New polling from the British Retail Consortium (BRC) shows

significant concern among retail finance chiefs, who say

government policy is driving up inflation and job losses. A

survey of CFOs (Chief Financial Officers) and Finance Directors

at retailers together representing over 9,000 stores comes as the

Chancellor is preparing for the next Budget.

Given concerns about potential tax rises on the horizon, 56% of

CFOs described their feelings about trading conditions over the

next 12 months as “pessimistic”, with only 11% suggesting they

were optimistic (33% were neither optimistic nor pessimistic).

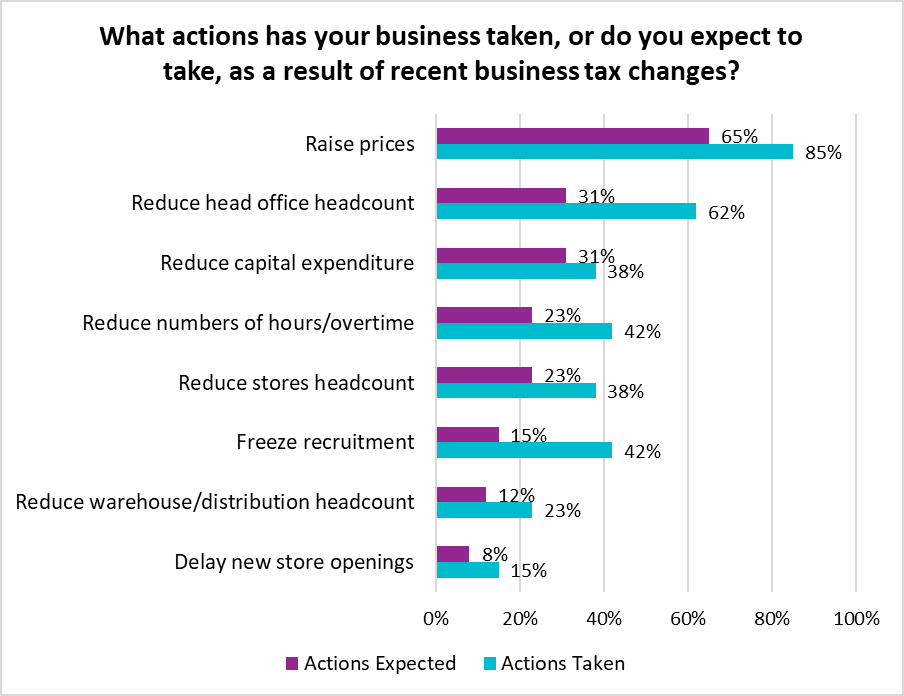

When asked about the consequences of the last Budget, which saw

huge increases to employer National Insurance and National Living

Wage, 85% of CFOs said their businesses had been forced to raise

prices, with two-thirds (65%) predicting further rises in the

coming year. Given inflation has been rising steadily over recent

months, with food inflation now at 4.0% (BRC-NielsenIQ Shop Price

Monitor), the BRC now predicts food inflation will be up to 6% by

the end of the year. This will pose significant challenges to

household budgets, particularly in the run up to Christmas.

Jobs were also at risk: 42% of CFOs said they had frozen

recruitment, while 38% said they had reduced job numbers

in-store. This was reflected in the official job figures, with

almost 100,000 fewer retail jobs in the first quarter of 2025

compared to the previous year. Investment in local communities

has also suffered. 38% of CFOs suggested they had reduced

investment, while one in six (15%) had already delayed opening

new stores.

The biggest financial fear – those appearing in almost 9 out of

10 CFOs “top 3 concerns for their business” (88%) – was the “Tax

and regulatory burden” which included worries around National

Insurance, Business Rates, National Living Wage and the new

packaging tax (EPR). This was up over 20 percentage points from

January, when 62% of CFOs had it in their top 3 concerns.

As the largest private sector employer, offering huge numbers of

part-time and entry-level roles, the changes to the NI threshold

and National Living Wage have had a disproportionate impact on

both retailers and their supply chains, who together employ 5.7m

people across the country.

The Government has pledged to reform the broken business rate

system, reducing rates for some retail, hospitality and leisure

(RHL) outlets, by creating a new higher threshold for large

non-domestic properties, including 4,000 retail stores. These

large stores account for hundreds of thousands of retail jobs,

and play a vital role in attracting footfall to high streets and

other shopping destinations, benefitting smaller businesses

around them.

Helen Dickinson, Chief Executive at the BRC,

said:

“Retail was squarely in the firing line of the last Budget, with

the industry hit by £7 billion in new costs and taxes. Retailers

have done everything they can to shield their customers from

higher costs, but given their slim margins and the rising cost of

employing staff, price rises were inevitable. The consequences

are now being felt by households as many struggle to cope with

the rising cost of their weekly shop. It is up to the Chancellor

to decide whether to fan the flames of inflation, or to support

the everyday economy by backing the high street and the local

jobs they provide.

“Retail accounts for 5% of the economy yet currently pays 7.4% of

business taxes and a whopping 21% of all business rates. It is

vital the upcoming reforms offer a meaningful reduction in

retailers' rates bill, and ensures no store pays more as a result

of the changes. If instead, the Chancellor chooses to add further

costs to retailers and high streets, it will be the British

public who suffer from the knock-on impact on inflation.”

-ENDS-

CFO Survey:

CFO Survey took place between 19th June - 11th July and was

completed by CFOs and Finance Directors of BRC retail members,

whose businesses collectively employ over 300,000 people and

operate over 9,000 stores across the UK. The retail industry

directly accounts for 9% of employment in the UK, making it one

of the most important private sector employers in the country.