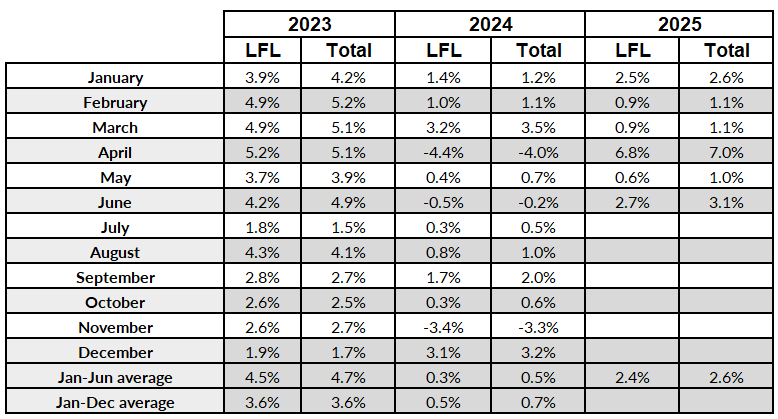

Covering the five weeks 01 June - 05 July 2025

-

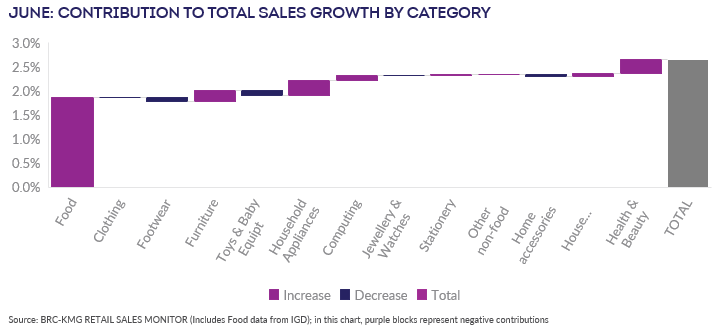

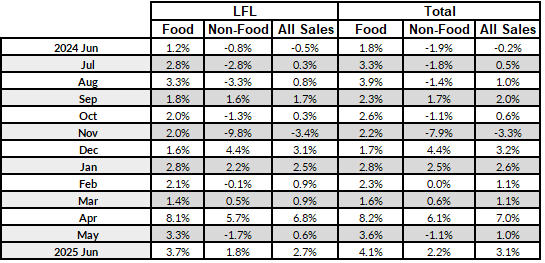

UK Total retail sales increased by 3.1% year

on year in June, against a decline of 0.2% in June 2024.

-

Food sales increased by 4.1% year on year in

June, against a growth of 1.8% in June 2024.

-

Non-Food sales increased by 2.2% year on year

in June, against a decline of 1.9% in June 2024.

-

In-Store Non-Food sales increased by 2.2% year

on year in June, against a decline of 2.6% in June 2024.

-

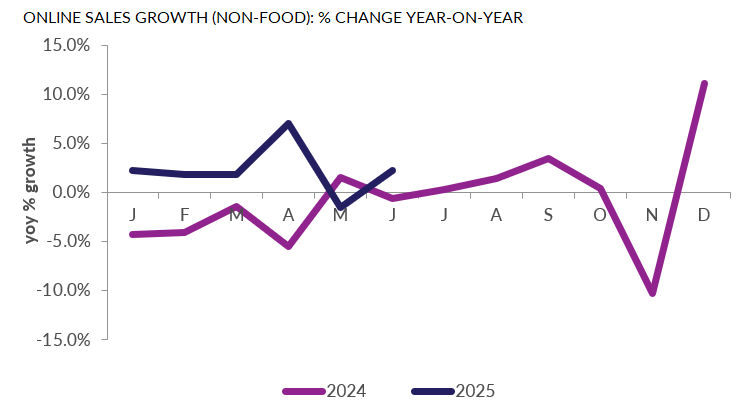

Online Non-Food sales increased by 2.3% year

on year in June, against a decline of 0.7% in June 2024.

-

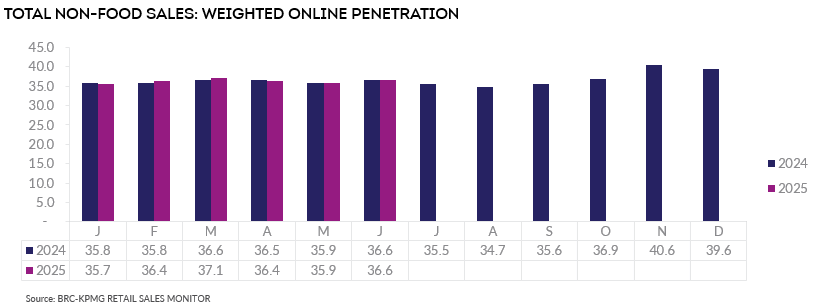

The online penetration rate (the proportion of

Non-Food items bought online) of 36.6% in June was unchanged

compared to June 2024. This was below the 12-month average of

36.8%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Retail sales heated up in June, with both food and non-food

performing well. The soaring temperatures increased sales of

electric fans while sports and leisure equipment was boosted by

both the weather and the start of Wimbledon. Food sales remained

strong, though this was in-part driven by food inflation, which

has risen steadily over the course of the year.

“The outlook is not all bright and sunny: retailers are watching

Government closely for details of the upcoming business rates

reform. If the Government includes shops within its new higher

rates threshold, then many retailers will be forced to rethink

their investment plans. The closure of larger stores would harm

the local communities they support, costing jobs and reducing

footfall in the area they serve. If Government wants to improve

high streets and help local communities, they must ensure that no

shop pays more under their new rates reforms.“

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

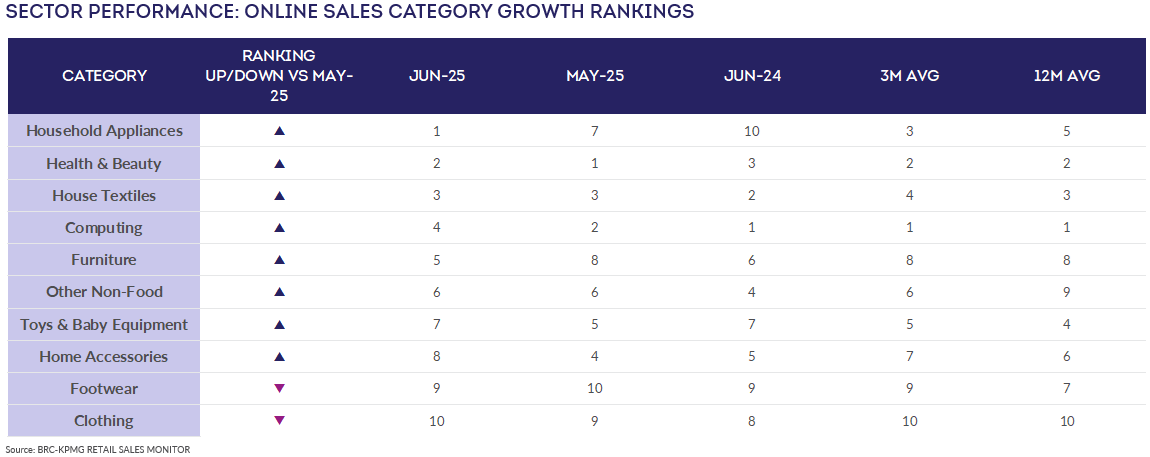

“Home appliances and homeware purchases helped retail sales to

grow in June, as new homebuyers and those having a refresh in

their current home took advantage of summer promotions both

in-store and online.

"Warm weather and the start of the holiday season led to modest

monthly growth for clothing sales. But retailers will be

hoping that the buying is not yet complete and that the pace

picks up further in July and August as suitcases get packed and

the sun hopefully keeps shining"

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“Shopper confidence fell back this month but stayed marginally

above zero, landing at just 1. Escalating global tension and

economic pressures left shoppers feeling uncertain in the year

ahead. Notably, the number of shoppers expecting food prices to

get much more expensive rose from 14% to 20%, reflecting renewed

inflation concerns. Value sales growth continues to be

predominately driven by inflation with volumes under sustained

pressure. However, the arrival of new summer ranges and improved

weather presents retailers with opportunities to tap into more

consumer occasions, particularly amongst higher income shoppers

who remain focused on quality.”

Source: BRC-KPMG RETAIL SALES MONITOR (Includes

Food data from IGD)