Fieldwork conducted on 3-6 June

2025

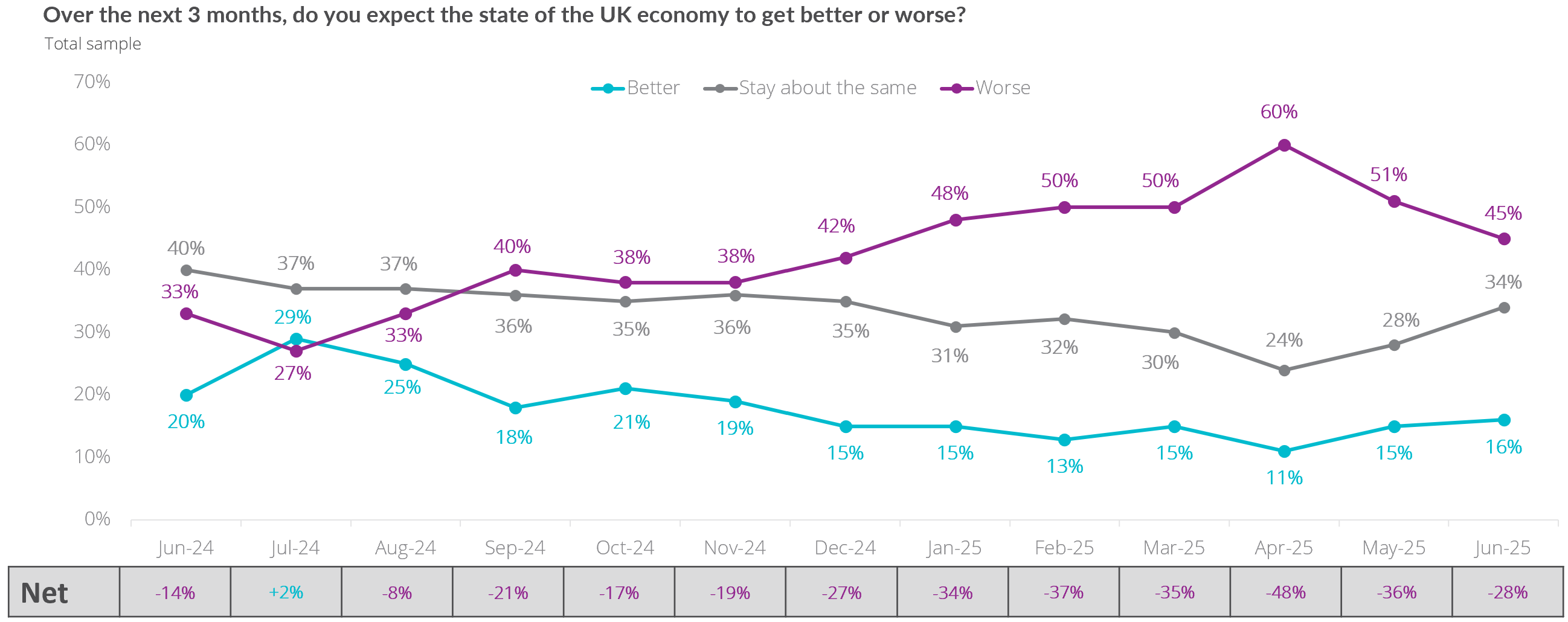

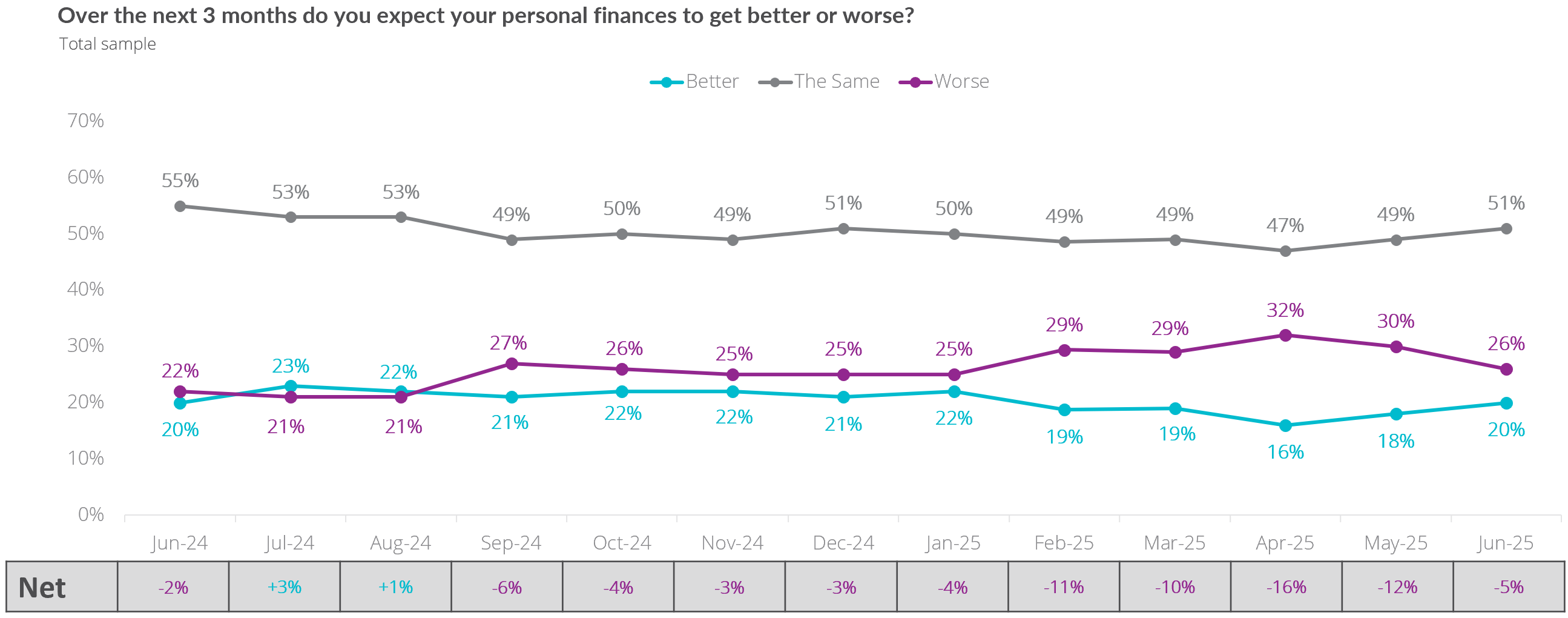

According to BRC-Opinium data, consumer expectations

over the next three months of:

-

The state of the economy improved to -28 in

June, up from -36 in May.

-

Their personal financial situation improved to

-5 in June, up from -12 in May.

-

Their personal spending on retail rose to +2

in June, up from 0 in May.

-

Their personal spending overall rose to +12 in

June, up from +10 in May.

-

Their personal saving rose slightly to -4 in

June, up from -5 in May.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Consumer confidence improved for the second month in a row,

reaching its highest level since Christmas, albeit still firmly

in negative territory. Gen Z saw the biggest improvement, in both

economic outlook and their expectations of their future finances,

with younger generations remaining the most optimistic about the

future. This rising optimism may also reflect the increase in

minimum wage from April, with many younger people expected to

have seen a significant uplift in their pay packet. Expectations

of future spending – both in retail and more generally – rose

slightly, with more spending on groceries planned over the coming

months.

“The Chancellor's Spending Review laid out some big spending

commitments, with the BRC welcoming its promises on skills,

police and transport spending. However, with retail already

paying a disproportionate tax burden compared to other

industries, it is vital the Government does not balance the books

on the backs of retailers and their customers. While we welcome

reforms to the broken business rates system, it is vital that no

shop ends up paying more as a result. With retail accounting for

5% of the economy and paying 21% of the total business rates

bill, levelling the playing field would unlock investment and

jobs in high streets and town centres all over the country,

supporting the UK's economic growth.”

Consumer expectations for the state of the economy

over the next three months:

Consumer expectations for their personal financial

situation over the next three months:

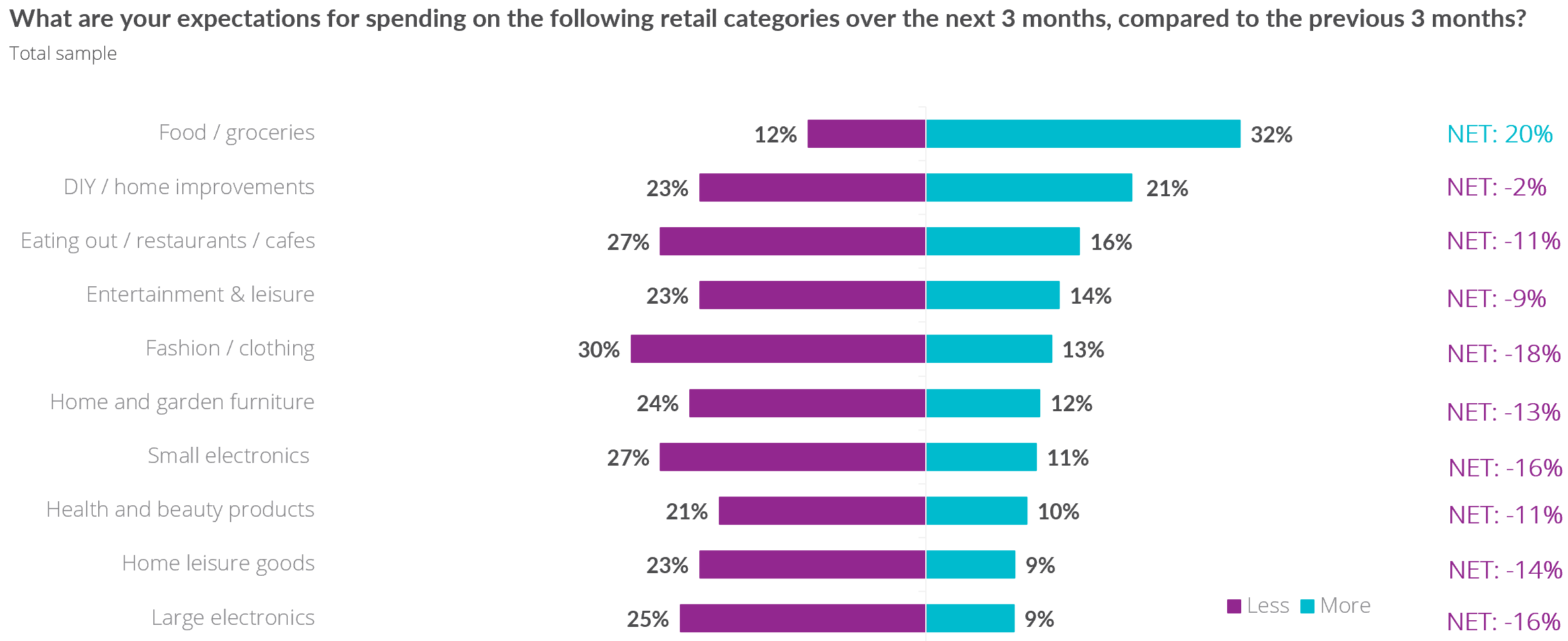

Consumer expectations of spending over the next three

months by category:

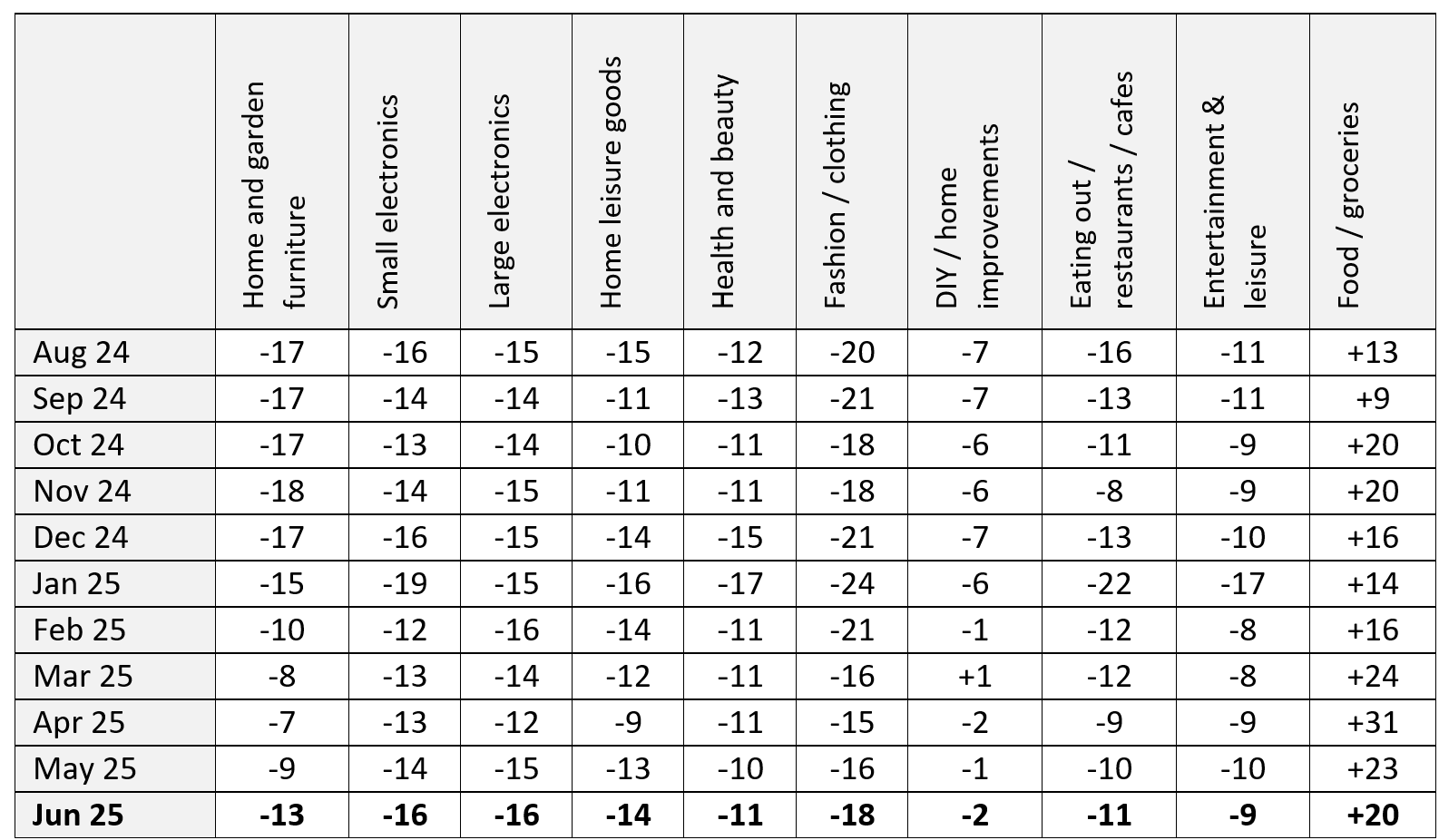

Consumer NET expectations of spending over the next

three months by category:

-ENDS-

All monitor dates for next year can be found here

Methodology:

Fieldwork conducted by Opinium for the BRC. Sample included 2,000

UK adults and results have been weighted and assigned a net

score. The better/worse figures in the graphs are rounded, while

net scores are calculated from precise figures. Questions were:

- Over the next 3 months, do you expect your personal finances

to get better or worse?

- Over the next 3 months, do you expect the state of the UK

economy to get better or worse?

- What do you plan to do in relation to your spending over the

next 3 months?

- Reflecting on your retail spend across different categories,

overall do you expect to spend more or less on retail items over

the next 3 months?

- What are your expectations for saving over the next 3 months?

- What are your expectations for spending on the following

retail categories over the next three months compared to the

previous 3 months?