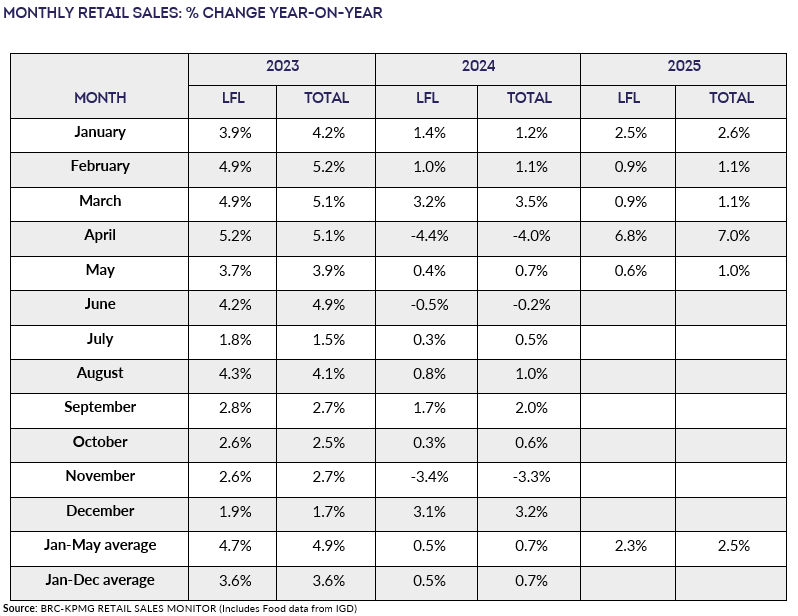

Covering the four weeks 04 May - 31 May 2025

-

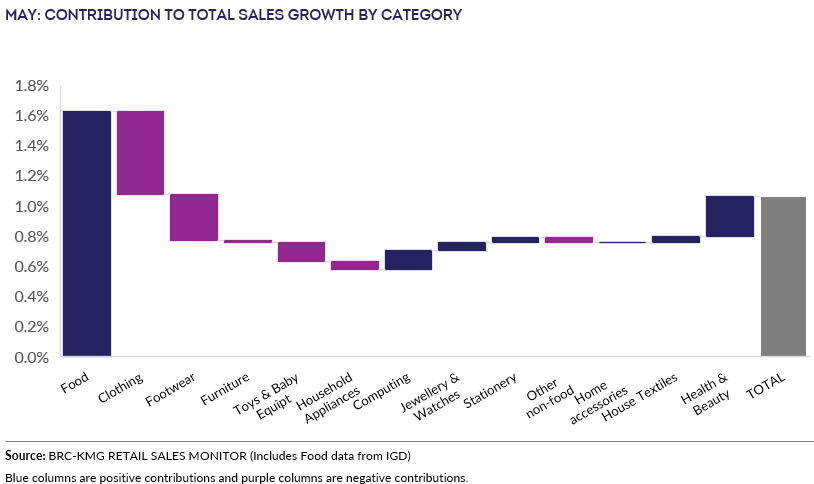

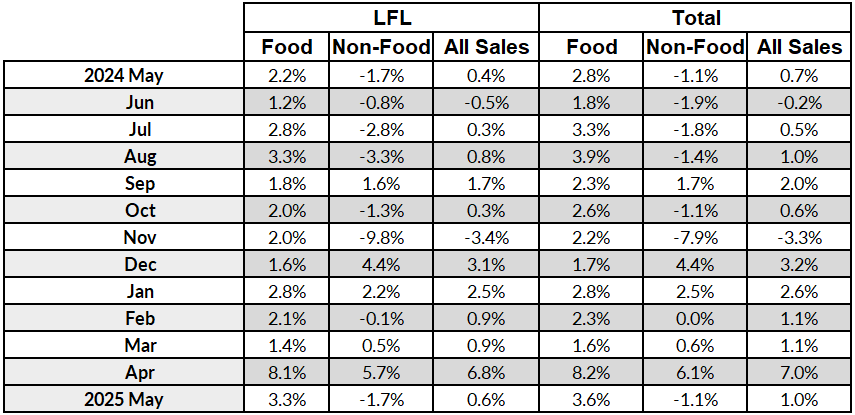

UK Total retail sales increased by 1% year on

year in May, against growth of 0.7% in May 2024.

-

Food sales increased by 3.6% year on year in

May, against growth of 2.8% in May 2024.

-

Non-Food sales decreased by 1.1% year on year

in May, flat against a decline of 1.1% in May 2024.

-

In-Store Non-Food sales decreased by 0.9% year

on year in May, against a decline of 2.6% in May 2024.

-

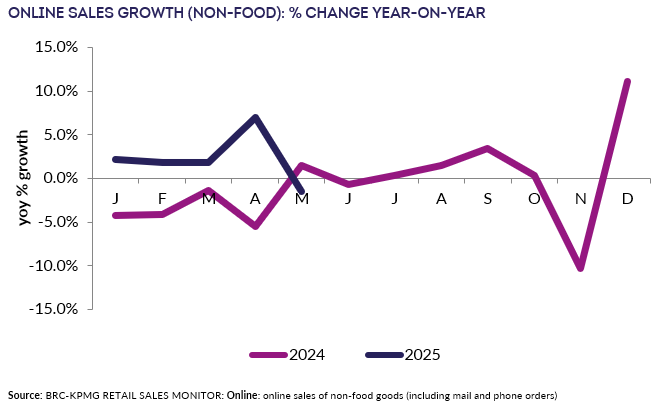

Online Non-Food sales decreased by 1.5% year

on year in May, against growth of 1.5% in May 2024.

-

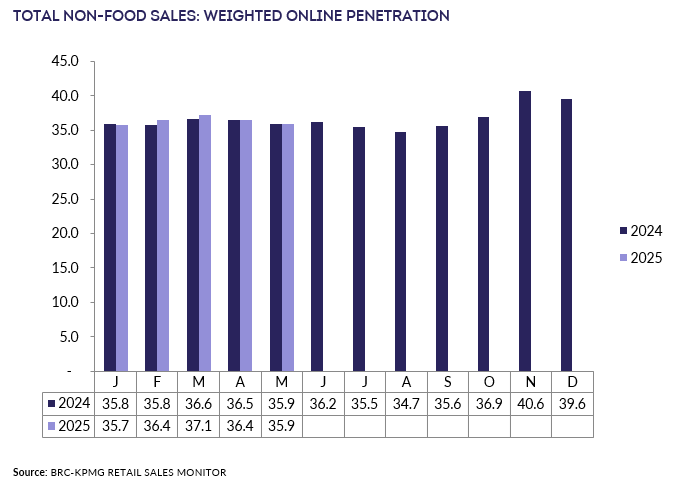

The online penetration rate (the proportion of

Non-Food items bought online) remained flat at 35.9% in May,

matching 35.9% in May 2024.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Consumers put the brakes on spending, with the slowest growth in

2025 so far. This was due largely to declines in Non-food sales,

as fashion and full price big-ticket items were held back by

lower consumer confidence. Gaming bucked the trend, thanks to

some popular new releases. Food sales remained solid as the month

saw the conclusion of football tournaments and two bank holidays,

prompting spending on BBQs and picnics.

“Retailers are grappling with the £5bn in extra costs from higher

National Insurance contributions and wages, which kicked in

during April. They also face an additional £2bn later this year

from new packaging taxes and remain concerned about the

consequences of the Employment Rights Bill. Ensuring the new Bill

supports workers' rights without undermining retailers' ability

to continue to provide jobs and investment in people will

determine whether Government achieves economic growth across the

country or not.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“While the sunshine continued, the pace of retail sales growth

didn't in May. Early seasonal purchases were likely a

factor, as was a dampening of some spending appetite as

households reflected upon the recent combination of essential

bill rises. But May still saw slight growth, driven mainly

by food and drink, with non-food purchases falling overall.

“Travel demand for the summer months ahead looks healthy, so

retailers will be hoping June sees an upturn in related spending

as people begin to think about what they want to pack in their

suitcase.”

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“After the sunniest spring on record and a string of bank

holidays, our Shopper Confidence Index rose by five points in

May, helped by the prospect of lower energy bills and renewed

momentum in UK trade agreements with the US and EU. This uplift

marks a welcome shift from ‘Awful April', but beneath the

surface, confidence remains fragile. Our research shows that

shoppers are still navigating financial uncertainty and continue

to rely on money-saving tactics like planning ahead and buying on

promotion. While the mood has brightened, we've yet to see this

translate into meaningful changes in behaviour. With the external

environment still volatile, shoppers remain cautiously

optimistic, but not necessarily ready to spend freely.”

Source: BRC-KPMG RETAIL SALES MONITOR (Includes

Food data from IGD)