This year Easter was in April, while last year it was

in March. This calendar change distorts the year-on-year sales

comparisons - resulting in an artificially higher April, but

lower March sales growth. In addition to April results, we also

report the combined results for March and April to negate this

distortion, presenting a clearer view of the underlying sales

trend.

Covering the four weeks 06 April – 03 May

2025

-

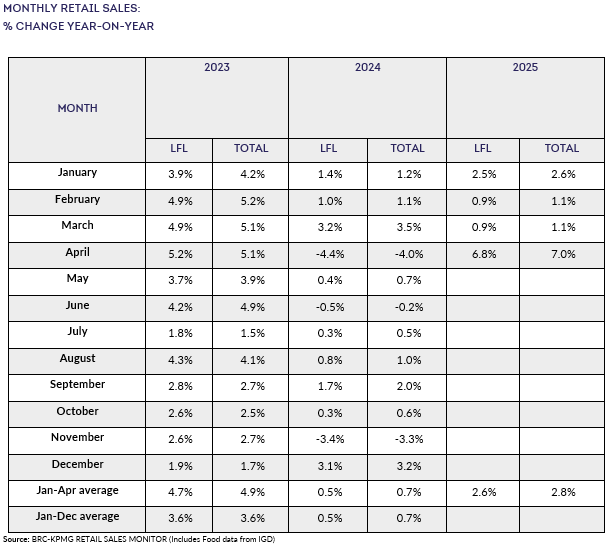

UK Total retail sales increased by 7% year on

year in April, against a decline of 4% in April 2024. This was

above the 3-month average growth of 2.9% and above the 12-month

average growth of 1.4%.

-

For March and April together, compared

with the same two months in 2024 (to mitigate the

year-on-year timing of Easter) UK Total retail

sales increased by 4.3% year on year for the

two-month period.

-

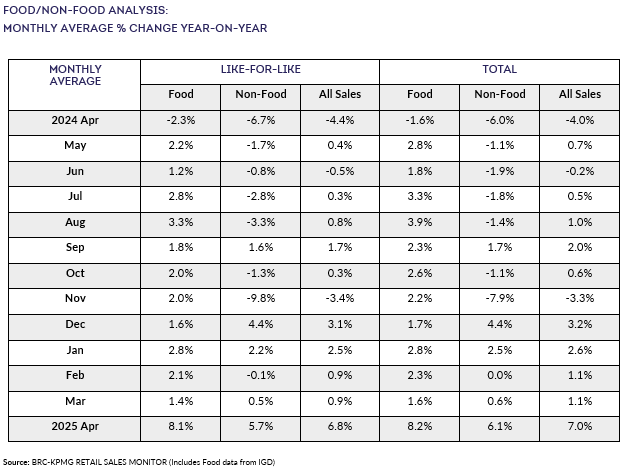

Food sales increased by 8.2% year on year in

April, against a decline of 1.6% in April 2024. This was above

the 3-month average growth of 3.9% and above the 12-month

average growth of 2.9%.

-

Non-Food sales increased by 6.1% year on year

in April, against a decline of 6% in April 2024. This was above

the 3-month average growth of 2.1% and above the 12-month

average growth of 0.1%.

-

In-Store Non-Food sales increased by 5.6% year

on year in April, against a decline of 6.2% in April 2024. This

was above the 3-month average growth of 1.3% and above the

12-month average decline of 0.8%.

-

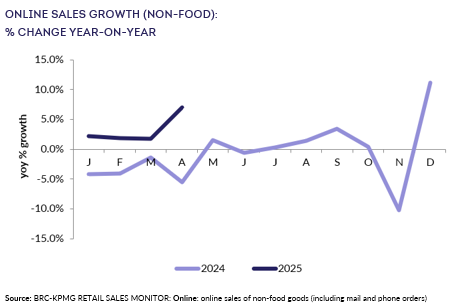

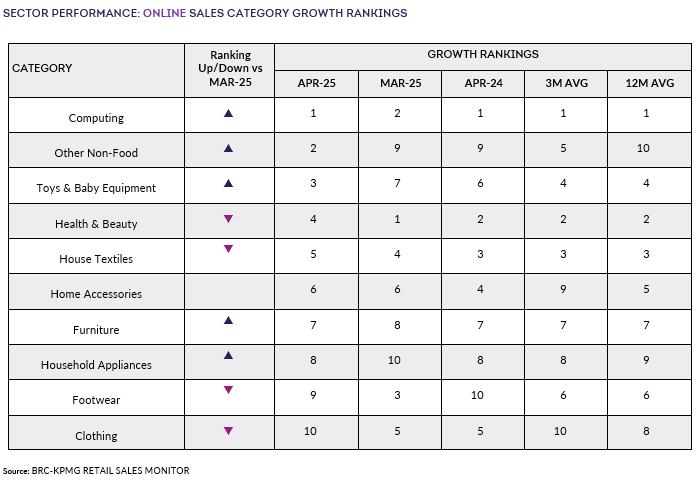

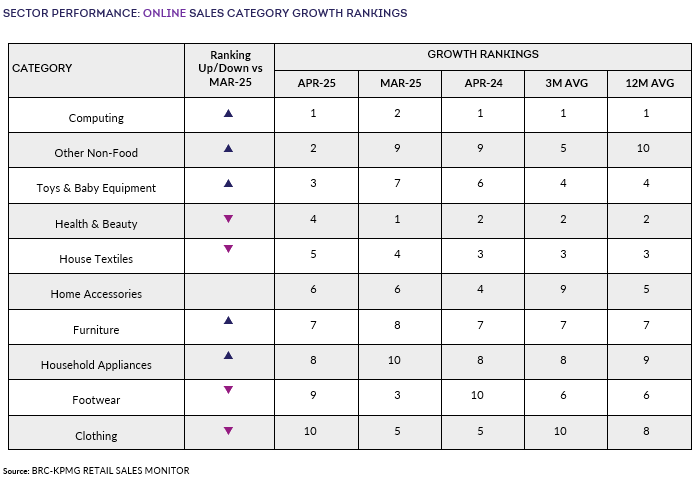

Online Non-Food sales increased by 7% year on

year in April, against a decline of 5.5% in April 2024. This

was above the 3-month average growth of 3.4% and above the

12-month average growth of 1.8%.

-

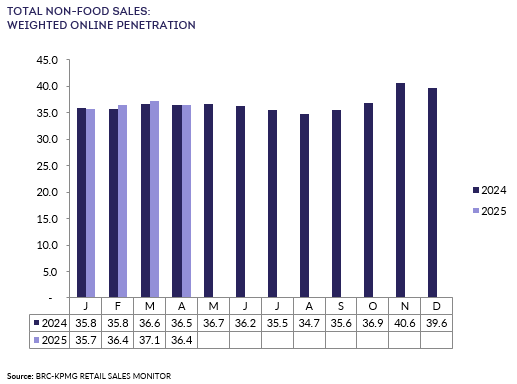

The online penetration rate (the proportion of

Non-Food items bought online) decreased to 36.4% in April from

36.5% in April 2024. This was below the 12-month average of

36.8%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

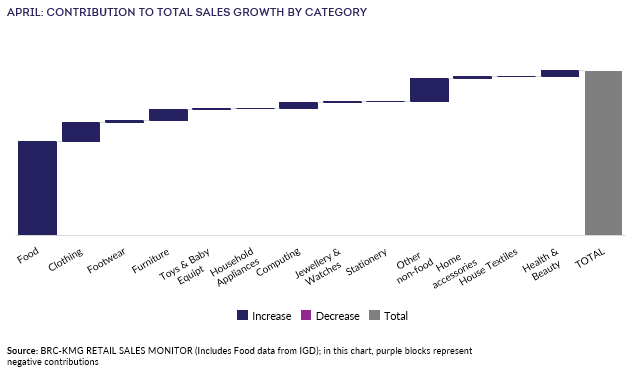

“The sunniest April on record brought with it a boost to retail

sales. While the stronger performance was partially a result of

Easter falling in April this year, the sunshine prompted strong

consumer spending across the board. Food sales performed well as

people brought together their family and friends for Easter

celebrations, while sales of DIY, homeware and gardening goods

shone bright as people made the most of the weather. Clothing

sales, where growth has been sluggish in recent months, also

improved as consumers refreshed their wardrobes for the new

season.

“But clouds loom on the horizon as new costs begin to bite. Even

a strong April performance will do little to make up for the

extra £7bn facing the industry this year. Both Employer National

Insurance Contributions and the National Living Wage rose last

month, and retailers face another £2bn bill when a new packaging

tax comes in later this year. If the Government wants to secure

the future of our high streets, then it must ensure that no shop

pays more as a result of the upcoming business rates reforms, or

it will be our local communities that pay the price.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“Retail sales have been showing growth for five months now.

The pace of that growth picked up in April due to Easter

and the drier weather boosting clothing and garden related sales,

while the uptick in house buying ahead of the Stamp Duty changes

likely filtered through to furniture and DIY related sales, as

well as other homewares.

"Consumers tell us they are still taking steps to manage their

household budgets, so retailers will need to focus on how they

can continue to unlock spending over the coming months to keep

the growth going - including capitalising on purchases related to

strong summer holiday demand."

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“April saw a welcome boost for the market and shoppers, thanks to

sporadic spells of warmer weather, interest rate cuts and the

long Easter weekend, which lifted overall confidence by a point.

However, the persistent challenge of food price inflation, which

climbed to 2.6% in April from 2.4% in March, continues to weigh

heavily on both businesses and households. As they grapple with

rising costs, we foresee limited further gains in shopper

confidence."