The UK's used car market started the year on a high with

2,020,990 vehicles changing hands in Q1 – the first time sales

have breached two million in the first quarter since before the

pandemic – according to the latest figures published today by the

Society of Motor Manufacturers and Traders (SMMT).1

Sales grew by 2.7% on the same period last year, capping off nine

consecutive quarters of growth as the market responded to greater

supply from the new car sector.

Petrol remained the best-selling fuel type, rising 2.1% to

1,149,855 units, while diesel experienced a -3.1% decline to

679,739 units. As a result, ICE cars made up 90.5% of all used

transactions in the quarter. However, their combined market share

fell 2.4 percentage points on Q1 2024 as more buyers opted for

electrified options.2

Hybrids attracted record numbers of second and third owners, up

30.2% to 98,830 units, while 23,540 plug-in hybrids changed

hands, up 14.0% on the same period last year. Battery electric

cars recorded the highest growth, increasing by 58.5% to 65,850

units and a record 3.3% share of all transactions.

This positive performance saw the greenest powertrain continue

its streak as the fastest growing, a trend which must continue to

deliver the UK's net zero goals. Long term success, however,

relies heavily on healthy demand for new electric cars, making

government incentives paramount. Halving VAT on new EVs and

scrapping or amending their liability to the VED Expensive Car

Supplement, alongside equalising VAT paid on public charging to

domestic rates, would all help increase uptake of new cars and,

in turn, promote a vibrant used market.

Smaller cars remained the mainstay of demand, with superminis

again the best-selling segment, accounting for almost a third

(32.4%) of all used car transactions, followed by small family

(lower medium) cars (27.0%). Dual purpose models also proved

popular, accounting for 16.8% of sales. Combined, these segments

represented three-quarters (76.2%) of all transactions in the

period. Specialist sports, executive, upper medium and MPV

were the only segments to record declines in Q1, down -6.1%,

-3.5%, -1.6% and -0.4% respectively.

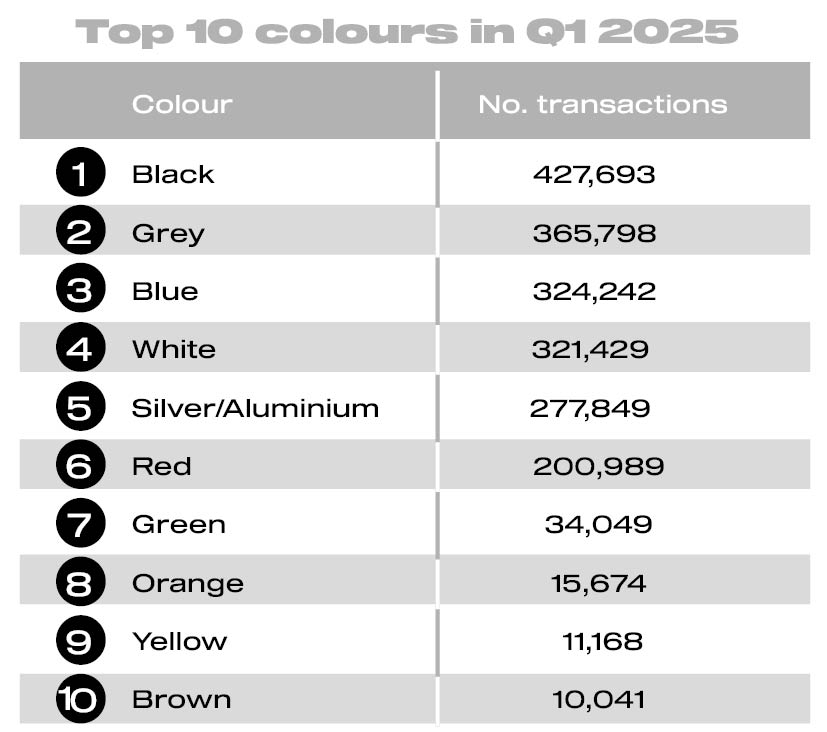

Black was the most popular colour for the 29th quarter,

accounting for a fifth (21.2%) of cars sold, while grey and blue

held second and third place, up 6.3% and 1.2%, respectively.

Previous best-seller silver, along with orange and gold, were the

only colours within the top 20 to record declines, falling by

-3.1%, -4.9% and -5.1% respectively.

Mike Hawes, SMMT Chief Executive,

said, “The used car market has enjoyed its

strongest start to a year since before the pandemic, with supply

fuelled by a recovering new car market. Critically, more

second-hand buyers are opting for electric vehicles, with greater

choice and affordability enabling more people and businesses to

switch. Sustaining and expanding this growth, however, depends on

a healthy supply of EVs from the new car market – which in turn

requires fiscal incentives alongside a nationally accessible and

affordable charge point network so that everyone, whatever their

budget or driving needs, can benefit from zero emission

motoring.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to editors:

All used car data published by SMMT is correct based

on information available at the time of publication. SMMT

used car data is derived from information supplied by

DVLA, which periodically revises historic data, which can

therefore result in variations in data previously

reported.

1. Used car transactions, Q1 2019: 2,040,144 units

2. Used car diesel and petrol transactions, Q1 2024:

1,828,082 units = 92.9% market share

|