BRC-KPMG RETAIL SALES MONITOR – March 2025

This year, Easter is in April, while last year it was in

March. This calendar change distorts the year on year sales

comparisons - resulting in an artificially higher April, but

lower March sales.

Covering the five weeks 02 March – 05 April

2025

-

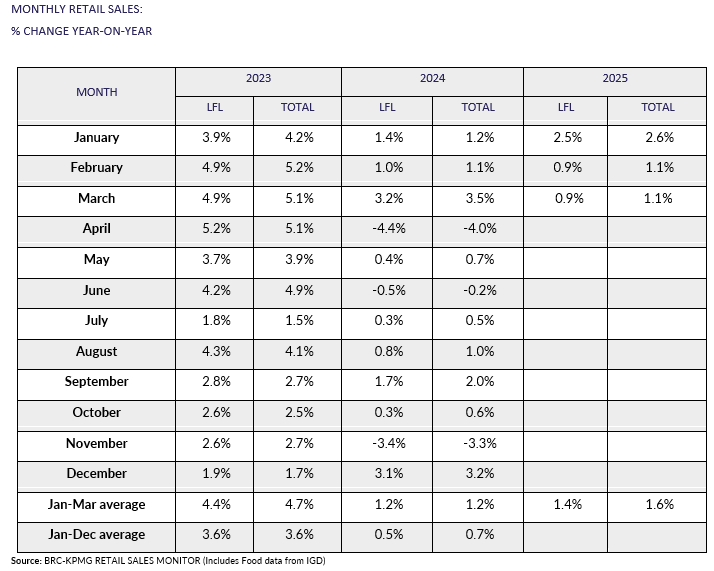

UK Total retail sales increased by 1.1%

year on year in March, against a growth of 3.5% in March 2024.

This was below the 3-month average growth of 1.6% and above the

12-month average growth of 0.6%.

-

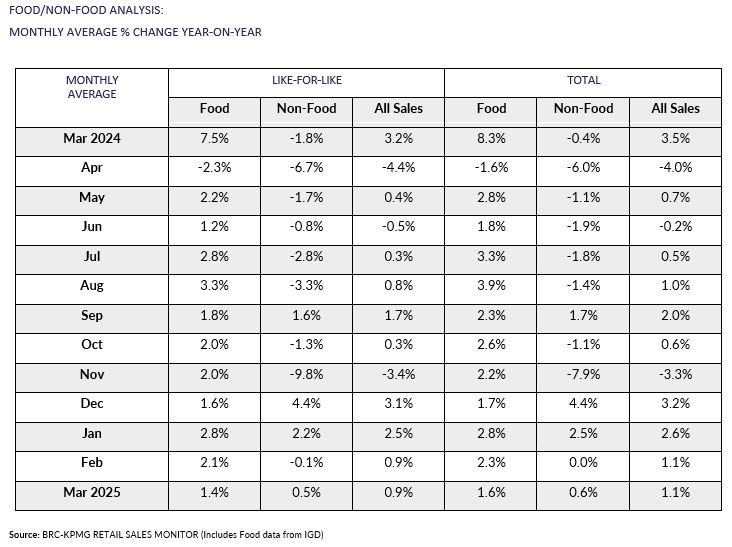

Food sales increased by 1.6% year on year

in March, against a growth of 8.3% in March 2024. This was

below the 3-month average growth of 2.3% and below the 12-month

average growth of 2.2%.

-

Non-Food sales increased by 0.6% year on

year in March, against a decline of 0.4% in March 2024. This

was below the 3-month average growth of 1.1% and above the

12-month average decline of 0.8%.

-

In-Store Non-Food sales decreased by 0.1%

year on year in March, against a growth of 0.1% in March 2024.

This was below the 3-month average growth of 0.6% and above the

12-month average decline of 1.7%.

-

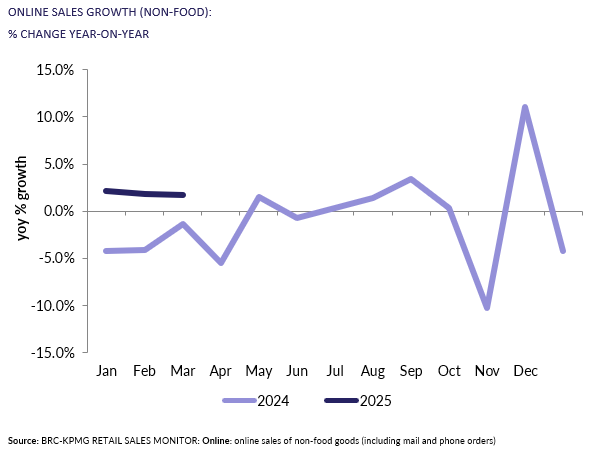

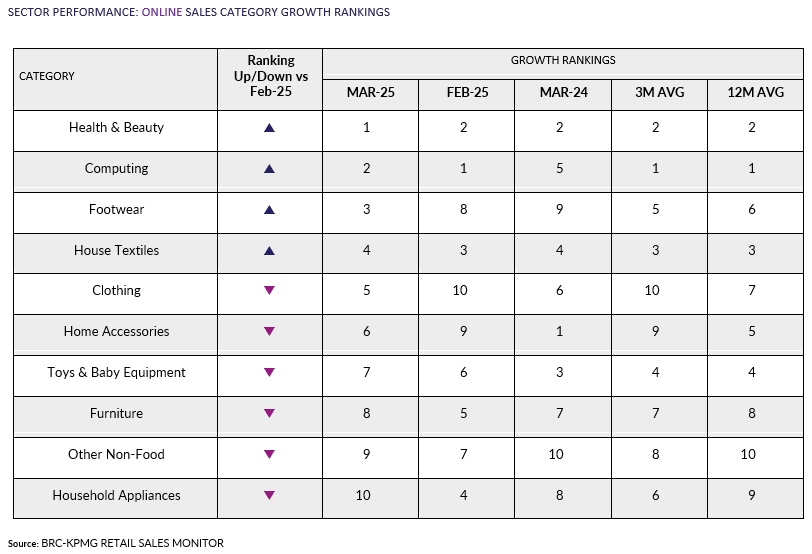

Online Non-Food sales increased by 1.8%

year on year in March, against a decline of 1.4% in March 2024.

This was below the 3-month average growth of 1.9% and above the

12-month average growth of 0.9%.

-

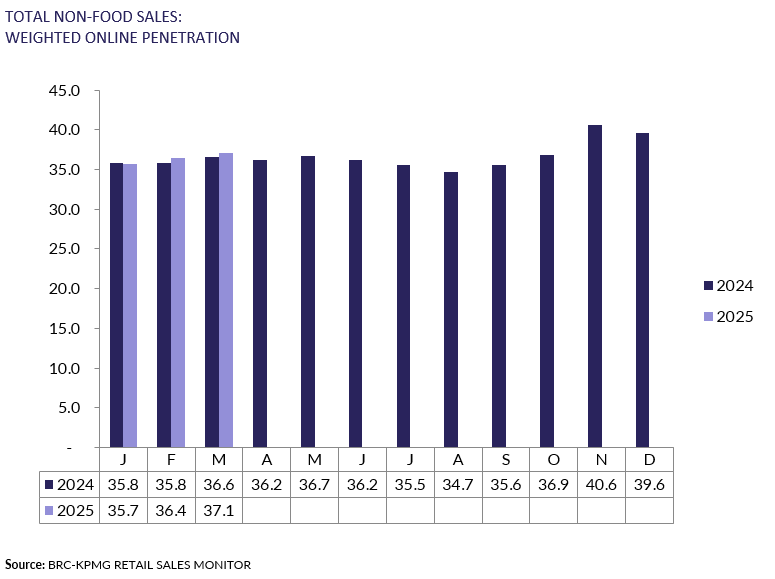

The online penetration rate (the

proportion of Non-Food items bought online) increased to 37.1%

in March from 36.6% in March 2024. This was above the 12-month

average of 36.8%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

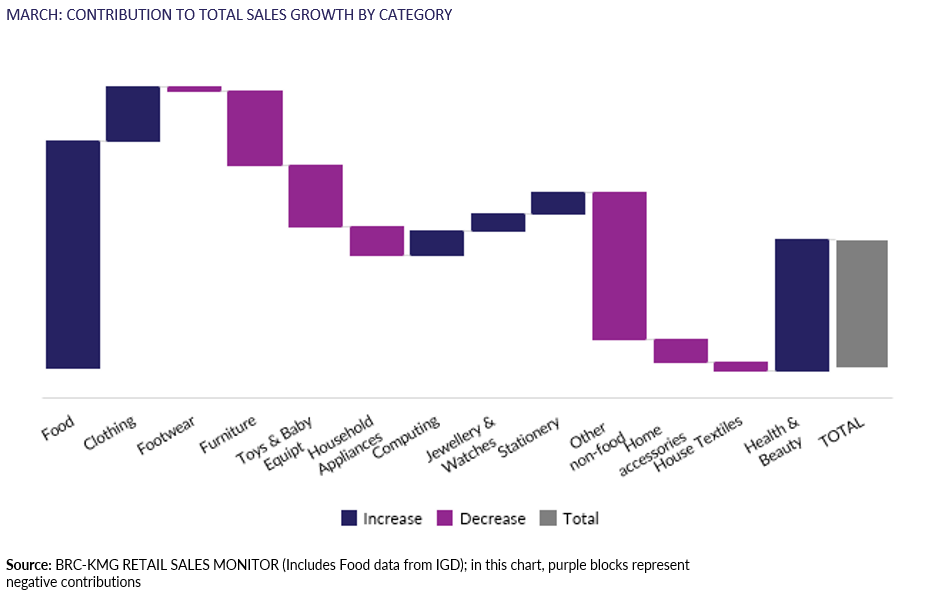

“Despite a challenging global geopolitical landscape, the small

increase in both food and non-food sales masked signs of

underlying strengthening of demand given March 2025's comparison

with last year's early Easter. The improving weather made for a

particularly strong final week, with gardening and DIY equipment

flying off the shelves. Jewellery and beauty products were helped

by Mother's Day, though sales of bigger ticket items like

furniture remained weak. Retailers are making final preparations

for Easter, with food expected to be the big winner next month.

“Since the start of April, retailers have had to contend with £5

billion pounds of new government-imposed costs as a result of

increases to the National Living Wage and National Insurance.

This rises to £7bn when the new packaging tax comes into effect

in October and will undoubtedly increase inflation later in the

year and hold back critical investment in high streets across the

country. Government has ample opportunities to kick start that

investment by ensuring that no shop pays more as part of their

planned reforms to business rates and that the Employment Rights

Bill doesn't reduce the availability of entry level and part time

jobs. Investment and growth are what the economy needs right

now.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“As Spring weather arrived, house and garden related purchases

and gifts for Mother's Day drove retail sales growth in

March.

“Amidst downbeat consumer confidence in the UK's economic

outlook, and many households facing rising costs, retail sales

growth feels an achievement. But with non-food sales

only climbing around 1% on average, competition means there are

some retailers really struggling whilst others win, especially

online. Retailers will be pushing for higher growth rates

as we move toward summer and holiday season, particularly as they

are now paying higher wage costs and facing volatility and

potential impact on their supply chains due to global tariffs.”

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“Shopper confidence fell from 4 to -2 in March after a brief

boost in February. Rising geopolitical uncertainty and the

imminent increases in household bills will have contributed to

this decline. While half-term, Bank Holidays, and Easter may

temporarily lift sales, the potential negative impact of U.S.

tariffs and recession concerns are likely to keep confidence low.

We may have already seen the peak for some time.”