Covering the five weeks 29 December 2024 – 01 February

2025

According to

BRC-Sensormatic data:

-

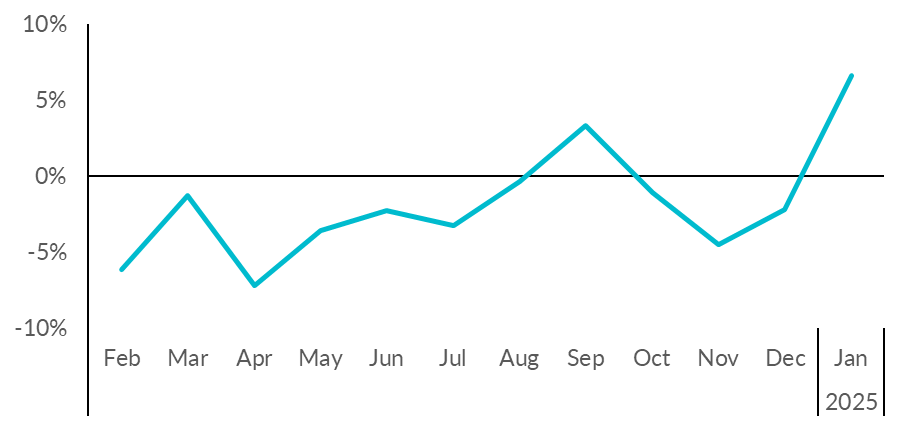

Total UK footfall increased by 6.6%

in January (YoY), up from -2.2% in December.

-

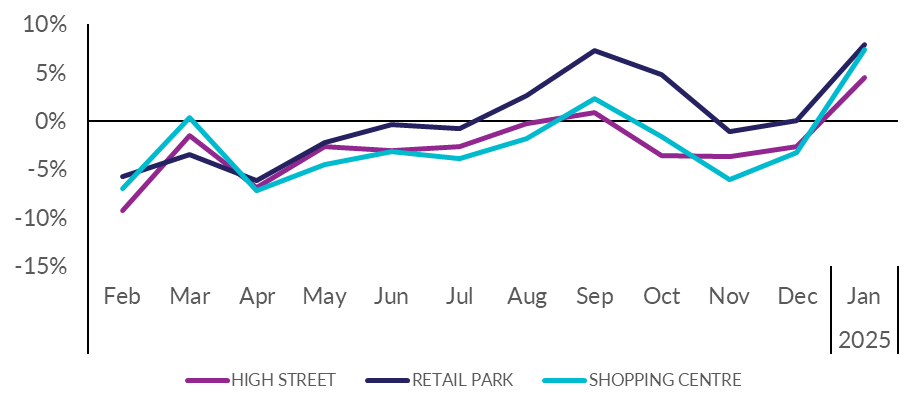

High Street footfall increased by

4.5% in January (YoY), up from -2.7% in December.

-

Retail Park footfall increased by

7.9% in January (YoY), up from 0.0% in December.

-

Shopping Centre footfall increased by

7.4% in January (YoY), up from -3.3% in December.

- Footfall increased year-on-year in all four UK nations, with

Wales improving by 8.5%,

Englandby 7.4%, Northern

Ireland by 3.5%, while Scotland

improved by 1.0%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Shopper footfall received a welcome boost in January following a

disappointing festive period. Store visits increased

substantially in the first week of the month as many consumers

hit the January sales in their local community, with shopping

centres faring particularly well. Despite snowy weather and Storm

Eowyn causing disruption in some areas, footfall was still

positive across major UK cities over the whole month.

“Improved shopper traffic is welcome news for high streets

following a particularly difficult ‘Golden Quarter' to end 2024,

and low consumer sentiment to start the year. Retailers want to

invest more in stores and staff to enhance the shopping

experience for customers and help to grow the economy, but the

swathe of additional costs from April will limit investment and

lead to job losses and higher prices at the tills. To drive

growth in communities across the country, the government must

ensure costs are limited in other areas. This can be done by

delaying packaging taxes and ensuring that business rates reform

leaves no shop paying more than they currently do.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic,

commented:

“After a dreary December, retailers will welcome January's

footfall jump. The uptick was boosted by a very strong Week

1, helped in part by New Year's Day falling on a Wednesday, which

may have prompted ambient store traffic as consumers bolted on

additional days of leave, as well as retailers extending

post-Christmas discounting well into January. Not even the

significant disruption from Storm Eowyn was enough to dampen

overall footfall performance. While welcome, after

months of erratic and constrained footfall, the jury's out as to

whether January's store performance signals the start of a

sustained High Street revival or if it will be a flash in the pan

come February. And, even if shopper traffic recovery has finally

turned a corner, the challenge for retailers will be solving the

next conundrum; how they balance enhanced footfall – which

requires optimised store staffing to convert into sales – and the

significant rises to labour costs borne out of the Budget on the

one hand, with consumer appetite for discounts - a long-term

margin-eroder - on the other, which will not be an easy circle to

square.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE

YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Jan-25

|

Dec-24

|

|

1

|

West Midlands

|

10.0%

|

-1.1%

|

|

2

|

South East England

|

9.4%

|

-1.1%

|

|

3

|

Wales

|

8.5%

|

-2.6%

|

|

3

|

East of England

|

8.5%

|

-3.4%

|

|

5

|

South West England

|

7.9%

|

-4.8%

|

|

6

|

North West England

|

7.7%

|

-1.4%

|

|

7

|

England

|

7.4%

|

-2.1%

|

|

8

|

North East England

|

6.8%

|

-3.3%

|

|

9

|

London

|

6.7%

|

-1.2%

|

|

10

|

East Midlands

|

6.4%

|

-2.7%

|

|

11

|

Northern Ireland

|

3.5%

|

-5.8%

|

|

12

|

Yorkshire and the Humber

|

3.3%

|

-2.9%

|

|

13

|

Scotland

|

1.0%

|

-1.5%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Jan-25

|

Dec-24

|

|

1

|

Birmingham

|

14.3%

|

4.8%

|

|

2

|

Manchester

|

10.3%

|

-3.0%

|

|

3

|

Cardiff

|

9.1%

|

-3.5%

|

|

4

|

London

|

6.7%

|

-1.2%

|

|

4

|

Nottingham

|

6.7%

|

-3.3%

|

|

6

|

Bristol

|

6.2%

|

-7.5%

|

|

7

|

Belfast

|

4.8%

|

-7.2%

|

|

8

|

Liverpool

|

3.2%

|

-3.8%

|

|

9

|

Edinburgh

|

2.8%

|

-1.1%

|

|

10

|

Glasgow

|

1.9%

|

0.2%

|

|

11

|

Leeds

|

1.0%

|

-3.0%

|

-ENDS-

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.

While High Streets, Shopping Centres and Retail Parks are the

main components of the Total Footfall, there are also additional

categories not included as separate indices. These include

outlets, travel hub locations, and free standing locations such

as garden centres.