A survey of CFOs (Chief Financial Officers) at 52 leading

retailers has revealed significant concern about trading

conditions over the next 12 months.

Sentiment languished at a concerning -57 with 70% of respondents

“pessimistic” or “very pessimistic” about trading conditions over

the coming 12 months, while just 13% said they were “optimistic”

or very “optimistic” (17% were neither optimistic nor

pessimistic).

The biggest concerns, all appearing in over 60% of CFO's “top 3

concerns for their business” were falling demand for goods and

services, inflation for goods and services, and the increasing

tax and regulatory burden.

When asked how they would be responding to the increases in

employers' National Insurance Contributions(NICs) (from April

2025), two-thirds stated they would raise prices (67%), while

around half said they would be reducing ‘number of

hours/overtime' (56%), ‘head office headcount' (52%), and ‘stores

headcount' (46%). Almost one third said the increased costs would

lead to further automation (31%).

The impact of the Budget on wider business investment was also

clear, with 46% of CFOs saying they would ‘reduce capital

expenditure' and 25% saying they would ‘delay new store

openings.' 44% of respondents expected reduced profits, which

will further limit the capacity for investment.

This survey comes only a few weeks after 81 retail CEOs wrote to the

Chancellor with their concerns about the economic

consequences of the Budget. The letter noted that the retail

industry's costs could rise by over £7 billion in 2025 as a

result of changes to employers' NICs (£2.33 bn), National Living

Wage increases (£2.73bn) and the reformed packaging levy (£2

billion).

The Budget is not the only challenge retailers are facing, with

weak consumer confidence and low consumer demand also an issue.

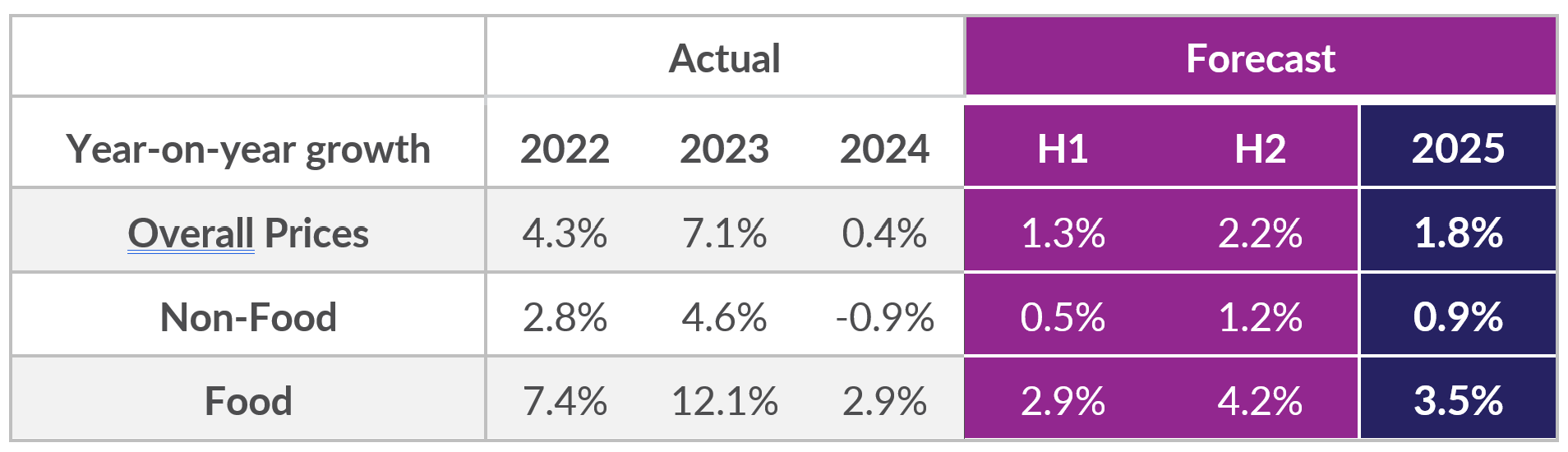

As part of the survey, CFOs offered their forecasts for the year

ahead. These suggest that shop price inflation, currently at

0.5%, will rise to an average of 2.2% in the second half of 2025.

This would be most pronounced for food, where inflation is

expected to hit an average of 4.2% in the second half of the

year.

Shop Prices – Actual and

Forecast

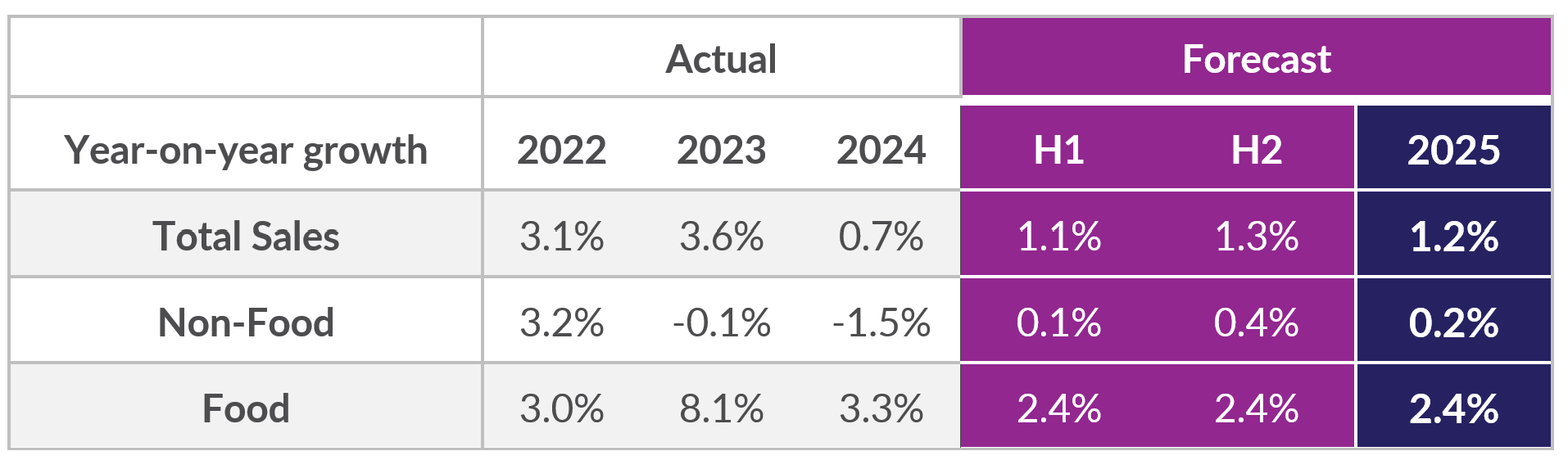

The forecast for sales was more muted. While sales growth is

expected to improve on the 2024 level of just 0.7% , at just 1.2%

this would still be below inflation. This means the industry

could be facing a year of falling sales volumes at the same time

as huge new costs resulting from the Budget.

Retail Sales – Actual and Forecast

Helen Dickinson, Chief Executive at the BRC,

said:

“With the Budget adding over £7bn to their bills in 2025,

retailers are now facing into the difficult decisions about

future investment, employment and pricing. As the largest private

sector employer, employing many part-time and seasonal workers,

the changes to the NI threshold have a disproportionate effect on

both retailers and their supply chains, who together employ 5.7m

people across the country.

“Retailers have worked hard to shield their customers from higher

costs, but with slow market growth and margins already stretched

thin, it is inevitable that consumers will bear some of the

burden. The majority of retailers have little choice but to raise

prices in response to these increased costs, and food inflation

is expected to rise steadily over the year. Local communities may

find themselves with sparser high streets and fewer retail jobs

available. Government can still take steps to shore up retail

investment and confidence. Business rates remain the biggest

roadblock to new shops and jobs, with retailers paying over a

fifth of the total rates bill. The Government must confirm the

planned reforms will make a meaningful difference to retailers'

bills and that no shop will end up paying more.”

-ENDS-

CFO Survey:

CFO Survey took place between 18th Nov –

9th Dec and was completed by CFOs and Finance

Directors. Responses were received from 52 members whose

businesses turnover £65bn per year, employing 478,000 people and

operating 17,500 stores across the UK.