Covering the five weeks 24 November – 28 December

2024

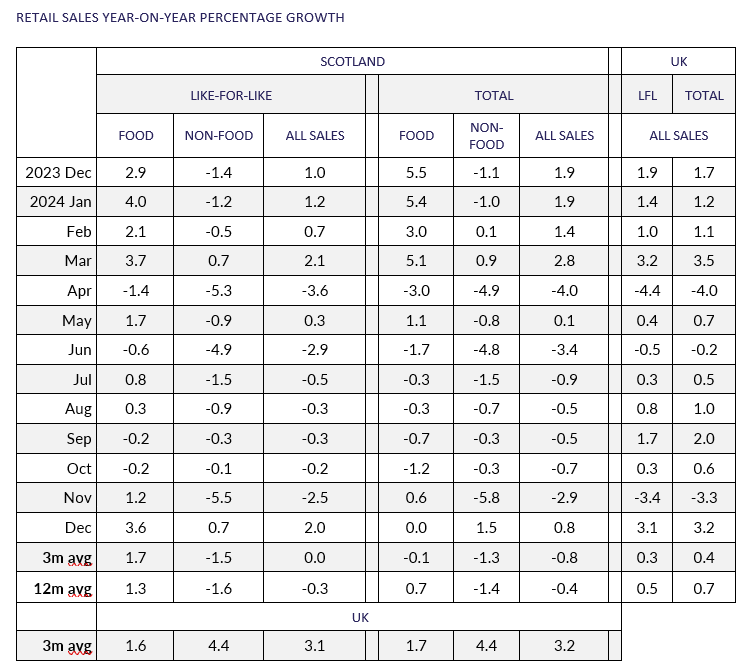

- Total sales in Scotland increased by 0.8% compared with

December 2023, when they had grown 1.9%. This was above the

3-month average decrease of 0.8% and above the 12-month average

decrease of 0.4%. Adjusted for inflation, there was a

year-on-year increase of 1.8%.

- Scottish sales increased by 2.0% on a like-for-like basis

compared with December 2023, when they had increased by 1.0%.

This is above the 3-month average of 0.0% and above the 12-month

average decline of 0.3%.

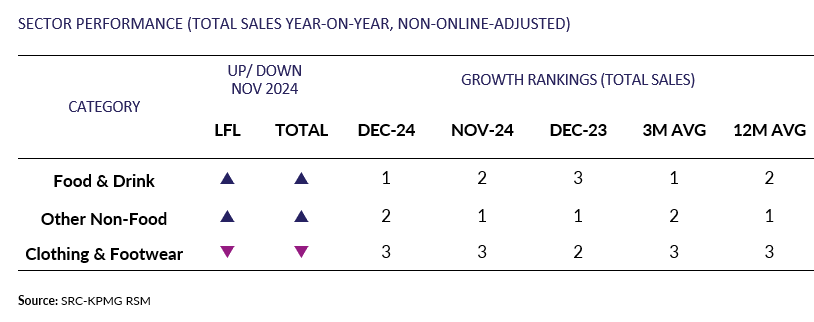

- Total Food sales were flat at 0.0% versus December 2023, when

they had increased by 5.5%. December was above the 3-month

average decline of 0.1% and below the 12-month average growth of

0.7%. The 3-month average was below the UK level of 2.1%.

- Total Non-Food sales increased by 1.5% in December compared

with December 2023, when they had decreased by 1.1%. This was

below the 3-month average decrease of 1.3% and 12-month decrease

of 1.4%.

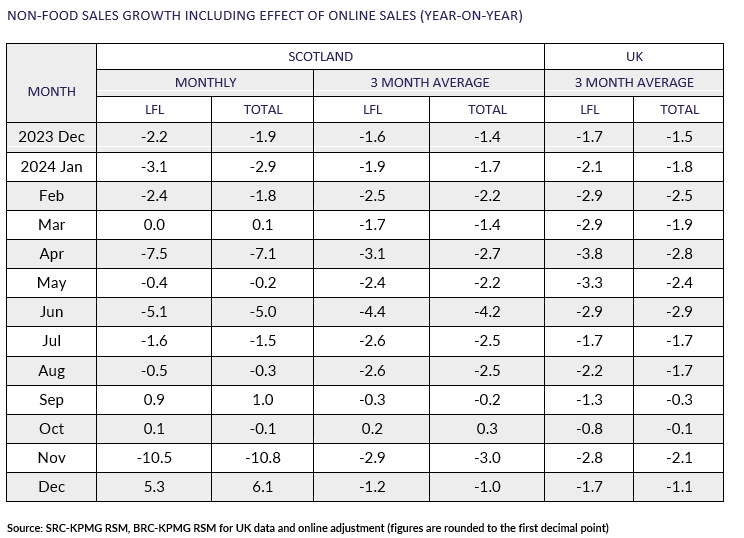

- Adjusted for the estimated effect of Online sales, Total

Non-Food sales increased by 6.1% in December versus December

2023, when they had decreased by 1.9%. This was above the 3-month

average decline of 1.0% and 12-month average decline of 1.7%.

David Lonsdale, Director, Scottish Retail

Consortium

“Scottish retail sales saw solid growth in December as Black

Friday and Christmas helped retailers to their best monthly

performance of an otherwise flat golden trading quarter and tepid

2024. Overall, the value of Scottish retail sales rose by 1.8

percent in real terms during December.

“Food sales were flat, reflecting consumers cutting back a little

alongside significant price competition between grocers competing

for festive purchases. Non-food trading was more mixed.

Computing and gaming did well alongside home appliances and

health and beauty products. Sales of toys and home accessories

however were weak. Customers continued to increase their online

shopping across Black Friday and in the run-up to Christmas; in

part driven by the poor weather which hit Scotland in December.

“As the Hogmanay bells tolled retailers won't have been

heartbroken to bid farewell to 2024. Sales in the crucial final

golden trading quarter were identical to last year. That is

indicative of a tough combination of household discretionary

spending being limited, and much of what there is being spent on

experiences rather than products. Retailers will be hoping there

are brighter skies ahead in 2025.”

Linda Ellett, UK Head of Consumer, Retail and

Leisure | KPMG

“With Black Friday falling as late as it did, this year it was

part of the Christmas shopping season even more so than in

previous years.

“December, coupled with Black Friday week at the end of November,

delivered sales growth for retailers - with the likes of

AI-enabled tech and beauty advent calendars boosting festive

takings.

However, there was no sales growth during the golden quarter of

October to December in Scotland compared to last year, reflecting

the ongoing careful management of many household budgets during a

time when many costs remain at a heightened level.

“In 2025, we will see retailers increasingly utilising customer

data and AI technology to deliver increased personalisation when

it comes to targeting products and offers to their current, and

potential, customers.”