The later timing of Black Friday in 2024 meant that 1-7

December data period included the final days of the Black Friday

discounting period (including Cyber Monday), while the Black

Friday discounting period had passed by December 2023. This means

Non-food prices are likely to appear more deflationary than the

underlying trend.

Period Covered: 01

– 07 December 2024

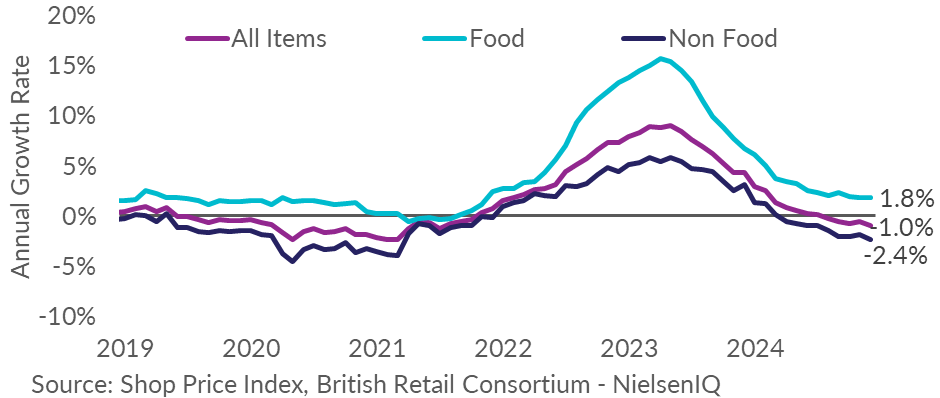

- Shop Price deflation was 1.0% in December, up from deflation

of 0.6% in the previous month. This is slightly above the 3-month

average rate of -0.8%. Shop price annual growth remained at its

lowest rate since August 2021.

- Non-Food remained in deflation at -2.4% in December, edging

down from -1.8% in the preceding month. This is below the 3-month

average rate of -2.1%. Deflation is its most since April 2021.

- Food inflation was unchanged at 1.8% in December. This is in

line with the 3-month average rate of 1.8%. The annual rate has

eased considerably since the start of the year and inflation

remained at its lowest rate since December 2021.

- Fresh Food inflation was unchanged in December, at 1.2%. This

is slightly above the 3-month average rate of 1.1%. Inflation was

its lowest since November 2021.

- Ambient Food inflation edged up to 2.8% in December, from

2.7% in November. This is in line with the 3-month average rate

of 2.8% and remained at its lowest since February 2022.

|

|

OVERALL SPI

|

FOOD

|

NON-FOOD

|

|

% Change

|

On last year

|

On last month

|

On last year

|

On last month

|

On last year

|

On last month

|

|

Dec-24

|

-1.0

|

0.0

|

1.8

|

0.1

|

-2.4

|

-0.1

|

|

Nov-24

|

-0.6

|

0.2

|

1.8

|

0.3

|

-1.8

|

0.2

|

Note: Month-on-month % change refers to changes in the

level of prices.

Helen Dickinson, Chief Executive of the BRC,

said:

“Retailers discounted heavily for Black Friday this year as they

attempted to make up for weaker sales earlier in the year.

However, the later Black Friday timing brought many of the

non-food discounts into the measurement period, making non-food

prices look more deflationary than the underlying trend. With

food inflation bottoming out at 1.8%, and many price pressures on

the horizon, shop price deflation is likely to become a thing of

the past.

“As retailers battle the £7 billion of increased costs in 2025

from the Budget, including higher employer NI, National Living

Wage, and new packaging levies, there is little hope of prices

going anywhere but up. Modelling by the BRC and retail CFOs

suggest food prices will rise by an average of 4.2% in the latter

half of the year, while Non-food will return firmly to inflation.

Government can still take steps to mitigate these price

pressures, and it must ensure that its proposed reforms to

business rates do not result in any stores paying more in rates

than they do already.”

Mike Watkins, Head of Retailer and Business Insight,

NielsenIQ, said:

“During December, shoppers benefited from both lower inflation

than last year and bigger discounts as both food and non-food

retailers were keen to drive sales after a slow start to the

quarter. However, higher household costs are unlikely to

dissipate anytime soon so retailers will need to carefully manage

any inflationary pressure in the months ahead.”