Covering the four weeks 27 October – 23 November

2024

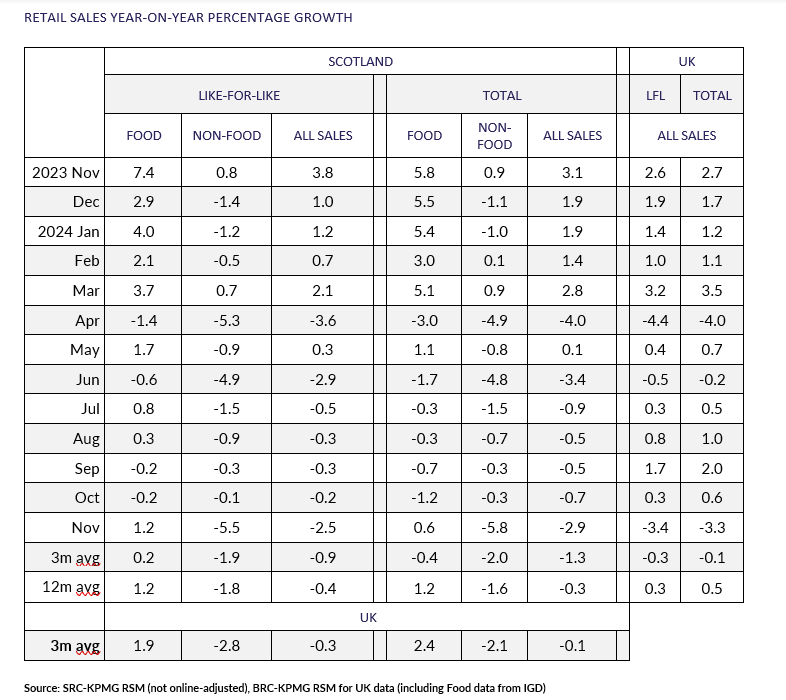

- Total sales in Scotland decreased by 3.3% compared with

November 2023, when they had grown 2.6%. This was below the

3-month average decrease of 0.1% and below the 12-month average

growth of 0.5%. Adjusted for inflation, there was a year-on-year

decrease of 2.3%.

- Scottish sales decreased by 2.5% on a like-for-like basis

compared with November 2023, when they had increased by 3.8%.

This is above the 3-month average decrease of 0.9% and below the

12-month average decline of 0.4%.

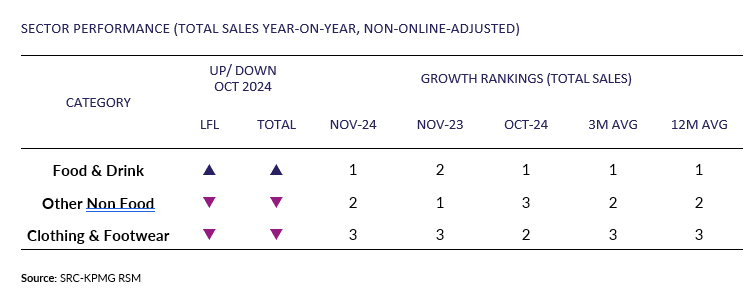

- Total Food sales increased by 0.6% versus November 2023, when

they had increased by 5.8%. November was below the 3-month

average increase of 1.2% and below the 12-month average growth of

1.6%. The 3-month average was below the UK level of 2.4%.

- Total Non-Food sales decreased by 5.8% in November compared

with November 2023, when they had increased by 0.9%. This was

below the 3-month average decrease of 2.0% and 12-month decrease

of 1.6%.

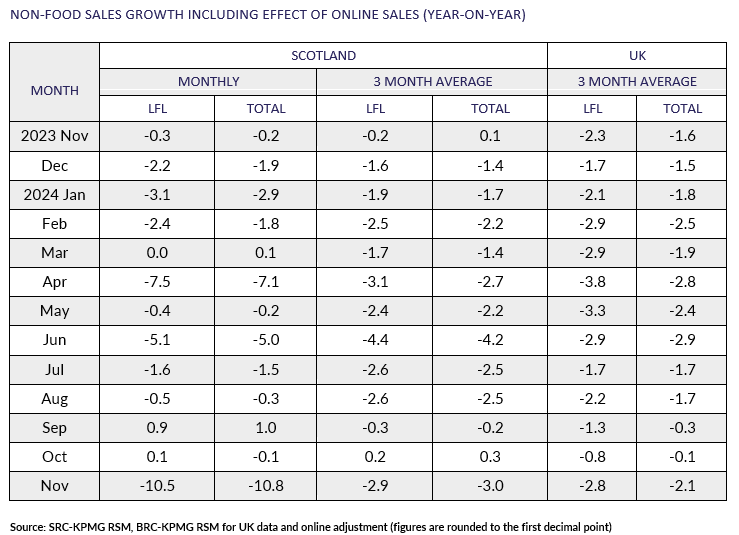

- Adjusted for the estimated effect of Online sales, Total

Non-Food sales decreased by 10.8%% in November versus November

2023, when they had decreased by 0.2%. This was below the 3-month

average decline of 3.0% and 12-month average decline of 2.5%.

Ewan MacDonald-Russell, Deputy Head | Scottish Retail Consortium

"Scottish retail sales slumped by 2.3 percent in real terms in

November as the mid-month of the golden trading quarter

disappointed. With retailers already reeling from the enormous

bills coming out of the UK Budget and the bitter arctic weather,

the poor trading performance will have alarm bells ringing for

many. Omni and digital retailers can at least cling to the hope

that Black Friday itself, which falls in December's reporting

period, may make up a little ground.

"Health and beauty products continue to perform well for

retailers, with the now staple beauty advent calendars being

popular. Sales of Christmas trees and decorations and

energy-efficient products did well. However, broader technology

and fashion both underperformed, a combination of consumers

holding back on festive spending and the significant discounting

in the run-up to Black Friday.

"Scotland's retailers are already facing a £190 million cost next

year from the changes to employer National Insurance. They will

be nervously looking towards Wednesday's Scottish Budget with

very significant trepidation. Bluntly, consumers are already

likely to see prices rise in the new year due to rising

government-mandated cost pressures whilst jobs and shops are at

risk. If the Scottish Government choose to increase costs further

through new levies or large business rates increases, it's

Scotland's shoppers who are likely to face the price in 2025."

Linda Ellett, UK Head of Consumer, Retail and

Leisure | KPMG

“Along with the cold snap at the end of the month, retail sales

also went into minus numbers for November.

“An upturn in health product buying also signalled that the

winter months had arrived, with food and drink the only other

category to see sales growth.

“While the majority of November's data tells a disappointing tale

for the retail sector, this reporting didn't include Black Friday

week, so the hope for Scotland's retailers is that consumers were

being savvy shoppers and that the promotional push in the last

days of the month saw held-back consumer spend materialise and

mitigate what is otherwise a disappointing month. If not,

then we may see some retailers launching Christmas sales early.”