Period Covered: 01 – 07

November 2024

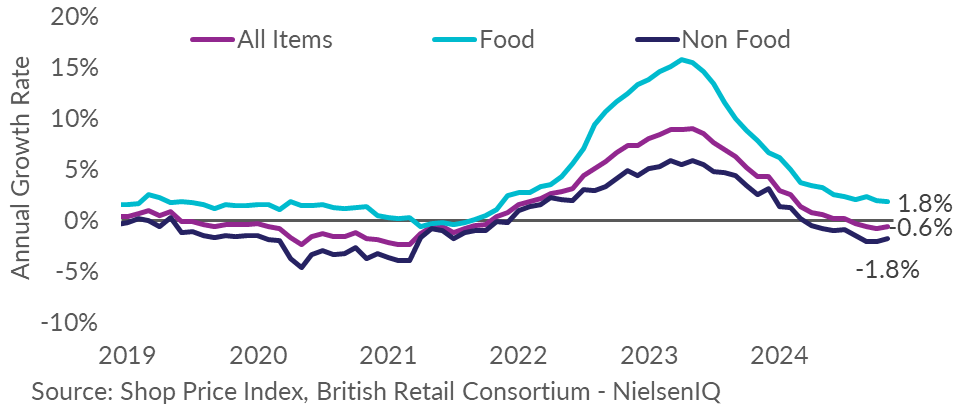

- Shop Price deflation was at 0.6% in November, up from

deflation of 0.8% in the previous month. This is slightly above

the 3-month average rate of -0.7%. Shop price annual growth

remained its lowest rate since September 2021.

- Non-Food remained in deflation at -1.8% in November, up from

-2.1% in the preceding month. This is above the 3-month average

rate of -2.0%. Inflation is in-line with levels last seen in

mid-2021.

- Food inflation slowed to 1.8% in November, down from 1.9% in

October. This is below the 3-month average rate of 2.0%. The

annual rate continues to ease in this category and inflation

remained at its lowest rate since November 2021.

- Fresh Food inflation accelerated in November, to 1.2%, up

from 1.0% in October. This is in line with the 3-month average

rate of 1.2%. Inflation was its lowest since November 2021.

- Ambient Food inflation decelerated to 2.7% in November, down

from 3.1% in October. This is below the 3-month average rate of

3.0% and remained at its lowest since February 2022.

|

|

OVERALL SPI

|

FOOD

|

NON-FOOD

|

|

% Change

|

On last year

|

On last month

|

On last year

|

On last month

|

On last year

|

On last month

|

|

Nov-24

|

-0.6

|

0.2

|

1.8

|

0.3

|

-1.8

|

0.2

|

|

Oct-24

|

-0.8

|

0.1

|

1.9

|

0.0

|

-2.1

|

0.1

|

Note: Month-on-month % change refers to changes in the

level of prices.

Helen Dickinson, Chief Executive of the BRC,

said:

“November was the first time in 17 months that shop price

inflation has been higher than the previous month, albeit

remaining overall in negative territory. Food prices increased

for fresh products such as seafood, which is more vulnerable to

high import and processing costs, especially during winter. Tea

prices also remained high as poor harvests in key producing

regions continued to impact supply. While coffee prices

experienced a momentary dip, price rises are imminent as global

coffee prices approach record highs. In non-food, while many

retailers unwound some of their discounting, there are still many

bargains across fashion and furniture. Customers looking to

upgrade their electricals were able to pick up some great deals

in early Black Friday sales.”

“With significant price pressures on the horizon, November's

figures may signal the end of falling inflation. The industry

faces £7 billion of additional costs in 2025 because of changes

to Employers' National Insurance Contributions, business rates,

an increase to the minimum wage and a new packaging levy. Retail

already operates on slim margins, so these new costs will

inevitably lead to higher prices. If the government wants to

prevent this, it must reconsider the existing timelines for the

new packaging levy, while ensuring any changes to business rates

offer a meaningful reduction for all retailers as early as

possible.”

Mike Watkins, Head of Retailer and Business Insight,

NielsenIQ, said:

“Shoppers are still being cautious

by shopping savvy for the essentials and holding back their

discretionary spend, so the lower level of inflation should help

sentiment ahead of Black Friday promotions. And with lower

inflation than this time last year, many food retailers are

extending offers and discounts to help sales momentum in

December.”