Period Covered: 01 – 07

October 2024

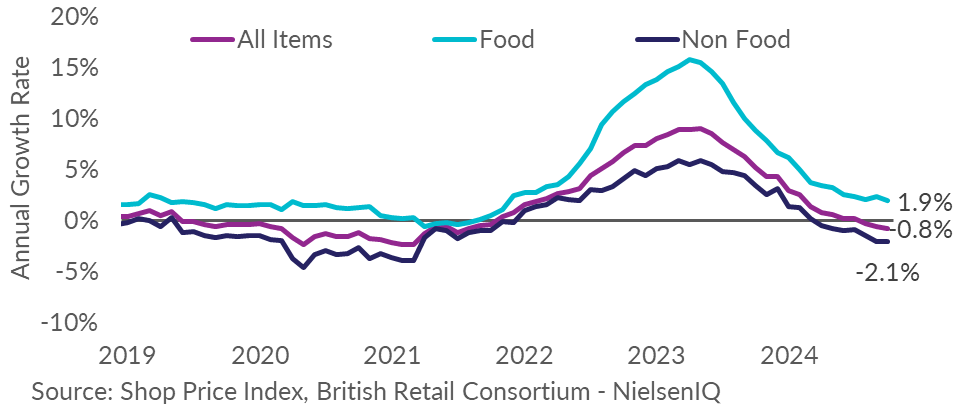

- Shop Price deflation was at 0.8% in October, down from

deflation of 0.6% in the previous month. This is below the

3-month average rate of -0.6%. Shop price annual growth was at

its lowest rate since August 2021.

- Non-Food remained in deflation at -2.1% in October, unchanged

from the preceding month. This is below the 3-month average rate

of -1.9%. Inflation is at its lowest rate since March 2021.

- Food inflation slowed to 1.9% in October, down from 2.3% in

September. This is above the 3-month average rate of 2.1%. The

annual rate continues to ease in this category and inflation

remained at its lowest rate since November 2021.

- Fresh Food inflation decelerated in October, to 1.0%, down

from 1.5% in September. This is below the 3-month average rate of

1.2%. Inflation was its lowest since October 2021.

- Ambient Food inflation decelerated to 3.1% in October, down

from 3.3% in September. This is below the 3-month average rate of

3.3% and remained at its lowest since March 2022.

|

|

OVERALL SPI

|

FOOD

|

NON-FOOD

|

|

% Change

|

On last year

|

On last month

|

On last year

|

On last month

|

On last year

|

On last month

|

|

Oct-24

|

-0.8

|

0.1

|

1.9

|

0.0

|

-2.1

|

0.1

|

|

Sep-24

|

-0.6

|

-0.2

|

2.3

|

0.2

|

-2.1

|

-0.5

|

Note: Month-on-month % change refers to changes in the

level of prices.

Helen Dickinson OBE, Chief Executive of the BRC,

said:

“October saw shop prices fall marginally further into deflation

for the third consecutive month. Food inflation eased,

particularly for meat, fish and tea as well as chocolate and

sweets as retailers treated customers to spooky season deals. In

non-food, discounting meant prices fell for electricals such as

mobile phones, and DIY as retailers capitalised on the recent

pick-up in the housing market. With fashion sales finally turning

a corner this Autumn, prices edged up slightly for the first time

since January as retailers started to unwind the heavy

discounting seen over the past year.”

“Households will welcome the continued easing of price inflation,

but this downward trajectory is vulnerable to ongoing

geopolitical tensions, the impact of climate change on food

supplies, and costs from planned and trailed Government

regulation. Retail is already paying more than its fair share of

taxes compared to other industries. The Chancellor using

tomorrow's Budget to introduce a Retail Rates Corrector, a 20%

downwards adjustment, to the business rates bills of all retail

properties will allow retailers to continue to offer the best

possible prices to customers while also opening shops, protecting

jobs and unlocking investment.”

Mike Watkins, Head of Retailer and Business Insight,

NielsenIQ, said:

“Inflation in the food supply chain

continues to ease and this helped slow the upward pressure of

shop price inflation in October, however other cost pressures

remain. Consumers remain uncertain about when and where to spend

and with Christmas promotions now kicking in, competition for

discretionary spend will intensify in both food and non-food

retailing.”